Congress held hearings on the buyout. A number of former Medicare/Medicare Chiefs supported the deal, including ManorCare board member Gail Wilensky. No one asked about Carlyle's LifeCare Hospitals failure after Hurricane Katrina which resulted in 25 patient deaths. Oddly ManorCare is being investigated for poor quality care, including patient deaths, and inappropriate billing.

Beneath the Carlyle-Apollo PEU match lies an internal foe, ManorCare's CEO Paul Ormond. NY Post reported:

The landlord of America’s second-biggest nursing home chain is haggling with the company’s top executive over a lavish compensation package, even as the chain teeters on the edge of bankruptcy, sources told The Post.Could Carlyle be that bad to work for, that a CEO would need that kind of pay to stomach working for PEU ilk? Not likely. Ormond invited Carlyle in and partnered to make himself stinking rich. Carlyle expected to make billions more. After putting ManorCare in a precarious position, Carlyle's founders know better to throw good money after bad.

Paul Ormond, CEO of HCR ManorCare, is demanding $100 million in deferred compensation that private equity giant Carlyle Group promised to pay him as part of a $6.3 billion buyout of the company in 2007.

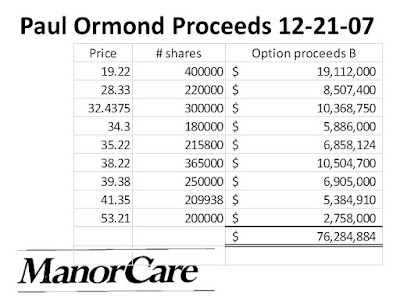

ManorCare CEO Paul Ormond grossed $198 million from Carlyle's purchase of the company. Here's the breakdown:

.

Now Paul wants another $100 million. The Carlyle Group is free to pay Ormond what he's due. They won't pay from the sponsor level. Affiliates pay Carlyle for the privilege of being owned.

Ormond's excessive deferred compensation is a window into private equity practices where the top get outsized rewards while legions of employees struggle as costs from deteriorating benefits eat up more than any pitiful raises PEU boys hand out

Carlyle is ready to walk away from ManorCare's failing financial health. The cause is PEU ownership.

They have two fights as they ready to hand over the keys. One has Leon Black ready to back door Carlyle on ManorCare, a move quite familiar to Carlyle chiefs (Brinton's, Mrs. Fields).

The other fight is with the CEO who brought Carlyle in. Does that make The Carlyle Group a Trojan Horse?

Update 6-13-17: Carlyle is out of ManorCare according to NYPo. Ten years of PEU ownership drove it under.