Reuters reported:

A lender owned by private equity firm Warburg Pincus LLC was sued on Tuesday by several U.S. states, and accused of charging cash-strapped borrowers hundreds of millions of dollars for "hidden" add-on products that they never agreed to buy.

Mariner Finance, with more than 480 offices in 27 states, was accused of engaging in "widespread credit insurance packing," by selling costly policies and other products without telling borrowers or even after being instructed not to.

The plaintiffs - Pennsylvania, New Jersey, Oregon, Utah, Washington state and Washington, D.C. - also said Mariner encouraged employees to trick borrowers into refinancing loans unnecessarily, to generate higher fees and sell more add-ons.

"These kinds of predatory sales practices can lead consumers into a cycle of debt that's hard to overcome," the office of Pennsylvania Attorney General Josh Shapiro said.

Wells Fargo Bank got into trouble for similar practices.

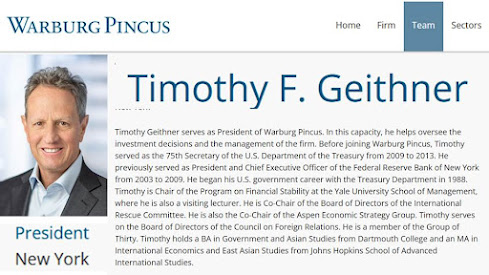

Mariner Finance is owned by Warburg Pincus (WP). WP's President is Timothy Geithner. On might expect a former New York Fed Chair and Treasury Secretary to be on the lookout for such misdeeds, especially as Geithner spoke out against predatory lending during his public service.

What other misdeeds is PEU greed driving in the WP finance family?

Under WP ownership Santander Consumer settled with the Justice Department for repossessing the vehicles of 1,112 servicemembers without a court order.

Also, Santander settled a $550 million multistate investigation by various state attorney generals into their subprime lending practices.

Based on the multistate investigation, the coalition alleges that Santander, through its use of sophisticated credit scoring models to forecast default risk, knew that certain segments of its population were predicted to have a high likelihood of default. Santander exposed these borrowers to unnecessarily high levels of risk through high loan-to-value ratios, significant backend fees, and high payment-to-income ratios. The coalition also alleges that Santander’s aggressive pursuit of market share led it to underestimate the risk associated with loans by turning a blind eye to dealer abuse and failing to meaningfully monitor dealer behavior to minimize the risk of receiving falsified information, including the amounts specified for consumers’ incomes and expenses. Finally, the coalition alleges that Santander engaged in deceptive servicing practices and actively misled consumers about their rights, and risks of partial payments and loan extensions.

Under the settlement, Santander is required to provide relief to consumers and, moving forward, is required to factor a consumer’s ability to pay the loan into its underwriting. Santander will pay $65 million to the 34 participating states for restitution for certain subprime consumers who defaulted on loans between Jan. 1, 2010 and Dec. 31, 2019.

The settlement period includes the time of Warburg Pincus sponsorship.

Due diligence is now PEU-diligence. Steer the money to the people at the top of the economic food chain while starving the folks at the bottom of resources. It's a PEU gang of dirty.