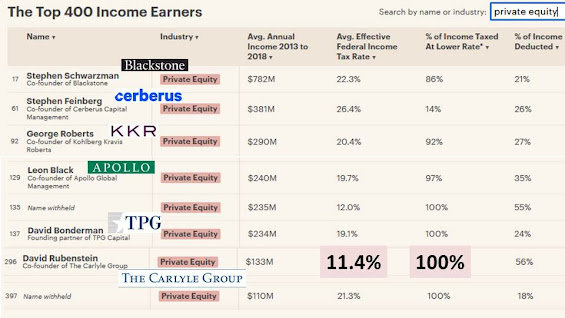

Carlyle Group co-founder David Rubenstein paid a mere 11.4% of his $133 million in income in federal taxes. All of his income was taxed at the lower capital gains rate or as carried interest, preferred taxation for private equity underwriters (PEU).

A ProPublica report showed nearly 400 PEU boys with the highest earning $782 million and the lowest $110 million. Private equity mavens paid an average of 22% of their income in federal taxes.

Recall how Carlyle turned political influence into massive profits. David Rubenstein dined with Presidents of all stripes over the last two decades. As a policy making billionaire Rubenstein calls all his chits whenever someone gets serious about getting rid of private equity's preferred taxation.

Politicians Red and Blue love PEU and increasingly, more are one.

Update 4-13-22: Between 2014 and 2018, the 25 wealthiest Americans collectively earned $401bn, but paid just $13.6bn – about 3.4% of that – in taxes. These policy making billionaires are the direct beneficiary of government tax policies and financial interventions during times of crisis.

Update 4-20-22: Goldman Sachs CEO will be paid like a PEU chief. Can he get down to Rubenstein's 11% federal income tax rate? He did toss a meal stipend bone to GS workers staying late in the office.

Update 4-22-22: The richest man in Bethesda, Maryland hates paying taxes. He hosts three television shows, two on Bloomberg and one on PBS. That's nice of the media to give regular airtime to a policy making billionaire. I'll wager his taxes stay low. Also, bad press means no future interviews, so reporters beware.

Update 2-1-23: Former Labor Secretary under President Bill Clinton cited the break American billionaires like Rubenstein got from cozy-ing up to politicians Red and Blue.