Carlyle Group co-founder David Rubenstein suggested a 25 basis point rate hike at next week's Fed meeting. Rubenstein is a member of the Fed's Investor Advisory Committee on Financial Markets and former employer of Fed Chief Jay Powell.

Rubenstein didn't mention the removal of "mark to market" requirement for bank assets. Private equity underwriters utilize "mark to model." These practices have resulted in private equity valuations (often highly levered) being much less volatile than public equity. Levered private equity should swing more than less levered public equity. It does not.

Banks face the prospect of increased operating costs as they have to pay more to depositors to keep their accounts. Private equity underwriters (PEU) face a wall of debt refinancings that will dramatically increase interest expenses. There are predictions that many PEU affiliates will fail.

Rubenstein said monetary policy makers during this tightening cycle were focused on tamping down inflation and likely didn't spend much time worrying about the ability of banks to survive the surge in borrowing rates.

He suggested the Fed can't walk and chew gum at the same time.

At the New York Fed, our mission is to make the U.S. economy stronger and the financial system more stable for all segments of society. We do this by executing monetary policy, providing financial services, supervising banks and providing thought leadership on issues that impact the nation and communities we serve.

The Fed was not alone in failing to warn the investing public about SVB. Debt rating agencies and certified public accountants provided zero warning.

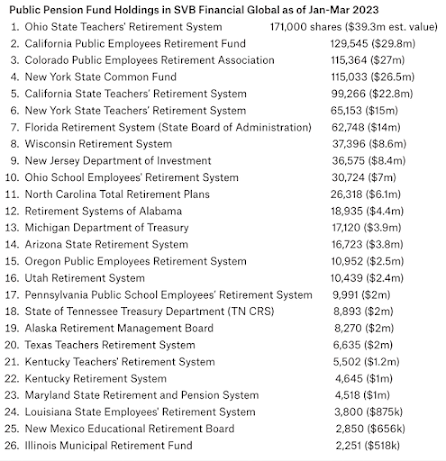

Moody’s had given the lender an ‘A’ rating prior to its collapse. Accounting giant KPMG signed off on the now-beleaguered bank’s audit just 14 days before it went bust.President Joe Biden had no sympathy for SVB shareholders which included large pension funds from California, Ohio, Illinois, North Carolina, Colorado New York and twenty other states.

Biden saved SVB depositors which included billionaire and PEU Peter Thiel while shafting public pensions.

Should the American people trust the system partially built by insider David Rubenstein? Rubenstein and his PEU brethren ensured preferred "carried interest" taxation, generous valuation models and affiliates' long term access to Uncle Sam's wallet.

Politicians Red and Blue love PEU and increasingly, more are one.

Update: SVB's executive team was loaded with former KPMG. Bloomberg Law reported:

CEO, CFO, some board members, risk officer all worked for KPMG

Update 3-19-23: With the Fed meeting looming Insider put together predictions from connected persons, including Carlyle's Rubenstein.

Premiering April 26th:

Iconic America: Our Symbols and Stories with David Rubenstein (PBS, new documentary series)