Thursday, October 29, 2015

Carlyle Buys Second Bay Area Mobile Home Park

Determined to get the little guy's money at all costs The Carlyle Group will buy Plaza del Rey mobile home park in Sunnyvale, California for a reported $180 million. If they can't get your retirement money they'll take your rent, maybe the whole house.

Update 11-26-17: Mountain View Voice reported: "A couple years ago, the Carlyle Group, a global private equity firm, paid $151 million to acquire Plaza Del Rey, one of the city's largest mobile home parks. Ever since, the park's residents have been hammered by the steepest rent increases in the park's history, said Judy Pavlick, founder of the Sunnyvale Mobile Home Park Alliance. In negotiation meetings, Carlyle executives told Pavlick they were watching nearby markets to see what prices Sunnyvale could bear."Poor Judy, greed came to her neighborhood and it doesn't want to leave, much less be rent controlled.

Wednesday, October 28, 2015

PEU Run on Carlyle's Claren Road

WSJ reported:

A struggling hedge-fund firm owned by Carlyle Group LP won’t immediately pay back about two-thirds of the nearly $2 billion that investors recently asked to withdraw, according to people familiar with the matter.Investors badly want out of Carlyle owned hedge fund Claren Road. Here's how Carlyle co-founder David Rubenstein characterized fleeing investors in the Q3 earnings call:

Well, I'd say first of all, over the last year -- it hadn't been a couple years, over the last year, the performance of hedge funds hasn't been what we hoped it would be, in either our emerging markets funds or in Claren Road -- that capital in the hedge fund business is not sticky capital. It depends usually on performance. A year or year and a half ago in Claren Road, they were turning money away, we were turning money away. And you get down and have a couple bad quarters and some people want their money back and that's part of the model. You given them their money back as best you can when that happens.

The last time Carlyle rolled up a hedge fund was July 2008. That was four months after Carlyle stiffed a large number of investors with Carlyle Capital Corporation's bankruptcy.

It looks and smells like a PEU hedge fund run. It's a dangerous time when the big money boys don't trust each other to pay back their debts. That's when they turn to the little guy to make them whole.

Update 12-26-15: Boxing Day finds Carlyle facing another $1 billion in Claren Road redemptions.

Carlyle Group Posts Loss for Q3

MarketWatch reported:

Carlyle Group LP on Wednesday said it swung to a third-quarter loss as its private-equity and energy funds lost value, the pace of deals slowed and it took a big charge related to losses at a hedge fund it owns.Carlyle's SEC filing stated:

The Washington, D.C., firm reported a loss of $84 million, or $1.11 a share, compared with a profit of $25 million, or 35 cents a share, in the same period last year.

GAAP results for Q3 2015 included loss before provision for income taxes of $(529) millionPrivate equity underwriters use economic net income, a nonstandard way of reporting earnings. The story highlighted areas in which Carlyle took losses, nearly every section of its giant portfolio:

Carlyle's funds that can earn the firm a slice of profits depreciated by 4% in the quarter, as its buyout funds lost 3% and its credit and hedge funds dropped 9%. The firm took a $162 million charge related to losses and investor redemptions at a credit hedge fund managed by its Claren Road Asset Management LLC.How many little investors want a piece of this in their retirement?

Carlyle's newer energy and infrastructure funds fell 4%, while its older energy investments managed by Riverstone Holdings LLC plummeted 17%. Carlyle's real-estate funds were the lone risers, gaining 6%.

Carlyle said its assets under management at the end of September were $187.7 billion, down from $202.6 billion a year earlier and $192.8 billion at the end of June.The last time Carlyle's AUM dropped significantly was the 2008 financial crisis and its aftermath.

Sunday, October 25, 2015

Carlyle to Buy Brazilian University

Reuters reported:

Brazil's Kroton Educational SA agreed to sell its Uniasselvi university to the Carlyle Group LP and Vinci Partners for 1.1 billion reais ($282.4 million), a newspaper reported on Friday, though the company said no sale deal for the university has been signed.How might Carlyle influence 75,000 students regarding the benefits of private equity underwriting (PEU)?

Uniasselvi, a university with about 75,000 students, is one of the assets Kroton agreed with antitrust authorities to sell as a condition for its purchase of Anhanguera, another education company, in July 2014.

Update 10-26-15: Bloomberg confirmed the story today

Tuesday, October 20, 2015

Carlyle Group Behind RushCard Problems

Forbes reported:

WSJ recently ran a piece on Carlyle's tech savvy, which leads one to ask: How did Carlyle botch this? Was it the same way they gunked up Boeing 787 Dreamliner production at Vought?

It’s been a terrible week for users of RushCard, a prepaid debit card created by hip hop mogul Russell Simmons, ever since a “technology transition” went awry last Sunday and locked users out of their accounts.The story went on to describe the financial pain felt by many low income card users.

Some users have reportedly been prevented from accessing their money for over a week.

Simmons founded UniRush, a financial services company that offers the Rush Card, in 2003.Forbes did not mention Carlyle's acquiring UniRush in 2010. The Carlyle Group commonly charges affiliates millions in management fees.

WSJ recently ran a piece on Carlyle's tech savvy, which leads one to ask: How did Carlyle botch this? Was it the same way they gunked up Boeing 787 Dreamliner production at Vought?

There is more to life than just technology, said David Rubenstein, co-founder and CEO of The Carlyle Group, and it's important to enjoy areas beyond technology whether you are a student or not.Like food, when you have access to your money.

Carlyle Closes on Veritas in Hot Data Storage Sector

Reuters reported:

OCT 20 closingWSJ ran a piece on the sizzling data storage sector.

-- Carlyle Group LP to acquire data storage unit Veritas from antivirus software maker Symantec Corp

Employees at private-equity firm Carlyle Group used to wait several minutes to hours for its computer systems to churn out some financial reports. Now such tasks are often completed in seconds, thanks to new-wave data-storage hardware from a startup called Tintri Inc. that it began installing a year and a half ago.WSJ helped establish Carlyle as a sophisticated data user.

“I could not believe the difference,” said Alan Thompson, Carlyle’s vice president of global information-technology services.

Such testimonials are becoming commonplace as one of Silicon Valley’s least-sexy sectors turns into one of its hottest. Technology for helping companies store data—the high-tech equivalent of filing cabinets—has become crucial to speeding operations to make companies nimbler. The change is giving storage gear a bigger claim on corporate information-technology dollars.

Companies will spend more than $40 billion in 2015 on storage hardware alone, research firm International Data Corp. estimates.Who else has an insatiable need for data storage? Uncle Sam, which is right up Carlyle's alley. I hope Carlyle co-founder David Rubenstein thanks WSJ owner Rupert Murdock for the publicity.

An IDC study, sponsored by EMC, last year estimated that the volume of digital bits from all sources will grow 40% a year into the next decade.

Update: WSJ may need a secure storage solution themselves, given they were hacked by Russians looking for trading tips.

Monday, October 19, 2015

SEC Releases PEU Stats

MarketWatch reported on the SEC's examination of private equity underwriters (PEU), otherwise known as the greed and leverage boys:

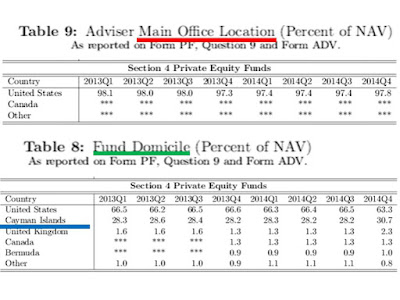

How can they get away with it? Uncle Sam allows it, as does the Cayman Islands. Nearly 98% of PEU home offices are in the U.S., yet less than 64% of funds are based here. Where do those primarily U.S. and Cayman Islands based funds invest their money?

Europe is the second largest region, which makes the following slide odd.

The SEC chose to list Russia at 0%, yet no European countries made it despite garnering nearly 20% of PEU investments. Odd, isn't it.

That's the PEU state of our world, according to the SEC.

Recent examinations of hedge funds and private equity funds revealed advisers allocating profitable trades and investment opportunities to proprietary funds rather than client accounts and multiple instances of improper fees and fee allocations to investors.So who are they screwing? Their investment partners of the non-unit holder variety.

How can they get away with it? Uncle Sam allows it, as does the Cayman Islands. Nearly 98% of PEU home offices are in the U.S., yet less than 64% of funds are based here. Where do those primarily U.S. and Cayman Islands based funds invest their money?

Europe is the second largest region, which makes the following slide odd.

The SEC chose to list Russia at 0%, yet no European countries made it despite garnering nearly 20% of PEU investments. Odd, isn't it.

That's the PEU state of our world, according to the SEC.

Sunday, October 18, 2015

Race to the Bottom on Accounting Disclosures

Accounting is the tool that should prevent corporations from misrepresenting the state of their business to investors and the public. The Federal Accounting Standards Board plans to drop minimum standards in material disclosures in notes to financial statements.

Existing phrases like “an entity shall at a minimum provide,” which may make it difficult to justify omitting immaterial disclosures, would be replaced with less prescriptive language.What language is that?

"A company at its determination, in consultation with public auditors, can chose to at its leisure or pleasure to..."Materiality would no longer be an accounting concept, but a legal one. The accounting profession is turning over their definition to lawyers! This would anathema to my deceased grandfather, a former President of Price Waterhouse (when it was solely an accounting firm).

The International Accounting Standards Board requires this on materiality, according to FASB:

An entity shall not reduce the understandability of its financial statements by obscuring material information with immaterial information or by aggregating material items that have different natures or functionsFASB's document states their amendment update does not address this IAS requirement.

A comment letter FASB posted on its website offered:

The valuation of securities is another area subject to high volatility as evidenced by the VIX index. VIX is one popular measure of the market's expectation of stock market volatility over the next month. High volatility as demonstrated by the VIX index will mean that valuations in individual portfolios are subject to wide swings up or down-sometimes due to purely irrational reasons.To hide our "financial market casino" companies need the freedom to not disclose. The overemphasis on finance and legal consideration has distorted business, especially in the last decade. FASB's acquiescence to having no standard in materiality fits with the drive to the lowest global common denominator in nearly everything that benefits corporations (which fuels income for companies and their PEU owners)

A related problem is that collateralized loans will have unstable security valuations due to unforeseeable investor fears and perceptions. For the accountant, the practical problem involves reacting to and assessing sudden and sometimes steep market drops which impact collateralized loans, as well as, securities valuations themselves. In reality, market swings do alter the total mix of information available to decision makers, regulators and investors alike.

Foreign currency valuations is another area which impacts portfolios, loans made, receivables and other accounts.

The rush to free corporations on materiality feels like a preventive move for the next crisis, which will be driven by insane debt driven and CEO incentivized business practices. It's sad irrational people ruin rational markets and corporations must find a proper fix, courtesy of a compliant FASB. That's the world they would have you see.

Update 11-27-15: The accounting fox is in charge of the hen house, at least in Ireland where four KPMG senior partners were arrested for tax evasion.

Update 6-17-19: KPMG will pay a $50 million fine to settle SEC allegations that it not only altered past audit work, but did so after receiving stolen information from an industry watchdog.

KMPG officials sought and obtained a list of inspection targets by the PCAOB because the firm had experienced a high rate of deficiencies. With the data, the former employees oversaw a program to revise certain audits to reduce the likelihood government inspectors would find shortfalls.Update 2-21-22: Wall Street on Parade noted "the largest global firms — Deloitte, EY, KPMG, and PwC— and the largest next tier firms such as Grant Thornton, BDO, and RSM, are less focused on performing their public duty of auditing and more interested in playing all sides of client opportunities to optimize their payday."

Monday, October 12, 2015

Political Fundraising: Jeb + W. = PEU Riches

Bloomberg reported:

Former President George W. Bush will return to the nation's capital this month to host a fundraiser for his younger brother, Jeb, who is trying to become the next family member to win the presidency.Jeb wants to be the latest Bush to help The Carlyle Group profit obscenely from their greed and leverage ways. W's and Jeb's helpers include Andy Card who sits on the board of Union Pacific alongside another Carlyle Group senior executive and former Presidential Chief of Staff, T.F. "Mac" McClarty. Both helped delay important safety advances that can prevent runaway train accidents.

The former president will host a fundraiser in Washington, D.C., on Oct. 29—the day after the third Republican presidential debate—at the home of Paul Horvath, chief executive officer of Orchard Global Capital Group, according to a copy of the invitation.

The host committee for the reception includes Andy Card and Josh Bolten, both chiefs of staff for the former president; former U.S. Secretary of Commerce Carlos Gutierrez; and Glenn Youngkin, president and chief operating officer of Carlyle Group, Inc., a Washington-based investment firm.

Card also sat on the board of Lorillard, the tobacco giant recently acquired by Reynolds American. Josh Bolten sits on the board of Emerson Electric. His bio shared Bolten is "Co-Founder and Managing Director of Rock Creek Global Advisors, LLC, an international advisory firm" and a Member of the International Advisory Board of BP plc. and helped BP manage its image in its Gulf of Mexico Oil Spew.

Bush Red Carlos Gutierrez is Chair of Albright Stonebridge Group, which has Clinton Blue Madeline Albright as founder. He also sits on the boards of MetLife, Occidental Petroleum and Time Warner.

What about the host of the Jeb fundraising soiree? His firm's product portfolio includes ChapelGate, EleganTree and Black Fores. Each brings to mind an era of serfdom. Here's his bio:

Paul D. Horvath — Chief Executive OfficerHe's looks more like a parasite than a host. Welcome to our world, where politicians red and blue love PEU. It's toxic and fully bipartisan. This group is raising money for Jeb but it's clearly not to help people. They help themselves.

Mr. Paul Horvath is Group Chief Executive Officer for Orchard Global Capital Group. Prior to co-founding the firm, Mr. Horvath was Global Head of Synthetic Credit Origination, Structuring and Distribution at Merrill Lynch from 2005 to 2008. From 1999 to 2005, Mr. Horvath was Global Co-Head of Structured Credit Distribution at JPMorgan, where he helped to grow the nascent credit derivatives market.

Sunday, October 11, 2015

Carlyle's Rubenstein Talks Recession with Bloomberg

Carlyle Group co-founder David Rubenstein spoke with Bloomberg reporters:

"You expect some slowdown after pretty good growth we've had the last couple years,"

"We're always a buyer and seller in our business. It's been very difficult to buy things the last couple years around the world in our business as price has been relatively high. The average cash flow multiple for deals done in the United States has been almost 10x cash flow the last couple years. Now it's going down a little bit. It's going to be better to buy things in the next year than it has been and be little bit tougher to sell at the prices you want to get."

Private equity underwriters love market dislocations, financial earthquakes they've predicted, prepared for. and even helped create. They hate economic black swans they haven't anticipated. This is important as PEUs provided a much greater share of commercial lending than banks post 2008 financial crisis/2009 recession. Investopedia reported:

Most private equity firms are also heavily involved in corporate lending as they move into fill a hole in the loan markets left by banks derisking their balance sheets.Also, highly leveraged PEU affiliates will get into financial trouble first in any recession. Watch what Carlyle does with theirs. They let a number sink in and around the last recession.

As for Bloomberg I see they continue catering to the PEU class with smiles and softball questions. Offscreen did they ask about President Obama's dinner at Mrs. Rubenstein's Alaskan palace or Michelle's recent talk at the "PEUs Love Veterans" event?

Did they ask how many WWII, Korean and Vietnam War veterans were harmed by PEU greed over the last decade? If not, one of their former peers commented four years ago:

I have seen so many people -- particularly those in their 50s - 70s -- taken apart by what has happened in their industry as greed has hollowed out the economy. These are people took pride in their jobs and held themselves to this invisible standard that we all just took for granted, but is being wiped out.We have insatiable greed intertwined with the permanent political campaign and a compliant business media. How much longer can they yuk it up amongst each other?

Friday, October 9, 2015

Wednesday, October 7, 2015

PEU Interest in Veterans Real or Selfish?

Bloomberg reported:

Blackstone Group LP will pay almost $39 million to settle claims stemming from a U.S. regulator’s industrywide investigation into whether private equity firms put their own interests ahead of investors’.On the same story Fortune added

Back in June, fellow private equity giant Kohlberg Kravis Roberts & Co. KKR settled with the SEC over charges that it breached fiduciary duty to investors in its flagship private equity funds between 2006 and 2011.Blackstone and KKR are two of the private equity underwriters sponsoring a veterans employment event in D.C. with First Lady Michelle Obama a headline speaker. Carlyle Group and TPG are the other sponsors. My question is how many WWII and Vietnam War veterans were harmed by PEU affiliates since 2000?

Private equity firms put their interests first. Greed and power will use anyone or anything. There is no policeman on this beat.

Tuesday, October 6, 2015

First Lady to Headline PEU Event

MarketWatch reported:

Update 10-8-15: NakedCapitalism found this piece (for which I am grateful).

First Lady Michelle Obama will join a roundtable discussion with the hosting firms’ CEOs, senior leaders, and veterans hiring champions and deliver remarks to approximately 150 portfolio company hiring representatives at the inaugural Veterans Initiative Summit, jointly hosted by Blackstone BX, +1.23% KKR KKR, +0.44% The Carlyle Group CG, +0.11% and TPG. The sessions in which the First Lady will participate will begin at 1:00p.m. EDT on Thursday, October 8th.Obama's PEU Presidency is now a family affair. The rewards for this couple for their PEU service will be great.

Update 10-8-15: NakedCapitalism found this piece (for which I am grateful).

Saturday, October 3, 2015

Executive Incentive Pay Is a Returnless Gift

Yahoo Finance reported:

It turns out offering CEOs huge bonuses to boost shareholder returns doesn’t actually work, according to a new study from Cornell University.

The analysis, done in conjunction with consultants Pearl Meyer and Partners, examined a decade’s worth of data from every company in the S+P 500 It compared companies that offer their top brass a total shareholder return (TSR) plan to those that don’t and found the increasingly popular pay plans haven't significantly boosted any of a number of key metrics.

In 2004, just 17% of S+P 500 companies gave CEOs and top executives some form of a TSR plan. A decade later, nearly half of the companies in the index offered it.

Outcome obsessed C-Suite and board room leaders have a new metric to explore and it relates to their performance. Their compensation theory failed miserably despite widespread application:

Nonetheless, giving CEOs more for total shareholder return doesn't make a difference, according to the Cornell study.“There is no strong evidence of a positive impact of TSR plans on firm performance,” wrote Hassan Enayati, Kevin Hallock, and Linda Barrington of Cornell University’s Institute for Compensation Studies.

Extrinsic motivators distort behavior and harm quality. Leaders intent on paying each other handsomely for their board room and executive suite service arrived at mind boggling complex pay schemes that paid off, no matter what the performance.

Most of it was a gift from their peers, completely unearned. I shudder to think of the harm these executives created in pursuit of their personal wealth.“Despite the fact that just under 50% of S+;P 500 firms have this pay metric as part of their executive compensation plans and that this pay metric is designed to align the interest of shareholders and executives,” Enayati told Yahoo Finance, “we find that there's no relationship between the pay metric and top-line business outcomes like 1-, 3-, or 5-year total shareholder return, return on equity, earnings per share growth, or revenue growth.”As for those S+P 500 CEOs that have TSR plans, it represents on average some 29% of their total direct compensation, though that percentage is a decline from 38% a decade ago. That's because as more companies adopt TSR plans, they are doing so with less weight than companies who took on these kinds of bonuses earlier.The average CEO of an S+;P 500 company made $13.8 million – or 204 times their average employee – in 2014.

The compensation of top executives is virtually independent of performance.That was the conclusion in Harvard Business Review in 1990. Twenty five years later, after implementing changes the article recommended, it's true again As for the damage ZeroHedge noted in a report about employment:

Nothing about the lack of job demand as mega corporations continue to lay workers off in droves instead of hiring, instead using every last dollar of free cash flow to buyback their own stock to boost executive compensation instead of growing their company and hire more workers.Optimize the company for executive pay, suboptimize the whole. Slow learners or greedy? Maybe both in the case of grocery store A&P, where Board members and executives enriched themselves handsomely just before the company declared bankruptcy.

Update 2-25-19: Bribing people to do work doesn't make happier people. It causes multiple forms of bad behavior. Job satisfaction comes from fair pay, support from managers and coworkers and the ability to perform meaningful work. NYT

Carlyle Group Gets New Lunchroom

The Daily Beast reported:

D.C.’s Hottest New Powerbroker Hangout…Is a GrillAs in robber baron old and PEU new. Old schoolers have long dined on the bones of many. The lunchroom is a place for the new generation, including Hunter Biden, to express their appetite for power and greed.

Tadich Grill, a much-loved San Francisco denizen, has a new East Coast outpost in the nation’s capital. Will the elite take it to their hearts?

Tadich will rise or fall based on foot traffic and the suit-clad denizens of surrounding office buildings. Luckily for the new management, the private equity firm The Carlyle Group, co-founded by billionaire Washington philanthropist David Rubenstein, has its offices upstairs.

“This will be our new lunchroom,” one Carlyle employee remarked.

Everything old is new again.

Subscribe to:

Comments (Atom)