Two hearings shed light into the proverbial darkness of outsized political influence. The first involved the U.S. Senate where Caritas Christi/Steward Healthcare CEO Ralph de la Torre, MD was a no show for his subpoenaed testimony.

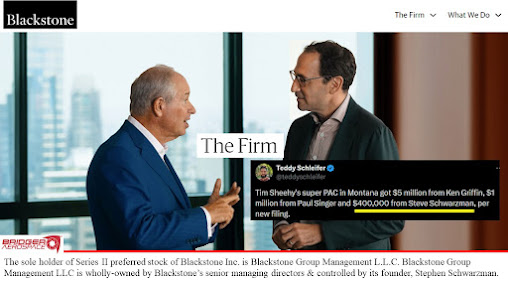

Cerberus received $719 million of the dividend while the remaining $71 million was paid to the Steward management team headed by CEO Dr. Ralph de la Torre.Private equity underwriters (PEU) spawned the term "policy making billionaire" back in 2011.

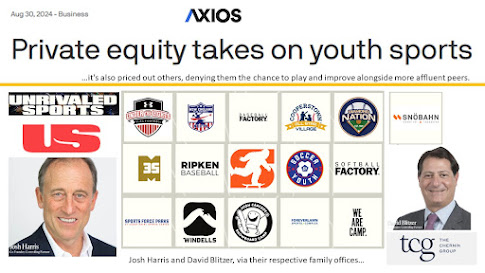

...the new philanthropists share a disdain for established politics and an impatience with the slow churn of old-fashioned policy making.And how have PEU political donations changed since 2011? They're way up:

I am not surprised that a PEU might skip an uncomfortable hearing with the people who repeatedly saved their highly unpopular, preferred "carried interest" taxation for the last decade and a half.

Heck, at least two members of the committee, Red Team Senators Mitt Romney and Tommy Tuberville are former PEUs.

What else changed in healthcare since 2011? Accountable Care Organizations came into being. PEU Cerberus cited forming an integrated accountable care organization in its rationale for buying Caritas Christi and forming Steward.

Another change is the mass migration of U.S. healthcare companies to private equity ownership.

Let that sink in...50% of the healthcare industry is owned by private equity. That means lots of deals. Oddly, one man behind the Affordable Care Act, Peter Orszag, is now head of Lazard. Their website states:

Lazard is one of the world's leading advisors on mergers, acquisitions, divestitures and related strategic matters.Orszag changed his tune on healthcare antitrust after joining Lazard. Consider his shift:

So Peter wanted healthcare to be overrun by private equity underwriters? That's quite the admission. Fortunately, a judge came to the PEU rescue and stemmed any antitrust overreach. Peter can get back to wheeler-dealing PEU style. His brother Jonathon can advise groups involved in both sides of an antitrust fight.

Let's tackle the second hearing.

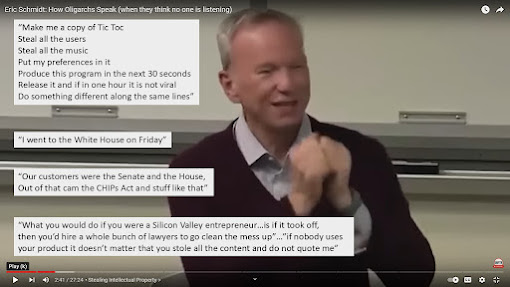

Billionaires can "buy a Congressman" and make their problems go away.

Who serves who in our PEU world? Politicians Red and Blue love PEU and increasingly, more are one. Nearly every former Medicare Chief is a PEU.

It's no wonder people feel the healthcare system is not serving them. An accountability mechanism does not exist. Right Dr. Ralph de la Torre?

Right Tom Scully? Scully is the former Medicare Chief who refused to testify before Congress and went on to General Partner with PEU Welsh Carson Anderson and Stowe. WCAS just benefited from that recent antitrust ruling.

Update 10-2-24: Lazard's Peter Orszag was on CNBC this morning bemoaning the FTC's antitrust focus on vertical intergration (PEU buyouts).