Politicians Red and Blue love PEU (private equity underwriters) and increasingly more are one. The latest greed and leverage boy to run for office is Tim Sheehy. Fresh off a massive base wealth injection Sheehy is ready to join the U.S. Senate for the Red team.

Tim Sheehy founded Bridger Aerospace in 2014. It merged with Jack Creek Investment Corporation, a blank check Cayman Islands exempted company.

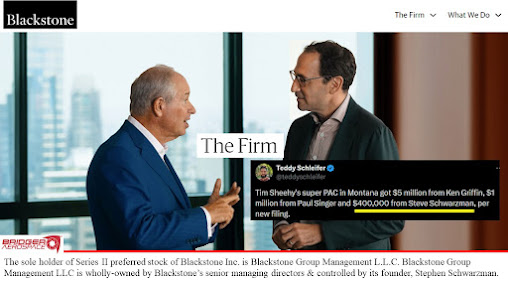

Stephen Schwarzman's Blackstone Group took a 20% stake in the merged company and received two board seats.

PEU legend Schwarzman went from sponsoring Bridger Aerospace to sponsoring its CEO for the U.S. Senate. Sheehy's main clients are federal and state government agencies. Schwarzman's $400,000 political donation is nearly Sheehy's 2021 CEO salary ($450,000). Once Blackstone got involved Sheehy's pay exploded.

Schwarzman and fellow Carlyle Group co-founder David Rubenstein emerge from their glass towers and light around Capital Hill when a serious challenge is made at taking away their tax dodge. Keeping carried interest is not enough. The PEU boys always want more.

My wise friend (who wanted me to note that he is not an expert) stated:

I was wondering if the taxes on non-realized gains was a wake up call for the guys borrowing against their portfolios hyper-inflated valuations in the debt markets to avoid taxes. We have seen this go on in the real estate market, the private equity market, the VC market, and who knows what else in the wealth management business. Our tax policy allows tax avoidance through this and these means. This also creates the wealth inequality and inflation in the system. None of these would be possible without a complicit federal reserve system. No one talks about this stuff though. If we are going to promote asset valuations as the economy then they should basically be willing to take a tax hit for the whole economy to sustain the fiscal budget to run the country. Otherwise they are using a subsidy guaranteed by all of us for their narrow interests.

My friend can see the 3D chess game PEU billionaires are playing. The board is invisible to most of us.

The wake up call might have prompted Blackstone to reach into its CEO pool for a Senate candidate. The PEU boys need more of their kind on the inside to craft billionaire advantaged tax policy.

Peter Thiel sponsored J.D. Vance twice and is going for the trifecta. Stephen Schwarzman is going for the double with Tim Sheehy. I hope they both strike out.

Update 9-8-24: My wise friend recently said this about Blackstone:

Don't you get a renewed sense of hope when the Blackstone Global Real Estate Co-head can get on CNBC and tell you how she is investing in the real estate data center market after walking away from hundreds of billions of dollars and obligations in the commercial real estate market.? The education all of us get from those that return the keys and kept the fees it's just so inspiring. The ability to bounce back after locking up investors in a falling market with false marks and yet still have the fortitude and their capital to reinvest in other ideas.

The PEU boys (and girls) are truly shameless.

Update 10-9-24: Sheehy referred to women under 25 who want the right to control their own reproductive systems as "indoctrinated." Projection? Patriarchy? Both?

Update 10-22-24: Near the end of his Hedgeye interview Marc Cohodes said:

"Hopefully, Sheehy gets his ass handed to him in Montana."..."This guy is bad news."

The Guardian ran a story on Sheehy's use of public bond funding as CEO. It stated:

Sheehy’s Bridger Aerospace, a company he founded in 2013, negotiated a deal with Gallatin county in eastern Montana to use its pristine credit rating to raise $160m in bonds. The county was meant to benefit from Bridger’s plans to hire more workers and build two new aircraft hangers.

But the company used most of the money, or $134m, from the 2022 bond issue to pay back previous investment from Blackstone, a New York-based investment giant.