CCMP Capital

will sell LHP Hospital Group and its five hospitals to Ardent Health Services, another privately owned for-profit healthcare company. After the deal Ardent will own nineteen hospitals in six states. James D. "Denny" Shelton chairs the board of LHP Hospital Group and is senior advisor to CCMP Capital. It's not unusual for a private equity underwriter (PEU) to be a Senior Advisor and Board Chair of an affiliate.

Shelton worked alongside Nancy-Ann DeParle at CCMP Capital. DeParle

left to Become President Obama's health reformer. Despite divesting all

conflicting assets Nancy-Ann received

a payout from CCMP's sale of

MedQuest while working in the White House.

Nashville based private equity underwriter Welsh, Carson, Anderson and Stowe

monetized its longstanding investment in Ardent for $1.825 billion in April 2015. WCAS employs Bush Medicare Prescription Drug creator Tom Scully. It's not clear how much Tom made from WCAS flipping Ardent. It's two new owners are Chicago-based real estate investment trust Ventas and Equity Group Investments. One is a PEU, while the other caters to private equity affiliates looking to monetize their real estate..

Five months before announcing the deal for LHP Hospital Group Ventas

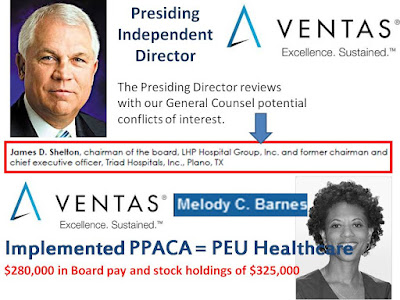

named James D. "Denny" Shelton as its Independent Presiding Director. Shelton

served on Ventas board since 2008 and controls nearly 24,500 shares of company stock, worth $1.4 million as of Friday's closing price of $58.75.

I'm not sure how the Presiding Independent Director can navigate the purchase of a company he

helped found and failed to mention in his public

board biographies.

Bloomberg listed Shelton's affiliation with LHP Hospital Group, but not his board chairmanship.

Consider Ventas Chair and CEO description of the deal in their recent

earnings call with Wall Street analysts:

Last year during the third quarter we closed our

acquisition of Ardent's hospital real estate and articulated a vision

for building formidable, high quality hospital business in this large,

dynamic space. We chose Ardent as our beachhead investment because it is

a winner and potential consolidator with its good hospitals,

significant market presence, attractive payer mix, good quality of care

and strong margin.

We also design the growth strategy that focus on scaling

Ardent's experience management team and strong infrastructure. At that

time, we identified some desirable acquisition target and Legacy Hospital Partners or LHP who's at the top of the list because it shared

these desirable characteristic. We are now happy to say that Ardent has

inked a deal to acquire LHP just like we drew it up on the board.

As healthcare premier capital provider, Ventas is

fueling Ardent's growth by providing a $700 million secured loan

enabling Ardent to acquire LHP. This deal is attractive both financially

and strategically for all Ardent partners and shows our continued

ability to align with market leaders to support their growth.

Financially, the loan will be accretive to Ventas' 2017 earnings with a going in floating interest rate of approximately 8%.

Just like we drew it up on the board, the one with Denny Shelton presiding independent director and chairman of LHP Hospital Group. Denny is on both sides of this deal and surely no longer independent.

PEUs buy companies and spin off the real estate, usually requiring a more expensive lease arrangement. Ventas CEO spoke to capital costs for LHP Hospitals in the earnings call.

And so it is a real gem and in terms of we are looking at 2017 expected

performance. And I'll tell you that LHP now is borrowing in the 4s.

LHP will pay double that Ventas, the 8s. No wonder healthcare costs are killing the average person.

Another political heavyweight sits on Ventas board of directors, Melody Barnes. Her Ventas board tenure began in 2014. Barnes'

speaker bio states:

Melody Barnes served as assistant to the President and Director of

the White House Domestic Policy Council (DPC) from January 2009 until

January 2012. In that capacity, she provided strategic advice to

President Obama and worked closely with members of the Cabinet

coordinating the domestic policy agenda across the administration.

Under

Barnes’ leadership, innovative new policies, practices and partnerships

were initiated to address significant national challenges.

During Barnes’ tenure, the DPC began working with the Department of

Health and Human Services and the Department of Treasury to implement

the health care reform legislation, coordinated government-wide

implementation of critical new food safety executive actions and crafted

and began implementing the first comprehensive national strategy to

address the domestic HIV/AIDS epidemic.

Barnes earned $223,000 in board compensation for 2015. She holds nearly 6,800 shares of Ventas stock, roughly valued at $325,000.

Be clear that former government health reformers, DeParle, Scully and

Barnes, have been personally enriched from the system they helped

create. It favors for-profit healthcare and their PEU owners. LHP Hospital Group is but a window into this world.