The Saudi Public Investment Fund, controlled by Crown Prince

Mohammed bin Salman,

invested

$2 billion in Jared Kushner's new private

equity firm six months after Kushner left the White House.

The fund's

screening committee voted unanimously against investing in Kushner's Affinity Fund, citing the "inexperience" of its management, an

asset management fee that "seems excessive," and the fact that due

diligence found the firm's operations "unsatisfactory in all aspects."

At the same time, the screening committee endorsed the fund's $1 billion

investment with former Treasury Secretary Steven Mnuchin's new Liberty

Strategic Capital.

"Ethics experts say that such a deal creates the appearance of potential

payback for Mr. Kushner's actions in the White House — or of a bid for

future favor if Mr. Trump seeks and wins another presidential term in

2024."

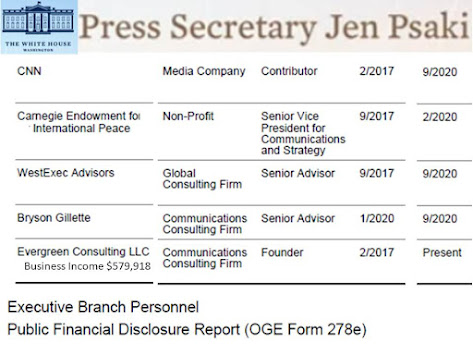

Politicians Red and Blue love PEU (private equity underwriters) and increasingly, more are one. Mnuchin and Kushner served the PEU class in office. PEU service facilitated their return as greed and leverage boys.

“Affinity, like many other top investment firms, is proud to have PIF

and other leading organizations that have careful screening criteria, as

investors.”

The Prince of Death supports the Lords of Greed. No surprise.

Update 5-16-22: Former golf great Greg Norman said in a

response to the Crown Prince ordered killing of journalist Jamal

Khashoggi at a media day

for his Saudi-backed LIV Golf’s inaugural event in London next month:

"Look, we’ve all made mistakes and you just want to learn from those mistakes and how you can correct them going forward."

Part

of rectifying a mistake is accepting responsibility and taking

accountability for one's action. The Prince of Thuggery has done

nothing in that regard. If Greg Norman has an inside information about

the murder he should inform authorities.

Update 6-6-22: The Shark went

name calling golfers who chose not to affiliate with a Saudi backed

golf tour. Greg Norman called Jack Nicklaus a "hypocrite" and.Rory

McIlory "brainwashed".

Greg

Norman, the public face of the breakaway LIV Golf series (sponsored by

Saudi Crown Prince MBS' Public Investment Fund), says the

executives and agents who currently run golf “are conspiring against LIV

to protect an antiquated system that prevents golfers from realizing

their own power and worth amid a global movement of athlete

empowerment.”

As for antiquated social systems in Saudi Arabia that don't involve the murder of a U.S. journalist:

Reports emerged that the women activists who pressed for the policy

change had been arrested and imprisoned. As of this morning, 13 are

reported to have been arrested; most are women. Apart from the driving

issue, they have campaigned against so-called guardianship rules which

require Saudi women to receive permission from a male relative before

making many life decisions, like traveling.

Update 8-16-22:

Bad leadership world wide means lots more opportunities to get one's

undies in a wad and resort to violence. Trump's undies have a quick wad

trigger that unleashes his ceaseless retaliatory impulse.

A Saudi woman studying at Leeds University was

sentenced to 34 years in prison for using Twitter to follow and retweet activists and dissidents. The World Economic Forum ran

a piece on using AI to reign in abuse on the internet:

By bringing human-curated, multi-language, off-platform intelligence

into learning sets, AI will then be able to detect nuanced, novel online

abuses at scale, before they reach mainstream platforms.

I imagine the Crown Prince would be most interested in such technology.

Update 8-17-22: The Saudi Crown Prince already has such an app. Someone "reported her on the Saudi app, which is called Kollona Amn, or We Are All Security."

Her alleged crimes including using a website to “cause public unrest”

and “assisting those who seek to cause public unrest and destabilise

civil and national security by following their Twitter accounts” and by

retweeting their tweets.

The World Economic Forum welcomed the Saudi Crown Prince in 2018 and now appears to endorse something similar to his security app.

Update 9-14-22: Trump's Sterling, Virginia golf course will host LIV Golf in May 2023. It will be the third LIV event at a Trump owned course.

Update 10-19-22: The Saudi Crown Prince also employs a number of retired U.S. military generals/admirals. Their commitment to free speech and fair justice did not last the flight to Riyadh or Dubai.

Update 11-12-22: Former Blue Teamer Peter Orszag and Lazard are behind the Crown Prince's resurgence on the world stage as his financial advisor.

Saudi Arabia's Public Investment Fund (PIF) is working with Lazard on

funding options and a potential initial public offering of Masar, a $27

billion mega project in the holy city of Mecca.

Greed is as greed does.

Lazard Geopolitical Advisory will combine some of the world’s most

experienced geopolitical minds with Lazard’s unmatched business

expertise.

It's an unholy alliance.

Update 12-6-22: The U.S. court case against the Crown Prince was dismissed under

the guise of sovereign immunity, something the Prince did not have at

the time of the execution. The judge said his hands were tied by the

Biden administration's recommendation to the court. Thugs win.

Update 3-31-23: Kushner's Affinity Partners received $200 million each from a Qatar and UAE sovereign wealth fund. That's on top of the $2 billion from the Saudi PIF.