The Carlyle Group's connection to Philadelphia Energy Solutions flamed out with the company's second bankruptcy filing in two years. Flashback to September 2012 when the private equity underwriter (PEU) announced the deal:

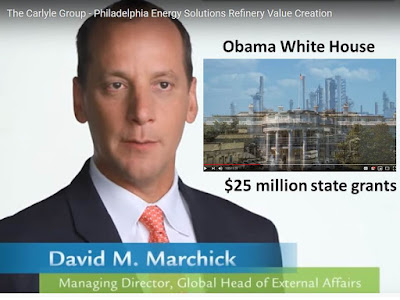

Philadelphia Energy Solutions (PES), the longest continuously operating refinery in the U.S., today officially launched its partnership with The Carlyle Group (NASDAQ: CG) and Sunoco Inc. (NYSE: SUN) at a celebration attended by elected officials, labor and business leaders, and hundreds of refinery employees. Philadelphia Energy Solutions also unveiled a new video depicting the determined efforts by business, labor and government to keep the refinery open for business.Public support reached $25 million in grants. A Carlyle press release cited state dollars:

Philadelphia Energy Solutions, with economic support from The Commonwealth of Pennsylvania, will invest in several capital intensive projects that are critical to the long-term economic viability of the facility. Planned improvements will help the environment through reduced waste and emission, and reduce reliance on foreign oil supplies. The Commonwealth will provide grants to help build a high-speed train unloading facility at the refinery, support a major capital project and upgrade the Cat Cracker (FCCU) at the refinery.Nearly seven years and one bankruptcy later Philadelphia Energy Solutions literally blew up.

Carlyle had plenty of dry powder to save Philadelphia Energy Solutions but the greed and leverage boys refuse to throw good money after bad.

Here's a picture of the nearly $600 million in good money Carlyle siphoned from PES before its initial fall:

Another interesting fact had the PES executive in charge of derivative trading leave the firm in March. Carlyle had Semgroup blow up from $2.4 billion in bad energy bets via forward looking contracts. I am not saying bad derivative bets contributed to PES second bankruptcy but found the timing interesting.

Pennsylvania's Governor is taking a Carlyle like approach in not throwing good money after bad. Carlyle won't refund public dollars for failure to meet an affiliate's commitment. Texas learned that with Vought Aircraft Industries. Governor Rick Perry's office gave Carlyle $35 million for 3,000 new jobs. As the six year deadline approached Vought had cut 35 jobs, $1 million per job eliminated.

Workers are nervous about their future. Reuters reported:

The company began selling the refinery’s oil supplies and equipment announcing it would seek to permanently shut the plant, sources have told Reuters. The asset sell-off triggered worries among workers that the company no longer aimed to find a buyer willing to restart the plant, as it had said it would do. The sale proposals included offers for future crude cargoes and time-chartered Jones Act vessels, sources had told Reuters.Owners Credit Suisse and investment firm Bardin Hill and PES debtholders seek to recover $1.25 billion in insurance losses from the June explosion. The Chemical Safety Board is investigating the blast and is yet to issue a report with their findings.

More than 600 union refinery workers will be laid off on August 25. Others were let go shortly after the fire. Hundreds of contractors that do business with the refinery are also expected to be affected by the shutdown.

Most stories on PES second bankruptcy have omitted Carlyle's ownership, albeit now minority. That echoes the Bush White House which omitted 25 patient deaths from Carlyle owned LifeCare Hospitals from its Hurricane Katrina "Lessons Learned" report. Like PES, LifeCare declared bankruptcy after seven years of PEU ownership (as did nursing home giant ManorCare after ten years of Carlyle sponsorship).

Some deals sink. Others blow up but Carlyle's billions in dry powder won't be used to pay back economic development agreements or retain promised jobs. The PEU boys take their money and run.

Update 7-28-19: The Obama White House helped setup the deal. The Trump administration helped the PEU boys avoid responsibility after bankruptcy number 1 and may help again with bankruptcy part deux.

Update 8-19-19: Bankruptcy trustee objected to Kirkland Ellis serving as bankruptcy counsel for PES due to its representation of PES creditors, Credit Suisse, Carlyle Group and Bardin Hill