Over the weekend the federal government declared "systemic risk" in order to fully back depositors at two banks, Silicon Valley Bank and Signature.

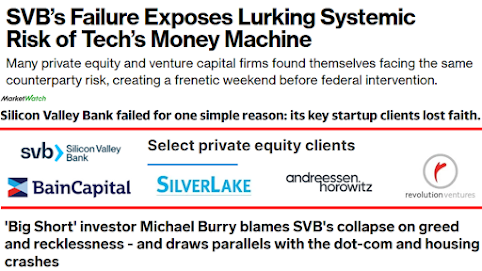

Silicon Valley Bank catered to private equity underwriters (PEU). The Biden White House is chock full of former PEUs. The just retired Chief of Staff Ron Klain worked for Revolution LLC.

PEU Peter Thiel put out the word last week to pull funds from SVB. It's ironic a billionaire helped kick off last week's bank run.

Signature Bank served the crypto world and held $250 million of Paxos funds. That money is fully guaranteed to the relief of Paxos board member Sheila Bair (former FDIC chair) and major investor David Rubenstein (Carlyle Group). Paxos has a bank, Paxos Trust. Might they benefit from crypto firms seeking a banking home?

"The Big Short's" Michael Burry called SVB "Enron" and anticipates a soon to fall "Worldcom."

"People full of hubris and greed take stupid risks, and fail."

This weekend's government action could be the biggest PEU boon since FDIC Chair Sheila Bair gifted BankUnited to Carlyle et al in the aftermath of the 2008 financial crisis.

PEU presents all around! Politicians Red and Blue love PEU and increasingly, more are one.

Update 3-14-23: The greed and leverage boys are circling SVB Bank and the other parts of SVB Financial

Bloomberg reported that Apollo Global and Blackstone have expressed interest in snapping up a book of loans held by Silicon Valley Bank.

SVB Securities may end up independent if CEO Leerink can find financing. The Carlyle Group used SVB Securities for Accelerate Learning and TriNetX. It predicted Carlyle would partner with UnitedHealth to buy Magellan Health.