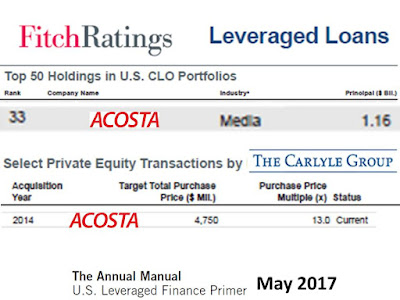

The Carlyle Group will hand another affiliate back to creditors/bondholders. PR Newswire reported:

Acosta's "pre-packaged" Chapter 11 Plan of Reorganization (the "Plan")Acosta, Inc. ("Acosta" or the "Company"), a full-service sales and marketing agency, today announced that it has reached an agreement with more than 70% of its lenders and more than 80% of its noteholders, each by principal amount, on the terms of a comprehensive reorganization and recapitalization. The deal will eliminate all of the Company's approximately $3 billion of long-term debt. Further, investors have committed $250 million in new equity capital backstopped by institutions committed to the long-term success of Acosta.

The piece offered no

word on how many billions Carlyle pulled from Acosta prior to

bankruptcy (September 2014 to present). Also, the release made no mention of The Carlyle Group.

New York City Retirement Systems invested $330 million in Carlyle's fund that owned Acosta. A 2017 Q3 report showed the negative impact of Carlyle's ownership of Acosta:

Carlyle Partners VI, L.P. - Side Car, a 2014 Co-Investment partnership, generated a net value loss of $0.03 million during the third quarter of 2017. Acosta, Inc. drove performance as the holding was written down 11% to $226.4 million as of September 30, 2017.

Update 12-1-19: Bloomberg reported Acosta filed for bankruptcy in the Delaware U.S. District Court.

Update 3-3-20: Forbes ran a story on Carlyle's failure with Acosta. While the piece did not highlight how much cash Carlyle pulled from the company it said, "Acosta is still running a respectable 10% net internal rate of return."