The Carlyle Group named a new head of energy strategy, Jeff Currie. Their press release stated:

Carlyle believes the energy transition is entering a new phase amidst the backdrop of significant geopolitical and macroeconomic shifts globally. Decarbonizing our global economy is not a simple linear transition from carbon-intensive energy generation to lower-carbon energy sources. It is a complex, multi-dimensional transition that involves energy production, distribution, transportation, refining, efficiency, and end usage, along with decarbonizing all other sectors of the economy. An effective and orderly energy transition will require new energy pathways – balancing energy availability, security, and affordability, as our energy systems simultaneously decarbonize. Carlyle has a large and diverse global energy platform that invests across the full spectrum of electrons and molecules necessary to develop these new energy pathways.Marcel van Poecke is Carlyle's Chair of Energy. That's not his only job. Marcel founded AtlasInvest in 2007.

Through its partnership with the Carlyle Group, AtlasInvest also manages the Carlyle International Energy Partners funds. These Carlyle Group funds manage more than $7bn of assets and invest in conventional energy businesses globally (outside of North America).

While not listed as a family office AtlasInvest employs a number of van Poeckes.

SEC filings show Marcel van Poecke as an officer for Regalwood Global Energy.

Regalwood Global Energy Ltd. is an international energy-focused special purpose acquisition company sponsored by an affiliate of Carlyle International Energy Partners, L.P., formed as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. Regalwood Global Energy Ltd. is led by Marcel Q. H. van Poecke, Chairman of the Board of Directors; Robert Maguire, a member of the Board of Directors; Brooke B. Coburn, President; and Kevin R. Gasque, Chief Financial Officer.

SPAC Regalwood rolled up in late 2019 without making any business combinations.

AtlasInvest and two Poeckes formed Tree Energy Solutions (TES) in 2019.

Carlyle Energy offered its second renewable and sustainable fund in 2023, hoping to raise up to $2 billion. It states the fund will use a "private equity value creation approach." That generally involves nondemocratic means in profit making.

And that brings us back to Marcel van Poecke's first stint with Carlyle.

1993 - Dutchmen Marcel Van Poecke and Willem Willemstein found Petroplus International B.V. from a management buyout.2005 - Private equity firms Carlyle and Riverstone Holdings buy Petroplus,2006 - Petroplus lists company on the Swiss exchange, raising $2.4 billion and making big profits for Carlyle and Riverstone. Marcel van Poecke resigns from the company.

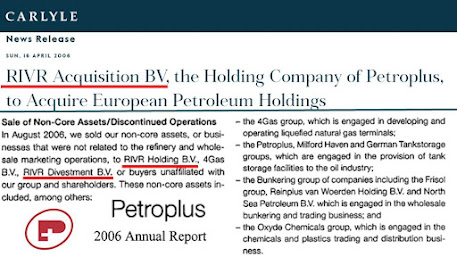

Carlyle executed a number of PEU moves at Petroplus. It spun off noncore assets in December 2005:

As part of the new strategy of Petroplus, all the LNG activities of Petroplus will be operated on a stand-alone basis with a management team dedicated entirely to LNG and power in a new entity called "4Gas".The CEO of 4Gas was none other than Paul van Poecke.

And who did they spin 4Gas off to? Their owners, Carlyle/Riverstone.

The holding company of Petroplus sold off "noncore assets" to other entities run by Carlyle/Riverstone. That hardly seems arms length.

Petroplus sold one asset to SemGroup LP, a fellow Carlyle/Riverstone affiliate.

Carlyle only controlled 30% of SemGroup.

"We are very excited about the opportunity to work with Carlyle/Riverstone and believe that our partnership will build upon SemGroup's financial and operating success. Carlyle/Riverstone is known as one of the premier private equity players in the energy and power sectors. The transaction will provide SemGroup with a strategic partner that offers a distinct combination of investment and industry professionals who have highly successful track records," Tom Kivisto, SemGroup president and chief executive officer, said.So what role did the strategic partner play in the sale of Petroplus' noncore assets to another holding of that same strategic partner?

Private equity underwriters (PEU) revel in leverage, whether they be personal or family relationships, sitting on both sides of the table in deals and driving affiliate business inside the PEU corporate family.

.

New energy pathways will likely come with Carlyle's same old tricks, deal fees, management fees, debt for dividends and cross selling services within the One Carlyle family.

Ride up the boom while generating fees, monetize and get out before the bust. That's the PEU way.

Other interesting facts:

Ironically Petroplus went on to do a joint venture with Blackstone and First Reserve. Unfortunately, refining margins fell too far to support Petroplus' massive debt and the company declared bankruptcy in 2012.

Update 3-19-24: Carlyle's Jeff Currie predicts much higher oil prices if the Fed cuts interest rates.