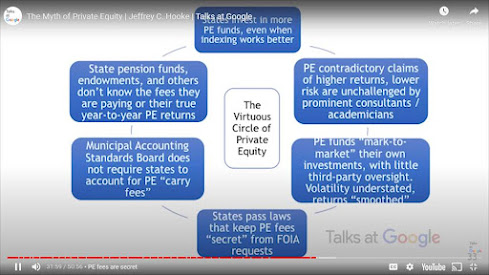

Private equity underwriters became ubiquitous over the last twenty five years. They influenced the system via elected officials and regulators, ending up with certain advantages. Jeffrey Hooke, senior lecturer in Johns Hopkins MBA program and a Wharton grad, speaks of private equity's virtuous cycle.

The cycle includes leverage that only increases/maintains asset values, preferred taxation, secrecy, accounting leniency, and stacked return measures, all enabled by people charged with standing guard. It's known as regulatory capture.

NYT wrote about policy making billionaires in 2011. They've grown in numbers and influence since.

PEU chiefs have more riches and power every

day.

We've had decades to see how they use it.

Update 10-16-23: It seems the richest people in the world may not save us with their philanthropy. Carlyle co-founder David Rubenstein coined the term "patriotic philanthropy," while disgraced FTX founder Sam Bankman-Fried offered "effective altruism." They are two sides of the same coin.

Business Insider reported:

An Israeli billionaire businessman and his wife stepped down from

their positions on a Harvard University board over the school's response

to the Hamas terror attacks on Israel.

Idan Ofer, who owns Quantum Pacific Group, is the world's 81st-richest person, with a net worth of $19.9 billion.

Insider later added:

Les Wexner, the billionaire retailer and founder of Victoria's Secret, is the latest to pull funding from an elite school in the wake of the attacks last week.

Wexner

funded Jeffrey Epstein for decades.

TeenVogue had the guts to print:

Every couple of years, a very wealthy, prominent individual dominates the headlines, having boldly vowed to give away their fortune to fix the crises of our time. A cynic might say they’re merely patching up problems of their own creation. Despite the glaring hypocrisy, a halo effect takes hold, allowing those who benefit most from deepening inequality to rebrand themselves as saviors.

As long as we’re reliant on the good will of the wealthy, big philanthropy will always have strings attached.

Abysmal leadership ensures the crises of our time remain firmly in place. Hamas had the gall to "pretend they were governing" before launching a horrific terror attack on Israel.

....pride, envy, gluttony, greed, lust, sloth, and wrath bring war, famine, plague and death

Update 10-17-23: The donor revolt at American Universities is spreading.

Update 10-19-23: Powerful donors continue weighing in U.S universities.

Update 10-22-23: A major investor pondered the implications of "the bank run on college university endowments."

Update 11-2-23: Bill Ackman lamented the PEU boys have to "police campus antisemitism."

semetic: relating to the peoples who speak Semitic languages, especially Hebrew and Arabic.

Update 11-6-23: Bill Ackman spoke to CNBC about his concerns regarding speech on Harvard's campus. Jordan's Queen Rania shared her thoughts about the horrific Israel-Hamas war in Gaza.

Update 11-10-23: PEU billionaires want to rule the airwaves:

Wall Street and Hollywood billionaires have discussed in recent weeks a plan to spend as much as $50 million on a media campaign to “define Hamas to the American people as a terrorist organization.”

It has long held the majority of war casualties, deaths and disability come from innocent civilians. The conditions of war kill more people than bombs and bullets. Intelligent billionaires should know this, yet they refer to these facts as "narrative."

“Public opinion will surely shift as scenes, real or fabricated by Hamas, of civilian Palestinian suffering will surely erode [Israel’s] current empathy in the world community,” he wrote. “We must get ahead of the narrative.”

....the billionaire collective has "a net worth of nearly $500 billion."

Update 11-29-23: Billionaires are lining up behind Red Team candidate Nikki Haley. Former free speech absolutists now want to restrict campus speech.

Update 11-30-23: Those who ask challenging questions or write anything critical about our "policy making billionaires" get shunned and shut out, even in the sports world.

Update 12-8-23: PEUs giveth and taketh away.

In 2017, Stevens, the founder and CEO of Stone Ridge Asset

Management, donated limited partnership units in his fund to Penn in

order for the school to establish a center for innovation in finance.

The donation is now worth about $100 million, according to a letter from

Stevens' lawyers to Penn.

"Mr. Stevens and Stone Ridge are

appalled by the University's stance on antisemitism on campus," reads

the letter, which Insider obtained a copy of. "Its permissive approach

to hate speech calling for violence against Jews and laissez faire

attitude toward harassment and discrimination against Jewish students

would violate any policies of rules that prohibit harassment and

discrimination based on religion, including those of Stone Ridge."

The

threat to withdraw the donation marks an escalation of the backlash

elite universities are facing following growing instances of

antisemitism on campus.

Is it that easy to take back? If so, is it really a donation or something else.

Update 12-11-23: Virginia Governor and former PEU Glenn Youngkin threw his weight behind fellow PEUs with his call that Harvard's and MIT's Presidents step down like Penn's President.

Update 12-16-23: The New Republic referred to billionaire Bill Ackman as the "plutocrat who thinks that being very rich entitles him to run more or less everything." PEUtocrats Rule, like they have for decades.

Update 1-3-24: The greed and leverage boys ousted Harvard University's President. Their hold on power is nearly absolute. PEU strings are attached...

Update 1-4-24: Bill Ackman's wife committed the same sin as Harvard's former President, dissertation plagiarism. Does she need to resign from her marriage?

Update 1-7-24: The power of PEUs to toss out university presidents has been noted by others.

Update 1-22-24: Larry Summers joined Bill Ackman in raking Harvard over the antisemitism coals.