The Virginia Economic Development Partnership announced last fall:

...a major joint venture has committed to build a manufacturing operation that projects to employ 2,500 people and produce 60 billion medical gloves a year.

As a direct result of the Commonwealth’s investments, Blue Star NBR, LLC and Blue Star-AGI, Inc., a joint venture between Blue Star Manufacturing and American Glove Innovations (AGI), have committed to invest $714.1 million to establish the largest, most advanced, one-of-a-kind nitrile butadiene rubber (NBR) manufacturing facility and nitrile glove production operation in Wythe County’s Progress Park.

OpenGovUS shows the company to be a Partnership or Limited Liability Partnership. It was established January 8, 2021. Ten months later Virginia Governor Ralph Northam attended a groundbreaking for the historic project.

Four names are associated with the project, Scott Maier (CEO), Marc Jason (co-CEO), Victor Galati (CFO) and Arthur Stark (Chairman). Blue Star NBR's website has no information on the company's leadership or board of directors.

Scott Maier has PEU roots with Cotton Creek Capital Management, where he was an executive vice president, and Hela Capital Partners, a joint venture PEU with GTCR. An old bio of his states:

Mr. Maier has 14 years of private equity, venture capital and operations experience. For the past 7 years, Mr. Maier has assisted private equity funds with the turnaround and management of their portfolio companies. His titles have included COO, CFO, and Director of Operations and Business Development.

Marc Jason is Founder and Chairman of London Luxury and had the time to be co-CEO of this major joint venture. London Luxury sued Walmart in January 2022.

London Luxury LLC filed a Jan. 5 lawsuit in New York State Supreme Court against Walmart Inc., charging that Walmart owes the company about $41 million for boxes of nitrile gloves produced in Malaysia and Thailand. The complaint goes on to state that London Luxury could lose more than $500 million on a deal to sell tens of millions of boxes of gloves to the retail behemoth.

“Walmart has created uncertainty regarding whether it intends to accept and pay for the vast majority of gloves it committed to buy,” the lawsuit claims.

In an emailed statement, a spokesperson for Walmart said the company has filed a counterclaim against London Luxury “for their repeated failure to meet product standards and delivery obligations.”

The case is scheduled to be heard in January 2024.

Virginia Business reported that lawsuit was the catalyst for a corporate divorce

Blue Star executives decided not to move forward with the partnership after learning of litigation involving Marc Jason, who was previously named co-CEO of the Blue Star-AGI joint venture.

...the joint venture may have fallen through, as Blue Star backed out of the partnership with AGI in January during the due diligence phase, according to Blue Star NBR CEO Scott Maier. “It’s just business,” Maier explained.

Blue Star is moving ahead with the project on its own, Maier said, and the decision to exit the joint venture will not impact the amount of the planned investment or the number of jobs previously announced. “They weren’t bringing any capital,” he said of AGI.

However, AGI spokesperson Deborah Brown, a partner with global law firm Quinn Emanuel Urquhart & Sullivan LLP, said the situation isn’t so cut and dry. “AGI is at least a 50% equity owner in [the project] and does not agree that it has departed or split from the venture,” Brown said in a statement. “AGI is committed to seeing the project through."

Brown also took issue with Maier’s characterization, saying, “AGI brought substantial capital to the deal and has invested funds into the venture.”

How is a major joint venture still in the due diligence phase a year after formation and two months after project groundbreaking?

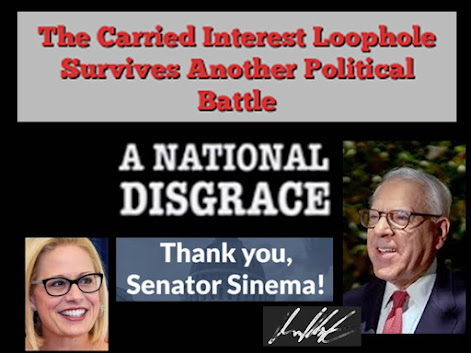

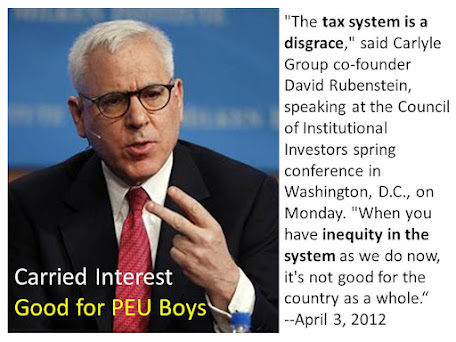

Current Virginia Governor Glenn Youngkin knows how to exit a major joint venture. The Carlyle Group dropped its lead developer role for the Harbor Island expansion at the Port of Corpus Christi. Youngkin was co-CEO at Carlyle and over the firm's infrastructure projects. Carlyle never gave a reason for exiting the planned port expansion to accommodate very large crude carriers.

Youngkin's Secretary of State Caren Merrick is also a private equity underwriter. Merrick held positions with Bilbury Partners and Gladstone Capital. All are familiar with holding multiple high paying roles simultaneously and slapping something together to take advantage of the latest trend or government opportunity.

Caren Merrick served on the board of Gladstone Acquisition Company, essentially an SPAC.

Gladstone Acquisition Corporation (the “Company”) is a newly organized blank check company incorporated as a Delaware corporation on January 14, 2021. The Company was formed for the purpose of acquiring, merging with, engaging in capital stock exchange with, purchasing all or substantially all of the assets of, engaging in contractual arrangements, or engaging in any other similar business combination with a single operating entity, or one or more related or unrelated operating entities operating in any sector (a “Business Combination”). While the Company may pursue an initial Business Combination target in any business or industry, the Company intends to focus its search on the farming and agricultural sectors, including farming related operations and businesses that support the farming industry, where the management team has extensive experience.If Bill Gates and Warren Buffet can buy farmland and farming operations so can Gladstone.

American manufacturing left the U.S. for China courtesy of the greed and leverage boys. The Carlyle Group sent auto parts jobs to China as Youngkin anchored his spot as a key top executive. Before running for Virginia Governor Youngkin watched Beijing rush hour traffic as a sign of economic vitality.

Re-homing manufacturing jobs is a national priority as the globe fractures.

On Feb. 4, the Virginia House of Delegates overwhelmingly approved legislation to fund up to $4.6 million for VEDP to provide recruitment and training of employees for Blue Star operations in Wythe County.Expect more public money for the PEU boys who earned big money offshoring jobs and want to do the same in bringing them back.