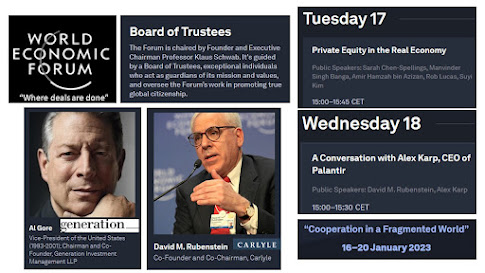

The World Economic Forum, an annual

meeting of global tamperers, convenes in two days. It's a deal making meeting of the private jet set in Davos, Switrzerland.

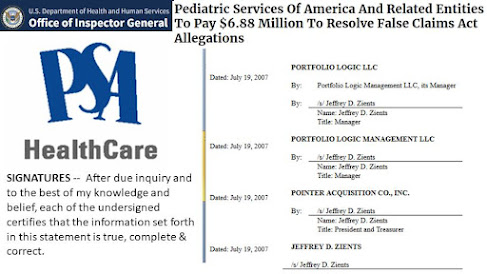

The WEF's board of directors includes Al Gore of Generation Investment Management and David Rubenstein of The Carlyle Group. Gore will speak at three sessions while Rubenstein interviews Palantir's Alex Karp. Palantir has provided security for the annual event.

Private equity underwriters (PEU) have a much lower profile in the 2023 agenda. It's harder to talk about fairness and equity with a session dominated by the greed and leverage boys.

FTX's failure is not on the agenda, however a path forward for crypto is the topic of one session.

This session is directly linked to the ongoing work of the World Economic Forum’s Digital Currency Governance Consortium.

That's likely a relief for Carlyle's Rubenstein whose family office has a stake in Paxos. Rubenstein interviewed FTX's Sam Bankman-Fried on his Peer to Peer program. Not mentioned in the interview was SBF's stake in Paxos or that SBF hit up the host's family office for funding.

What would it take to craft sufficiently robust regulation to realise

the benefits of digital currencies while ensuring positive macroeconomic

and societal outcomes?

Larry Summers will offer his insights in three sessions.

Is Rapid Growth Still Possible?

What Next for Monetary Policy?

Global Economic Outlook: Is This the End of an Era?

Summers has his own crypto shadow, a six year long advisory role for Digital Currency Group.

I doubt the WEF will explore its decade long failure to address income

inequality or its role in legitimizing shady crypto companies. Some things are just for show. Let the deal making begin!

Update 1-14-22: US. Representatives to the World Inequality Forum include:

- Ambassador Scott C. Miller -- Former UBS banker and Chair of Gill Foundation

- Secretary of Labor Martin J. Walsh

- Director of National Intelligence Avril Haines (former PEU with Tikehau Capital)

- United States Trade Representative Ambassador Katherine Tai

- Director of the Federal Bureau of Investigation Christopher Wray

- United States Agency for International Development Administrator Samantha Power

- Special Presidential Envoy for Climate John Kerry

- Senator Chris Coons

- Senator Maria Cantwell

- Senator Joe Manchin

- Senator Kyrsten Sinema

- Representative Joaquin Castro

- Representative Madeleine Dean

- Representative Mike Gallagher (Red Team)

- Representative Darrell Issa (Red Team)

- Representative Gregory Meeks

- Representative Seth Moulton

- Representative Maria Salazar (Red Team)

- Representative Mikie Sherrill

- Representative Juan Vargas

- Georgia Governor Brian Kemp

- Illinois Governor JB Pritzker

Update 1-15-23: Yahoo Finance will conduct a billionaire watch at Davos. Will they talk with Larry Fink who just signaled it was OK to jump back into bitcoin? Will any laid off BlackRock employees be interviewed alongside Fink?

Most of us won't see PEUs Tony Blair, Jared Kushner or any of the other power attendees dominating Davos.

Update 1-16-23: London School of Economics book review of "Davos Man: How the Billionaires Devoured the World" offered:

(the author) focuses on an elaborate sleight-of-hand perpetrated by global elites

primarily for their own benefit. He refers to these culprits both

individually and collectively as ‘Davos Man’

As they adopt the veneer of benign benefactor, Davos Men exploit

accounting loopholes and disproportionately avoid contributing to the

common good. By donating to political campaigns, economic elites lobby

governments to reduce their tax burden, a scheme that has been

disturbingly effective. As government revenues slump, resources to fund

social programmes dwindle, further exacerbating income and wealth

polarisation. The resulting downward pressure on wages, in combination

with fewer government programmes, has hit workers across the globe

particularly hard.

And that's why billionaire PEU and Carlyle Group co-founder David Rubenstein pays a mere 11.4% in federal income taxes.

malfeasance on the part of corporations and wealthy persons stems from

two distinct sources: corporate tax avoidance (including the legal

variants) and antitrust blocking. These are both exacerbated by

political campaigns wherein special interests wield undue influence.

Yet rather than blame the ultra-rich who have played a major role in

engineering this economic malaise, unscrupulous politicians have used

this opportunity to whip up voters by generating fear and animosity

through blaming immigrants and minorities.

That's why I say "Politicians Red and Blue love PEU and increasingly, more are one." PEU Report has tried to shed light on these revelations since 2007.

Senators Manchin, Coons and Sinema met with CEOs at a private Davos luncheon.

Update 1-24-23: Sinema is fresh from attending the World

Inequality Forum in Davos and rubbing elbows with the billion class. It

turns out the PEU boys were very generous with the Independent Senator after she saved their preferred taxation.

Senator

Krysten Sinema received at least $526,000 from donors in the private

equity, hedge fund, and venture capital industries after killing a bill

closing tax loopholes for private equity.

It sounds like the bidding has already started for her future services.

Sinema may have missed the call for taxing the super wealthy by Patriotic Millionaires at Davos.

“Extreme wealth is eating our world alive,” said Abigail Disney in a press release.

“It is undermining our democracies, destabilizing our economies, and

destroying our climate. But for all their talk about solving the world’s

problems, the attendees of Davos refuse to discuss the only thing that

can make a real impact—taxing the rich.”

Update 2-19-23: Al Gore's Generation Investment Management sold stock in Alibaba, Taiwan Semiconductor and Shopify.

Update 1-20-24: Oxfam chronicled a decade of failure by the World Economic Forum to impact income inequality.