Billionaire Elon Musk asked employees to envision themselves as a crime victim to increase productivity. He also invited Twitter employees to not leave the workplace by providing beds in conference rooms.

Musk likely drove away many intrinsically motivated Twitter workers. Live-in work under management by e-mail sounds like a special kind of hell.

Update: Founder Jack Dorsey said Twitter meets "none of the standards he hoped to achieve and that harassment of its staff is shortsighted and dangerous."

Update 12-14-22: Twitter debt holders are writing down the value of their debt/notes.

The biggest chunk of the debt -- $10 billion worth of loans secured by

Twitter's assets -- might have to be written down by as much as 20%.

Update 12-16-22: Twitter's Elon Musk, the free speech absolutist, banned a number of journalists. That got a warning from the European Union. Censorship by whim or retaliatory impulse is so 2022.

Update 12-20-22: Management by poll got a process change after Twitter users voted for Elon to step down as CEO. Now only paying Twitterheads votes will count.

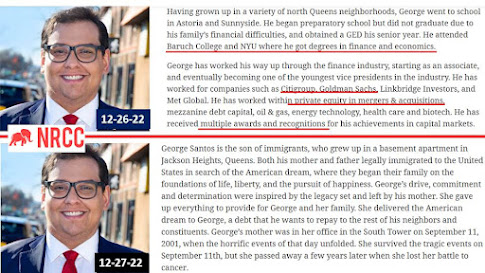

Update 12-26-22: Free speech absolutist Musk turns out to be a corporate autocrat. Visitors must wait for an hour and can only speak after Wizard Elon.

Update 12-29-22: In the midst of widespread technical problems shared by Twitter users Musk wrote "Works for me." Hellscape achieved.

Update 12-30-22: More evidence of Twitter's new Hellscape under Musk:

Some Twitter employees are bringing their own toilet paper to work after the company cut back on janitorial services.

The company's San Francisco headquarters have been left with dirty

bathrooms and the office is in disarray, per the publication. The stench

of leftover takeout food and body odor is present throughout the

premises.

Zero based budgeting has returned to Twitter. That brings a special hell for employees.

Update 12-31-22: TechCrunch reported:

Fidelity, which was among the group of outside investors that helped

Elon Musk finance his $44 billion takeover of Twitter, has slashed the

value of its stake in Twitter by 56%.

Cutbacks at Twitter abound as the company approaches $1 billion in interest payments due on $13 billion in debt, all while revenue dips.

The greed and leverage boys are happy to pay interest but will do anything to not pay taxes. Elon is a PEU in and of himself.

Update 1-1-23: Horror movie is close to Hellscape:

...the Twitter situation-- it's a nightmare on Elm Street that doesn't end.

Update 1-29-23: Hellscape achieved says many Twitter workers.

Update 2-6-23: A former Twitter employee said:

"We wanted to make people's lives more pleasant and more productive. And all of that went to garbage when Elon bought the company."

Update 2-19-23: Investor Elon made a Tesla co-founder's life a hellscape for two years after ousting him from the company.

Update 3-8-23: A laid off former Twitter manager who strongly supported Elon Musk tweeted "Cruelty is the worst" and stated supporting Musk was mistake.

Update 3-18-23: Musk joins the list of petulant billionaires unwilling to pay vendors and landlord, in this case Twitter suppliers. "Let them sue" Elon uses equity investors to negotiate supplier discounts.

Pablo Mendoza, a managing director at Vy Capital – who funded $700

million of his $44 billion Twitter takeover – has helped to negotiate

some bills down by as much as 90%. Mendoza sometimes plays on vendors'

emotions, telling them that his job is at risk if bills are not cut.

That is absolutely bizarre.

Update 3-26-23: Musk lost more than half the value of Twitter under his leadership.

...stock grants were based on a "$20b valuation." Musk paid $44 billion to take control of Twitter in late October.

No wonder equity investors are doing operations level work.

Update 4-8-23: Journalist Matt Taibi quit Twitter after Elon Musk made the platform unusable for Substack content creators.

Update 5-26-23: Elon Musk experienced

Twitter's failures during a Ron DeSantis presidential campaign

announcement. He is furious over the debacle. The next day Gov,

DeSantis signed

a bill granting liability protections for space flight entities in

Florida. Let's hope the liability shield performs better than the

Twitter app.

Update 5-31-23: Fidelity valued its Twitter holdings at 1/3 of Elon's purchase price. That's serious value destruction.

Update 7-4-23: One person wrote about their experience with Elon's Twitter leadership:

Elon Musk keeps finding creative ways to make the platform he paid $44 billion for less attractive to the majority of people.

Twitter, like our democracy, keeps taking away rights.

Update 7-16-23: Elon said Twitter is still losing money due to heavy debt and declining advertising revenue.

Update 8-2-23: Musk sued a nonprofit who cited an increase in disturbing content on Twitter, now X, after Elon purchased the company. The nonprofit called Musk's move straight out of the authoritarian playbook.

Update 8-27-23: Twitter X is now the home of the "blue tick" scammer. Wait until Musk turns it into a super app with digital payments. The scamming opportunities could be "next level."

Update 9-9-23: A former Twitter executive described working with Elon.

Musk’s moodiness made the job difficult, creating “a culture of fear” since he was so quick to fire people.

“I

quickly learned that product and business decisions were nearly always

the result of him following his gut instinct,” the post said, “and he

didn’t seem compelled to seek out or rely on a lot of data or expertise

to inform it.”

Dr. W. Edwards Deming noted the importance of "driving out fear" in his quality teachings. He put his learnings together into a system of profound knowledge late in his career. Dr. Deming worked until weeks of his death at the age of 93.

Update 9-25-23: Musk's biographer paints a disturbing picture of his subject in an interview with Carlyle co-founder David Rubenstein at the Economic Club of Washington. It seems Musk's childhood had a number of hellscape elements.

Update 3-7-24: Musk slammed MacKenzie Scott for donating to causes that advance women and minorities.

Update 11-4-24: TechGod Musk can make any job crappy:

canvassers were promised $2,000 per week in compensation and a return plane ticket. They were also told they would earn $1.50 per door knocked, text messages showed, and that rate would increase to $2 per door if they reached more than 1,000 doors per week — an unachievable number.

she and other canvassers were told they were fired because some of them had spoken to the media. ...

to inform it.”

Dr. W. Edwards Deming noted the importance of "driving out fear" in his quality teachings. He put his learnings together into a system of profound knowledge late in his career. Dr. Deming worked until weeks of his death at the age of 93.

Update 9-25-23: Musk's biographer paints a disturbing picture of his subject in an interview with Carlyle co-founder David Rubenstein at the Economic Club of Washington. It seems Musk's childhood had a number of hellscape elements.

Update 3-7-24: Musk slammed MacKenzie Scott for donating to causes that advance women and minorities.

Update 11-4-24: TechGod Musk can make any job crappy:

canvassers were promised $2,000 per week in compensation and a return plane ticket. They were also told they would earn $1.50 per door knocked, text messages showed, and that rate would increase to $2 per door if they reached more than 1,000 doors per week — an unachievable number.

she and other canvassers were told they were fired because some of them had spoken to the media. ...

to inform it.”

Dr. W. Edwards Deming noted the importance of "driving out fear" in his quality teachings. He put his learnings together into a system of profound knowledge late in his career. Dr. Deming worked until weeks of his death at the age of 93.

Update 9-25-23: Musk's biographer paints a disturbing picture of his subject in an interview with Carlyle co-founder David Rubenstein at the Economic Club of Washington. It seems Musk's childhood had a number of hellscape elements.

Update 3-7-24: Musk slammed MacKenzie Scott for donating to causes that advance women and minorities.

Update 11-4-24: TechGod Musk can make any job crappy:

canvassers were promised $2,000 per week in compensation and a return plane ticket. They were also told they would earn $1.50 per door knocked, text messages showed, and that rate would increase to $2 per door if they reached more than 1,000 doors per week — an unachievable number.

she and other canvassers were told they were fired because some of them had spoken to the media. ...found out she and others were fired through a GroupMe chat. ...they were not compensated for their work before they were terminated.

Glassdoor showed an X review by a software engineer which stated:

Elon Musk is an overrated dilettante who consistently proves to be a harmful influence. Despite his grandiose claims, his actions reveal a disturbing tendency to enable racism and foster an environment of incompetence. His Twitter antics are just the tip of the iceberg, showcasing his lack of genuine insight and responsibility. Musk’s public persona is a façade, masking the troubling reality of his behavior and impact on society. He’s more harmful than helpful. Overall, he is the product of privilege, not outsized intellect, and duplicitous exploiter of those who traffic in the idolatry of self-professed innovators.

His advice to X management? "Lay off the ketamine."

Update 1-29-25: Elon sent an update to staff which noted "our user growth is stagnant, revenue is unimpressive, and we’re barely breaking even." Banks holding X debt are nervous about the company's ability to repay.