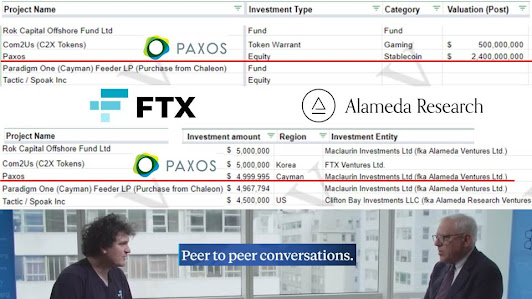

FTX bought a stake in Paxos in July 2021. Carlyle Group co-founder David Rubenstein invested in Paxos in several funding rounds through his family office Declaration Partners.

Rubenstein interviewed fellow Paxos investor and FTX founder Sam Bankman-Fried (SBF) on his Bloomberg show in September 2022.

Late in the interview Rubenstein mentioned his stake in crypto infrastructure firm but did not identify Paxos.

"I have invested in companies that service the industry.."

Sam did not disclose his roughly $5 million stake in Paxos, however FT did and I am grateful for that. FT showed a Cayman Islands investment in Paxos through MacLaurin Investments Ltd., which is now in bankruptcy in a Delaware court.

Rubenstein closed the Bankman-Fried interview with coaching on how to remain incognito. SBF may want more advice from the Carlyle co-founder on dealing with upset investors (Carlyle Capital Corporation).

Also unsaid in the interview, SBF hit up Rubenstein's family office for funding. Financial News recently interviewed the Carlyle co-founder:

Did you invest in FTX?

I didn’t. My family office team looked at FTX at the $30bn valuation [earlier this year]. It didn’t move forward, and the memo never reached me, but the other day they showed me what they had prepared. The memo pointed out all the concerns about conflicts of interest. There wasn’t a lot of transparency.

That would have been good research for an interview on Bloomberg. So much for a hard hitting business interview. It's front stage acting for the benefit of the masses.

Update 12-28-22: Sam Bankman-Fried's 56 million shares of Robinhood stock came from a $546 million loan from Alameda Research. SBF parked the shares in Emergent Fidelity Technologies. Creditors are trying to get that money. Where did FTX client funds go and how can those be clawed back?

Update 12-30-22: FTX ventures used $200 million in customer money to invest in two fintechs, Dave and Mysten Labs.

Update 1-7-23: SBF wants to keep "his" $450 million in Robinhood stock to fund his legal bills. Wall Street on Parade noticed Paxos last fall.

Update 1-12-23: Bankruptcy court learned:

Sam Bankman-Fried instructed his FTX cofounder Gary Wang to create a "secret" backdoor to enable his trading firm Alameda to borrow $65 billion of clients' money from the exchange without their permission.

Borrowing is not the right word. Some of those embezzled funds were used for investment purposes. Still no word from Paxos on refunding SBF's $5 million equity stake.

Update 6-29-23: Bloomberg reported:

EDX Markets, a nascent crypto exchange supported by Charles Schwab, Fidelity, and Citadel Securities, has reportedly ended its intended association with Paxos and is nearing an agreement with Anchorage Digital.