Anthony Scaramucci posted his August 2022 interview with Carlyle Group co-founder David Rubenstein

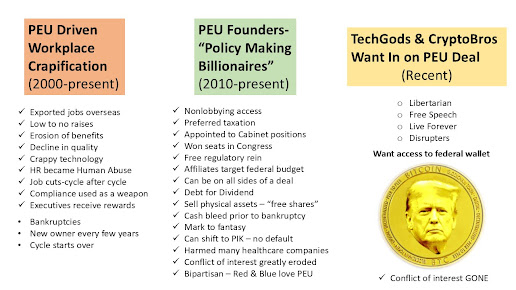

The discussion turned to politics, an area where Rubenstein is an innovator. Rubenstein and his co-founders located Carlyle in Washington, D.C. in 1987 for the purpose of being close to political power and mining Uncle Sam's wallet. For decades this was the private equity underwriter's (PEU) secret sauce.

Rubenstein told the Mooch:

"I'm not against business people, business leaders getting involved in government, politics and lobbying in one way or another.....

....you have to admit the level of money in politics today is so staggering that if we were a banana republic these campaign contributions would be called bribery....

....money is the mother's milk of politics....

....you can keep the money (political donations) the law now is that you can keep the money that's not expended. You can't use it for personal purposes, but for example, let's suppose you want to hire your daughter to be your campaign manager, you can give her a salary. If you want to rent one of your own buildings for your campaign headquarters, you can use that money....

You can do a lot of personal things with the money that's left over....it's not a great situation honestly."

"A one, two or three million dollar donation" in the Summer of 2022 bought the attention of members of Congress who spent 40% of their time raising funds.

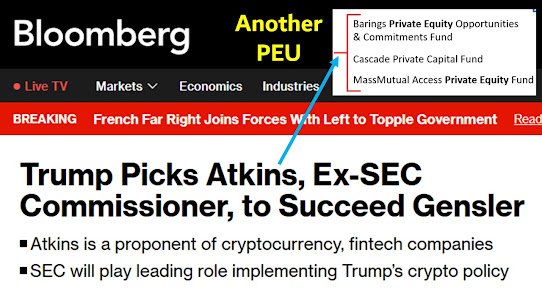

Elon Musk spent over $250 million towards a Trump White House redux. Other TechGods kicked in huge amounts for the return of the Donarch. The $1 million donation plate is circulating in corporate C-Suites for the upcoming Trump coronation.

The PEU boys spent decades currying political favor and getting their will enacted into law as policy making billionaires. It was silent, secret and surreptitious. TechGods play fast, loose and loud. Neither the PEU boys or TechGods have encountered a conflict of interest they couldn't minimize, discredit or simply ignore. Government has mostly been the enabler of shady behavior, like the campaign finance laws described above.

What few rules exist to restrain "what would be called bribery" in a banana republic are on their way out. It's a horrific situation, one crafted for the unethical, the dishonest and those obsessed with earthly gains.

Politicians Red and Blue love PEU and increasingly, more are one. It's the Red Team's turn to steer the power of the federal budget to their friends and family. TechGods want in on the action.