Yahoo Sports reported:

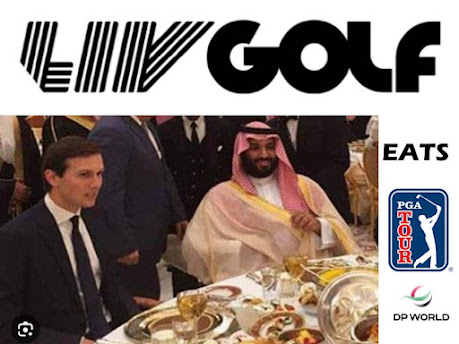

...the PGA Tour, the DP World Tour and LIV Golf, the upstart breakaway tour funded by Saudi Arabia's Public Investment Fund, have agreed to merge and create a new entity to unify the tours.

The

details are still sparse and incomplete, but the fact that the PGA Tour

and LIV Golf have agreed to create a new entity after more than a year

of acrimony and litigation is significant. The deal was negotiated in

such a secretive fashion that not even the PGA Tour's players knew. LIV

Golf CEO Greg Norman apparently found out in a phone call just before

the announcement was made public.

The sole and exclusive financial investor in the new entity will be Saudi Arabia's Public Investment Fund. Saudi Arabia's Public Investment Fund also retains the right of first

refusal for any additional investment in the new entity. That, in

effect, gives Saudi Arabia's PIF enormous power in dictating the scope,

goals and direction of the new entity.

Golf is the now the shiniest sportswash gem in Prince Mohammed bin Salman's crown. No pariah here, just a giant pair of gold truck nuts dangling from bin Salman's throne.

Like all good PEU and SWF deals the tax implications are minimized:

The PGA tour will continue to retain its status as a 501(c)(6) tax-exempt

organization, and will retain so-called "inside-the-ropes

responsibilities" of its events.

The greed and leverage boys want both money and image. State sponsored industries now include professional golfers. Are they ready to pay homage to their new owner?

The average citizen gets to pay more for gas to fund this deal. Who's ready to cheer on higher oil prices?

Golf, but LOUDER. Gas, but HIGHER!

Update 6-7-23: Many PGA players expressed concerns about the deal and called the PGA Commissioner a hypocrite. It's amazing how tons of money can change one's principles. Maybe the opposition will decrease when all the players get their set of gold MBS truck nuts. Can they spare a few sets for the 9-11 families, who are legitimately disgusted by the PGA's grotesque sellout?

PGA players experienced the kind of duplicitous, selfish behavior of the people in charge. You can't call it leadership because executives sold out their core beliefs and principles. Lesson here is greed wins. That's a sick and sad distortion, not close to any substantive transformation.

PEU Carlyle wants to exploit sports as well as Saudi Arabia's evil Crown Prince:

Update 6-8-23: Twitter user Mr. Skilling tweeted yesterday:

On 9/11, Jimmy Dunne skipped work to play golf.

66 of his Sandler O’Neill colleagues were murdered when Saudi-funded terrorists crashed a plane into the south tower.

Today, he joins the Executive Board of a golf league funded by the same government that murdered his friends.

Dunne joined the PGA board to protect it from Saudi owned LIV. Today he owned that justice looks different for his and the Crown Prince's kind of people. They can just kill those they believe are guilty.

Dunne, speaking to Golf Channel on Thursday afternoon, vowed to “kill” anyone who “unequivocally was involved with it” himself.

There you have it. The PGA and LIV really are like minded partners. I wasn't much of a golf watcher before. Now I'll skip their events.

Update 6-9-23: Matt Stoller's BIG ran a piece on the sellout, which he views as comically monopolistic and gives it a zero chance of going through as announced.

Update 7-10-23: One PGA board member resigned rather than support the Saudi buyout.

Update 7-11-23: A Congressional hearing is being held on LIV's buyout of the PGA. PGA reps said players would not be restricted to what they say about the Saudi Crown Prince or the Kingdom. That's what got WaPo journalist Jamal Khashoggi killed.

Update 7-12-23: The LIV-PGA deal includes a non-disparagement clause.

Update 8-9-23: PGA golfers learned that their voice makes zero difference. PGA Chief Jay Monahan held his first meeting with players since the deal was announced. Only 25 showed up.

Update 11-29-23: Tiger Woods insists a deal between the PGA Tour and Saudi Arabia’s Public Investment Fund, which bankrolls LIV Golf, “can’t happen again” without players being consulted. Tiger said of the deal:

So quickly, without any feedback or information. I was surprised that the process was what it was.