Maritime Executive reported:

Private equity companies The Carlyle Group and Stellex Capital Management have agreed to merge two American shipyard firms, Oregon-based Vigor Industrial and Norfolk-based MHI Holdings. The combined company - Titan Acquisition Holdings - will have ship repair, fabrication and defense contracting capabilities on both the Pacific and Atlantic coasts.Carlyle cut its teeth on defense contractors, United Defense, BDM international and Vought Aircraft Industries. Carlyle hired former Defense Secretary Frank Carlucci as managing director. That was three decades ago.

GovConWire reported on the CarlyleGroup-Stellex Capital deal:

Vigor has approximately 2,300 employees and provides ship repair and fabrication services for defense, aerospace and infrastructure customers through its eight drydocks across Alaska and the Pacific Northwest. Norfolk, Va.-based MHI offers ship maintenance, repair, hull cleaning and ship husbandry services to the U.S. Navy and Military Sealift Command.Portland Business Journal revealed:

Vigor, which builds and repairs ships as well as fabricates parts for several industries, employs 1,230 local workers and 2,300 overall. It's the region's eighth-largest manufacturer based on employee count. The company reported $678 million in 2016 revenue.It landed its largest contract ever, a nearly $1 billion contract to build the U.S. Army's next-generation landing craft, in 2017. Vigor also recently took over the former home of Christensen Yachts to set up the all-aluminum fabrication facility, saying at the time it will invest millions in capital upgrades and equipment.In February, the company announced it would build the craft in Vancouver. It also said the contract could boost its Vancouver employment by 400 workers.

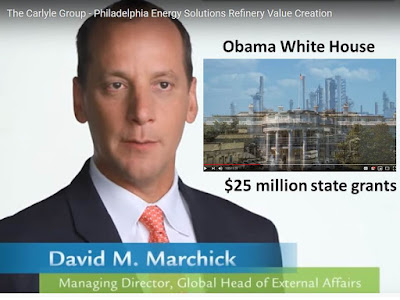

Today Carlyle is a global private equity underwriter (PEU). The U.S. PEU model involved hiring the politically powerful to influence government support for the greed and leverage boys. That's now worldwide.

Portland Tribune added:

Vigor also builds high-performance military craft for the United States and other allied foreign governments.

How will Carlyle use its political influence to profit from naval conflicts?

Tom Rabaut, former President and CEO of United Defense and a current operating executive at The Carlyle Group, and Admiral James Stavridis, a retired 4-star U.S. Navy officer, former NATO Alliance Supreme Allied Commander, and a current operating executive at The Carlyle Group, will both join the Board of Directors.Rest assured they will.

Update 8-2-19: President Trump indicated a blockage is under consideration for Venezuela to restrict outside support from Russia, Iran and China.

Update 8-25-19: The Obama administration declared Venezuela a national security threat and instituted economic sanctions which have harmed citizens. President Trump seems ready to finish off what Obama started.

Update 3-3-20: Motley Fool reported: "Huntington Ingalls allies with Vigor".

Perhaps this is why Huntington Ingalls announced a couple of weeks ago that it is forming a partnership with Vigor Marine. In a somewhat complex transaction, Huntington will contribute its San Diego Shipyard to Titan Acquisition Holdings, a company that (according to S&P Global Market Intelligence) is majority owned by private equity giant The Carlyle Group (NASDAQ:CG). Titan itself is described in this press release as being comprised of Vigor Industrial (Vigor Marine's parent company) and MHI Holdings (also a subsidiary of Vigor Industrial). In effect, Huntington Ingalls is merging part of its business with Vigor Marine, taking for itself a minority interest in Titan (and Vigor) in exchange.

Update 1-5-23: Carlyle is ready to cash in on Titan-Vigor-MHI for roughly $2 billion.

Update 6-29-23: Carlyle sold Titan-Vigor-MHI to an affiliate of Lone Star Funds for an undisclosed amount. A 6-15-23 press release on the closing is on Vigor's website but not on MHI's.