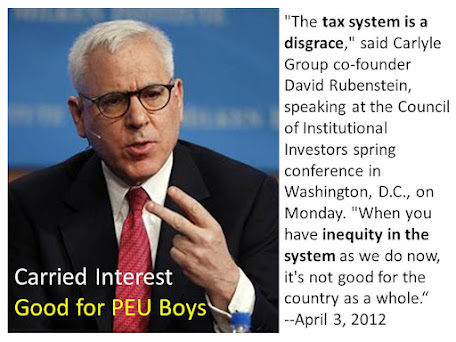

Carlyle Group co-founder David Rubenstein is likely pulling out the political stops once again to fend off a Senate Bill eliminating private equity's preferred carried interest taxation. He nixed numerous efforts to do so in the last two decades (2007, 2012 and 2016). After the 2012 failure Rubenstein had the gall to call his preferred taxation "a disgrace."

A key vote for the measure is Senator Kyrsten Sinema (Blue Team-Arizona). She received $38,300 from KKR and The Carlyle Group has donated $10,000 to her campaign in this election cycle.

Estimates indicate such a change would add $14 billion to federal coffers over the next ten years. Eleven years ago the estimate was $22 billion when private equity underwriters (PEU) managed a fraction of today's assets under management.

A 2016 New Yorker piece stated:

Had the loophole been closed, the Treasury would have taken in eight billion additional tax dollars, or eighty billion over ten years.

Rubenstein's personal lobbying to keep the tax loophole bought the greed and leverage boys over a decade to shift compensation away from carried interest to dividends, also taxed at a preferred rate to income. That's why the ten year Treasury gain fell from $80 billion to $14 billion. Blue Team corporacrats like Joe Manchin know this.

The public will see how much politicians Red and Blue love PEU. It may be the last chance to eliminate this unfair tax break. Increasingly more elected officials/candidates are former private equity underwriters. This is a worrying sign for those interested in real equity, the fairness version.

Update: Blackstone co-founder Stephen Schwarzman is lauded as a hero for relaying a message to Canadian President Justin Trudeau on updating NAFTA. There must be an effort to eliminate PEU preferred "carried interest" taxation. Cue to the PEU hero stories and ignore the billionaire villains not paying their fair share for decades.

Blue corporacrat Kyrsten Sinema may come to the rescue of the PEU boys. Reportedly she wants to block the measure narrowing the carried interest loophole.

Duplicitous David Rubenstein received his founders' share of a $344 million payout for the termination of a cash tax agreement with Carlyle. A pension fund is suing Carlyle's board over this blatant handout to billionaire founders.

Update 8-7-22:

Blankfein's son Alex worked for Bain Capital and The Carlyle Group. Alex is now a Principal at Redbird Capital Partners.

Update 12-9-22: Sinema hung her independent shingle to drum up funding from the billionaire boys.

Update 1-24-23: Sinema is fresh from attending the World Inequality Forum in Davos and rubbing elbows with the billion class. It turns out the PEU boys were very generous with the Independent Senator after she saved their preferred taxation.

Senator Krysten Sinema received at least $526,000 from donors in the private equity, hedge fund, and venture capital industries after killing a bill closing tax loopholes for private equity.It sounds like the bidding has already started for her future services.