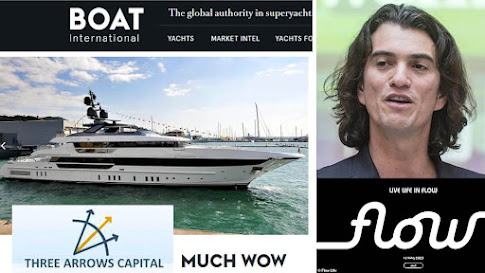

The founders of crypto hedge fund 3 Arrows Capital ordered a $52 million superyacht named "Much Wow" before disappearing as their fund became insolvent. Pictures of Much Wow circulated this week. The founders were detained in a Dubai airport while waiting to board a private plane to Switzerland.

Former WeWork CEO Adam Neumann resurfaced with Flow, his new residential real estate company. He plans to do for apartments what he did for office space. It's not clear how Flow will benefit from Neumann's eccentric/erratic behavior and drug use.

Andresson Horowitz invested in Neumann's Flow. Their website states:

Doing this requires combining community-driven, experience-centric service with the latest technology in a way that has never been done before to create a system where renters receive the benefits of owners.

Renters aren't owners unless their apartment goes condo. Do I smell a bend in the tax code or is that to scent of Rumination Syndrome? Mayo Clinic notes:

Rumination syndrome is a condition in which people repeatedly and unintentionally spit up (regurgitate) undigested or partially digested food from the stomach, rechew it, and then either reswallow it or spit it out.

I don't swallow either story as ethical examples for the citizenry.

Update 8-20-22: Penis rocket astronaut Jeff Bezos entered the real estate business via Arrived Homes which intends to buy more single family homes.

Arrived is the first SEC-qualified real estate investing platform that allows virtually anyone to buy shares in single-family rental properties with investment amounts ranging from $100 to $10,000 per property.

The company acquires rental homes and allows individual investors to become owners of the properties by purchasing shares through the platform. Arrived Homes manages the assets, while investors collect passive income through quarterly dividends in addition to earning a return through appreciation.

The business model sounds like a fee generating extravaganza.

Update 2-8-23: Neumann and Andresson continued their usual word overstuffed nonsense. Apparently it is too difficult to clearly explain Flow's business model. WeWork's valuation went from a high of $47 billion to $1.4 billion today.

Update 8-10-23: WeWork's stock imploded to 13 cents a share and its debt traded at $13 per $100 valuation. It issued a going concern warning.

Update 8-28-23: Tech bros are behind the purchase of over 55,000 acres of farmland with the intent of building a new high tech city.

One local rancher told the San Francisco Chronicle that Flannery Associates' buying spree "was like a hostile takeover ... it was Shakespearian, a 'Game of Thrones' kind of thing."

Andresson is part of Flannery Associates.