Recent examinations of hedge funds and private equity funds revealed advisers allocating profitable trades and investment opportunities to proprietary funds rather than client accounts and multiple instances of improper fees and fee allocations to investors.So who are they screwing? Their investment partners of the non-unit holder variety.

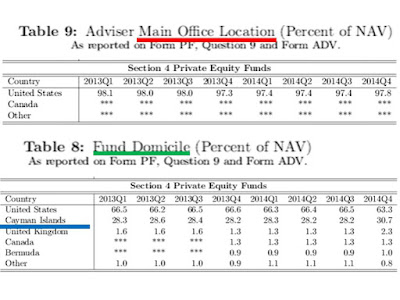

How can they get away with it? Uncle Sam allows it, as does the Cayman Islands. Nearly 98% of PEU home offices are in the U.S., yet less than 64% of funds are based here. Where do those primarily U.S. and Cayman Islands based funds invest their money?

Europe is the second largest region, which makes the following slide odd.

The SEC chose to list Russia at 0%, yet no European countries made it despite garnering nearly 20% of PEU investments. Odd, isn't it.

That's the PEU state of our world, according to the SEC.