Thursday, March 30, 2017

Corporate Cash to Enrich Executives

Corporate executives learned financial engineering from the greed and leverage boys. Companies plan to use $2.5 trillion in cash for strategies that boost their pay. Those strategies include cash for share buybacks, dividends and buyouts. Capital expenditures and research/development have decreased as executives sent a greater percentage of corporate cash toward financial engineering.

Employees know how little of this cash trickles down in the way of wage and benefit increases. The sad thing is employees helped generate the $2.5 trillion cash mountain. Executives sometimes offer words of gratitude but those ring hollow.

We are not all in this together. The top are in it for themselves. Cash use is a reflection of such management greed. At least 60% suggests it.

Tuesday, March 28, 2017

Rubenstein to Hold Up PEU Lantern

North End Waterfront.com reported Carlyle Group co-founder David Rubenstein will keynote an event commemorating the kickoff of the Revolutionary War:

On April 18, 1775, two lanterns were hung from the steeple of the Old North Church, launching what would become the American Revolutionary War. Signaling the departure of British regulars “by sea,” the two lanterns have come to represent the resolve and ingenuity of the American spirit.Some may find it odd for a private equity underwriter (PEU) to speak given greed's role in decimating the resolve of American workers and the size of America's middle class. PEU ingenuity via financial machinations informs workers that rewards go to owners and managers. They do not trickle down.

Every year, Old North commemorates the hanging of the lanterns with an evening of history and an inspiring address from the year's keynote speaker, David Rubenstein, co-founder and co-CEO of Carlyle Group.

Join us Sunday, April 16 2017 at Old North Church to celebrate this day.

The corporate ruling class can help sponsor the event.

For sponsors, a reception in the Washington Garden and Courtyard will begin at 6:30 p.m. and the Lantern Ceremony will start at 8:00 p.m.It took time but I found Rubenstein has more in common with aged revolutionaries than those waging war against the crown. Both David Rubenstein and Thomas Jefferson displayed youthful idealism, which waned as money rose in importance.

Steeple Climber - $25,000 (10 guests/2 pews/$24,150 is tax deductible)

Lantern Lighter - $10,000 (8 guests/2 pews/$9,320 is tax deductible)

Bell Ringer - $5,000 (5 guests/ 1 pew/ $4,575 is tax deductible)

Pew Owner - $2,500 (4 guests/ 1 pew/$2,160 is tax deductible)

The Smithsonian reported Thomas Jefferson's turn to the dark side:

It had long been accepted that slaves could be seized for debt, but Jefferson turned this around when he used slaves as collateral for a very large loan taken out in 1796 from a Dutch banking house in order to rebuild Monticello. He pioneered the monetizing of slaves, just as he pioneered the industrialization and diversification of slavery.Rubenstein pioneered the marriage of political and business connections, the long term use of preferred PEU taxation via carried interest, financial machinations that suck cash out of affiliates while enriching the PEU sponsor and much more.

The Lantern Ceremony with David Rubenstein sheds light on the shift from our country's founding ideals to a shadow side with its staggering emphasis on power and greed.

Monday, March 27, 2017

Rubenstein Funds PEU Oriented Brookings

Brookings InstitutionBrookings' board is populated by private equity supporters from America's Red and Blue political parties. Some names are in PEU Report archives.

The Washington billionaire David Rubenstein pledged $20 million, in part to establish the David M. Rubenstein Fellowships, a program for early and midcareer scholars and other experts. Fellows will be appointed for two years to conduct research and analysis and generate policy ideas and recommendations on key governance challenges of the 21st century. The first class will be in place by September. The money will also support the institution's Foreign Policy Research program. The $20 million will be paid over six years. Mr. Rubenstein is a co-founder of the Carlyle Group, a private-equity firm, and a co-chair of the Brookings Board of Trustees.

Don't expect Brookings to offer anything other than continued benefits to the greed/leverage boys. Universities and think tanks have been co-opted by Larry Summers' desire to profit handsomely and be heard.

Rubenstein's $20 million donation shouts in Rockerfeller fashion and will echo throughout D.C.'s swamps for decades.

Sunday, March 26, 2017

Carlyle's Bounty Looms in New York

Bloomberg reported:

Carlyle Group LP is weighing an initial public offering of vitamin and supplement firm Nature’s Bounty Co. alongside its ongoing sale process, people with knowledge of the matter said.Carlyle purchased the company for $3.8 billion. Dealbook reported in February:

Nature’s Bounty is expected to have an enterprise value of about $6 billion in a sale or IPO, the people said.

New borrowing helped fund dividends totaling almost $1.2 billion, allowing the buyout firm to recoup three-quarters of its investment in three years.In addition Carlyle mined the company for nearly $90 million in management and consulting fees from 2013-2015. Did Nature's Bounty employees get value from above?

Bloomberg offered the latest employment statistic of 11,000 workers. That's 3,400 jobs lost, a 24% decline in employment for the company under Carlyle Group sponsorship.

The Orange County Register reported new job cuts for Nature's Bounty employees in California:

Some 223 people will lose their jobs at The Nature’s Bounty Co. facilities in Garden Grove and Santa Fe Springs as the company shifts operations elsewhere in the country, including New York, where it will get $35 million in state tax incentives.Employees lamented changes since Carlyle purchased the company in 2010.

Carlyle Group has destroyed in 6+ years what two great men spent a lifetime building and that was once... a respectable company. It's not what you know anymore , it's how low you're willing to go with losing your self respect and continuing with the awful direction the company has been nose diving towards.New York state ignored Nature's Bounty employment history in giving $35 million in economic development incentives:

To encourage The Nature’s Bounty Co. to expand on Long Island, Empire State Development offered the company a grant of up to $25 million, as well as up to $8.5 million in performance-based tax credits through the Excelsior Jobs Program and $1.5 million in tax credits through the Employee Training Incentive program. Over the next year, the company will create 157 new jobs and retain 2,042 jobs, while investing over $142 million to modernize and expand its Long Island operations and consolidate China and California operations into its Long Island facilities.Texas gave Carlyle's Vought Aircraft Aviation $35 million in 2004 for 3,000 new jobs which never arrived. That deal involved relocating production from Nashville, TN and Stuart, FL. Texas taxpayers had $35 million of their hard earned money turn into a non-debt, non-equity capital injection for five years. Carlyle refunded a mere $900,000 to the State of Texas before selling Vought.

Nature's Bounty may perform better than Vought but this deal bears watching. Public funds are being used for:

major expansion and modernization of its corporate headquarters and manufacturing operations.Corporate headquarters will get an upgrade and manufacturing will become automated. That's how Carlyle can close production sites in California (223 jobs) and Zhongshan, China (105 employees) and add only 157 new jobs. The drop from a combined 328 jobs to 157 is a 52% reduction.

It's not clear what Carlyle plans to do with Nature's Bounty facilities. in China.

China. -- As of September 30, 2013, our subsidiary, Ultimate Biopharma (Zhongshan) Corporation ("Ultimate") owned in Zhongshan, China: a 50,000 square foot facility for manufacturing softgel capsules and for administrative offices, a recently built 75,000 square foot warehouse facility with packaging capabilities and 18.5 acres of vacant land adjacent to the manufacturing facility. In addition, Ultimate leased 11,300 square feet of dormitory space and 4,800 square feet of warehouse space in Zhongshan City. Also, one of our subsidiaries leased 84,800 square feet of warehouse space in Beijing.

Note: Nature's Bounty had no manufacturing facilities in China in its final 10-K filing before Carlyle's 2010 buyout.Overall Carlyle cut Nature's Bounty employment, set up manufacturing in China, and plans to shift it back to New York for $35 million in economic development funding. How much political hay will Carlyle get from the Trump White House for re-importing jobs it once exported?

Carlyle wants a big return on Nature's Bounty and the people of New York get to help.

Update 3-30-17: New York state is generous in giving money to companies that have been fined for harming workers.

Saturday, March 25, 2017

Carlyle's Assala Energy to Takeover Shell Gabon

Bloomberg reported:

Royal Dutch Shell Plc has agreed to sell its onshore oil assets in Gabon to a unit of Carlyle Group LP for $587 million. Carlyle will buy all of Shell’s onshore oil and gas operations and related infrastructure in Gabon.Assala Energy's website states:

Carlyle’s unit Assala Energy Holdings Ltd. will also take on $285 million of debt from Shell’s Gabon unit and will make an additional payment of as much as $150 million depending on production performance and commodity prices

Assala Energy will be funded by Carlyle International Energy Partners, a $2.5 billion fund, and Carlyle Sub-Saharan Africa Fund, which has $698 million under management.

"Our purpose is to provide positive returns on investment to our shareholders (two Carlyle Group funds) and our host countries"Africa is renowned for corruption and bribery. Carlyle has a history of hiring government insiders and using political power. A number of Carlyle affiliates crossed the legal line, ARINC--procurement violations, Synagro--bribery and Carlyle itself-NY pension fund pay to play settlement.

The Securities and Exchange Commission investigated Carlyle's Cobalt Energy for its oil dealings in Angola. Carlyle's ordeal ended last month. FT reported:

US prosecutors have dropped their corruption investigation into Cobalt International Energy five years after the Houston-based oil explorer’s local partner in an Angolan deal was revealed to have been secretly owned by top officials from the African nation.Houston Business Journal stated:

Carlyle took Cobalt public so concerned shareholders also had the opportunity to take action.The U.S. Department of Justice recently closed an investigation into Houston-based Cobalt International Energy Inc. (NYSE: CIE), the company and its law firm, Houston-based Baker Botts LLP, announced Feb. 9.The DOJ was conducting a Foreign Corrupt Practices Act investigation into Cobalt’s operations in Angola.

Back to Gabon, a fellow OPEC country with Angola. Gabon is north of Angola and both sit on the West Coast of Africa.

Gabon had a hotly contested Presidential election last year/ The Guardian reported:

The Bongo family will extend its 50-year rule over Gabon after the country’s constitutional court ruled Ali Bongo was the rightful winner of last month’s contested election.This is the stable political environment that enables Carlyle to make grand returns on Gabon oil. The election aftermath includes:

The court said it had retallied all the votes from the poll, though it could not do a full recount because all the votes were burned immediately after they were counted at the polling stations.

Each night since the election, the internet has been shut down, something the communications minister put down to mere “disruptions” in the network. Twitter, Facebook and WhatsApp have also been blocked.

With another seven years of Bongo family rule secured, progress on reducing Gabon’s income inequality is unlikely.

Time may show how Carlyle's profiteering aids government officials. Then again, it may not.

Update 1-7-19: A coup attempt in Gabon failed. Ironically Gabon's President is in Morocco recovering from a stroke. Carlyle's Gabon investment appears safe for now even as it pursues payment for Carlyle's massive losses in a Moroccan oil refinery.

Update 10-12-22: Carlyle is ready to cash in on Assala. Sell high.

Update 8-15-23: Sold to Maurel and Prom! Reuters reported:

Private equity fund Carlyle Group has agreed to sell its Gabon-focused oil and gas company Assala Energy to French producer Maurel & Prom for $730 million.

Another Carlyle cash in (with closing expected in Q1 2024.

Update 2-17-24: A military coup changed the deal. The new buyer is Gabon's state run oil company.

Wednesday, March 22, 2017

Palantir Founder and Funder Thiel Ready for New Zealand

Founders Fund and Clarium Capital Management's Peter Thiel made billions from Palantir, a company named after a seeing rock. Not long ago Palantir's value was trumpeted at $20 billion.

The company gets an estimated 40 percent of its revenue from government sources who include the FBI, the CIA, the Defense Intelligence Agency, the Securities and Exchange Commission, Immigration and Customs Enforcement and the military’s Special Operations Command.Thiel used his partially publicly funded riches to buy New Zealand citizenship.

The billionaire investor and vocal Trump supporter was able to secure New Zealand citizenship after "categorically" declaring that he has "found no other country that aligns more with my view of the future than New Zealand."New Zealand served as the movie set for the home of the Lord of the Rings trilogy.

That was in 2011, the year he was granted citizenship by the New Zealand government even though he did not fulfill the residency requirement and had no immediate plans to live in the South Pacific island nation.

PEU news from January revealed:

Peter Thiel’s Mithril Capital Management has stormed to an $850m final close for its latest fund, it has emerged.Note that technology is not being used to reduce decades of growing income disparity or attack the greed of Peter Thiel's PEU peers. Health care is not the least bit more affordable due to technology. I'd love to have my health insurance coverage and cost from 2011, the year Thiel became a New Zealander.

Mithril, named after the silver material stronger than steel mined by dwarves in the Lord of the Rings trilogy, targets businesses which “use technology to solve intractable problems, often in traditional sectors long overdue for innovation."

Back to Peter. After making billions from defense contracts Thiel has a man inside the Pentagon to steer business to Palantir and warn when he should flee to New Zealand:

Palanatir Technology’s Justin Mikolay, formerly a chief in-house lobbyist for the company who worked to win over billions of dollars in Army contracts, was quietly appointed to serve as a special assistant in the Office of the Secretary of Defense.

Should Thiel need to move to avoid populism New Zealand awaits. Until then Thiel has a prime section in the Trump Swamp.

Update 8-18-22: A local council denied Thiel's application to build an 18 acre series of buildings in their New Zealand community. His sprawling lodge community will have to go somewhere else.

Thursday, March 16, 2017

Greed at Top Unabated

Greed is an economic fractal, a pattern that repeats at varying levels of perspective. MarketWatch reported on the long term growth in Wall Street bonuses.

Since 1985, Wall Street bonuses have soared 890%, seven times the rise in the federal minimum wage.MIT Economist Peter Temin captured America's middle class decline:

...the incomes of goods-producing workers have been flat since the mid-1970s.Oddly, President George W. Bush's administration lectured the world that democracy required a rising middle class. His years in office were marked by the rise of private equity underwriters (PEU), whose business model sent middle class jobs overseas and prioritized PEU fees/profits. The Bush years saw much greed induced financial behavior. That recklessness carried few consequences after the crisis hit.

“We have a fractured society,” says Temin. “The middle class is vanishing.”

W. recently resurfaced as a "folksy wise man," which is only appropriate in that he had no role in the proliferation of greed the last eight years. Bush does bear responsibility for the growing plight of the middle class during his two terms in office.

I have seen so many people -- particularly those in their 50s - 70s -- taken apart by what has happened in their industry as greed has hollowed out the economy. These are people took pride in their jobs and held themselves to this invisible standard that we all just took for granted, but is being wiped out.President Donald Trump refilled the D.C. Swamp with the PEU/Wall Street bonus class. They will take care of their own. As for the rest of us? Sorry. They've trained us for three or four decades to accept our lot.

Sunday, March 12, 2017

Blackstone City Backed by Fannie Mae

What if the federal government started a new town with 48,431 private equity owned homes. Uncle Sam would back the rent on 46,010 homes if times got tough. The private equity firm would be at risk for the rent on 2,421 homes. That's the case with Blackstone's Invitation Homes, only the homes are spread across the country.

Invitation Homes, the 2012 buy-to-rent creature of private-equity firm Blackstone, and now owner of 48,431 single-family homes, thus the largest landlord of single-family homes in the US, accomplished another feat: it obtained government guarantees for $1 billion in rental-home mortgage backed securities.This is one Obama administration act that President Donald Trump won't undo or fire. Blacktown, a distributed modern Pottersville, lives thanks to our federal government's actions via Fannie Mae. It's not the first time Fannie Mae looked after the monied vs. the people they are charged with helping, potential low income home buyers.

The government agency that has agreed to guarantee the “timely payment of principal and interest” of these “Guaranteed Certificates,” as they’re called, is Fannie Mae, one of the government-sponsored entities (GSE) that has been bailed out and taken over by the government during the Financial Crisis.

This is the first time ever that a government-sponsored enterprise has guaranteed single-family rental-home mortgage-backed securities, issued by a huge corporate landlord.

Fannie Mae committed accounting fraud from 1998-2004.

by shaping "the company's books, not in response to accepted accounting rules but in a way that made it appear that the company had reached earnings targets, thus triggering the maximum possible payout for executives."Fannie Mae settled without admitting or denying guilt. Fannie Mae's board at the time the fraud started included Ken Duberstein, Stephen Friedman, Jamie Gorelick and James A. Johnson. Politicians Red and Blue love PEU.

Americans have the current Fannie Mae board to thank for fostering PEU home buying so they can rent worry free to struggling citizens. Board member Hugh Frater knows why Blackstone needs Fannie Mae's backing. Bloomberg shows Frater receiving $162,339 in Fannie Mae board compensation.

Hugh Frater helped found Blackrock and its commercial real estate arm Anthracite Capital. When Frater's Antracite Capital got into financial trouble in early 2009 he jumped from the board of directors. Frater had another two years left in his board term when he exited Antracite. At the time Forbes stated:

Anthracite invests in high-yield (read: junk) bonds and loans that finance commercial real estate. The company on Wednesday announced a mammoth fourth-quarter loss, financial problems ranging from busted loan covenants to unpaid margin calls, and a warning by its auditors that it might not be long for the world.Frater later went on to mortgage servicing giant Berkadia. A story on Frater's leadership noted Berkadia's significant status with Fannie Mae.

Last August, the Mortgage Bankers Association ranked Berkadia among the industry leaders in a wide range of primary and master servicing categories: third in overall loan portfolio ($184.2 billion), third in Fannie Mae and Freddie Mac loans ($27 billion)...One Fannie Mae board member had seen a company he founded implode from evaporating rents and declining commercial real estate asset valuations. Fannie Mae will prevent the same thing happening in the residential home rental market.

Hugh Frater also sits on Spearhead Capital's board. Their website describes Spearhead as "a boutique financial services firm exclusively focused on providing customized solutions for ultra high net worth investors, family offices, and asset management firms." What if they could steer their clients to tax free, risk free returns?

It appears another public service organization has been co-opted for the landed gentry.

Saturday, March 11, 2017

Oil Exports to Rise with U.S. Production Increases

ZeroHedge reported:

Rising production in the Permian, coupled with cheap pipeline and railway transport fees to the Gulf of Mexico, will enable the U.S. to significantly raise its already record-high crude oil exports, Mike Loya, head of the Americas business at oil trading giant Vitol Group, told Bloomberg in an interview published on Friday.Vitol is a joint venture partner with The Carlyle Group in Europe, where Vitol's CEO sees U.S. oil export expansion. It also has a joint venture with PEU Helios Investment Partners in Africa. Carlyle lost nearly $400 million on a North African oil deal. I'll venture Carlyle Capital Corporation investors understand how an investment can disappear in a stressed financial market.

“We will see a lot more growth in U.S. crude exports,” said the manager of Vitol, the company that handled the first U.S. cargo after restrictions on oil exports were lifted at the end of 2015.

According to Loya, the Permian crude production would increase by between 600,000 bpd and 700,000 bpd by the end of this year, and “a lot of that is going to be exported”.

Should exports keep their pace, they could help alleviate some of the record-breaking inventories piled up in the U.S.

What's fueling exports of WTI? The price spread between WTI and Brent crude. When U.S. production could not be exported the spread reached $28 a barrel. Carlyle's east coast refinery Philadelphia Energy Solutions entered dark times when the spread narrowed. Carlyle can refine oil domestically or in Europe until they decide to monetize the lot.

U.S. record breaking inventories look to go overseas instead of dropping prices at home. It's the PEU way.

Wednesday, March 8, 2017

PE Buying Companies: Inflation on Horizon

Bloomberg reported:

What do private equity firms and Oliver Twist have in common? They're generally always hungry for more.... there's Carlyle Group LP, which is attempting to raise $100 billion in four years.That means more money chasing potential private equity affiliates.

These eye-popping figures come as the industry's dry powder -- the amount raised by firms that isn't yet invested -- hits new highs ($820 billion as of Dec. 31, according to Preqin).

“When you have a lot more money than you did before, generally you bid prices up a little more than you would if you did not have competition,” Mr. Rubenstein told Handelsblatt. “And higher prices probably produce lower rates of return.”Bingo. Higher prices lead to higher multiples of earnings which leads to lower PEU returns.

Update 3-13-17: It appears some want to use new PEU money to buy old investments by the same PEU.

Monday, March 6, 2017

Carlyle's Citi Presentation

The Carlyle Group presented at the 2017 Citi Asset Management, Broker Dealer and Market Structure Conference. I took the liberty of combining aspects of Carlyle's private equity performance into the image above.

1) Carlyle has $17.5 billion in PEU dry powder to deploy in a market with elevated valuations.

2) Carlyle's carry fund performance is in a four year decline falling from 30% in 2013 to 11% in 2016.

3) It's fee earning PEU assets under management is the second lowest for the six year period shown.

Embarking Carlyle plans to raise another $100 billion.

Update 3-7-17: Carlyle's presentation made no mention of its legal efforts to force Lloyd's to pay for nearly $400 million of stolen Moroccan oil.

Update 3-8-17: The Citi presentation fit with co-founder David Rubenstein's prediction that PEU returns would drop but remain attractive enough to draw more capital. How might that change with Carlyle's purchase of Golden Goose?

Sunday, March 5, 2017

Towerbrook Behind J Jill IPO

Towerbrook Capital Partners is ready to monetize part of affiliate J Jill, a women's apparel retailer. Towerbrook bought the company in May 2015. A year later Towerbrook pulled $70 million in dividends from J Jill (source: SEC S-1). It now wants to sell nearly 12 million shares for $215 million (source: Nasdaq). J Jill will pay the $6.1 million in IPO fees while Towerbrook gets the proceeds. It's the PEU way.

Seeking Alpha wrote about the IPO and J Jill's history:

J. Jill used to be a public company until 2006 when Talbots bought them for $517 million. Then in 2009 Golden Gate Capital acquired them for $75 million. And finally, TowerBrook acquired them in 2015 for approximately $400 million.Talbots won J Jill in 2006 over more than a dozen potentially interested buyers. Companies sold for a premium price in 2006-2007. Then came the fall 2008 financial crisis and J Jill went cheap to its first private equity underwriter. Golden Gate Capital charged J Jill $1 million per year in Sponsor's fees.

A look back at J Jill's 2006 SEC filing showed Liz Claiborne pursuing the company. J Jill hired Peter J. Solomon Company as financial advisor for the merger process. Solomon showed a range of valuations for retailers like J Jill.

As a multiple of net sales, the value could be: 0.9x – 1.4x

SeekingAlpha's recent piece stated:

"Clearly their bankers must have told them they can get their equity at 1.2-1.3X sales, which is a generous price in my opinion"Does that mean we're back to a frothy IPO market fueled by private equity underwriters wanting to monetize affiliates and others determined to mobilize huge amounts of dry powder?

Consider this comment from December 2015:

“Right now we are back to where we were in 2006. It feels pretty frothy.”Fourteen months later would take us to spring 2008 when Carlyle Capital Corporation and Bear Stearn's imploded. Nothing like that appears to be on the horizon. Or does it?

SNAP IPO Sign of Greed & Darkness

SNAP's IPO is a race to the top on greed. Company founders gave new shareholders no voting rights. A former Goldman Sachs co-chair said it was Wall Street's duty to ensure shareholders got a vote, implying Morgan Stanley and his former firm should not have underwritten the shares (source: Fortune). Private equity underwriters (PEU) like The Carlyle Group did likewise but they had the decency to refer to IPO buyers as "unit holders."

SNAP's IPO is also a race to the bottom on ethical business practices. President Obama's JOBS Act aimed to reshape capital markets by lowering standards required to take a company public. Fortune reported

For certain companies with up to $1 billion in revenues (not a small firm by any measure), the act lessens the requirements now in place for financial statement audits, governance standards, and other controls. Provisions in the act also open the door to more conflicts in Wall Street research reports.These moves not only aid Silicon Valley unicorns but PEUs seeking to flip affiliates. A fall guy is required to capitalize on greed. Will SNAP's eunuch shareholders make the fortunes they envision or end up bag holders conned by ballsy insiders?

Carlyle's unit holders are down 24% from their IPO price (excluding dividends). Both SNAP and Carlyle are happy to take investor money and keep control of everything. It's an era of oversized personalities that love money and themselves most.

Friday, March 3, 2017

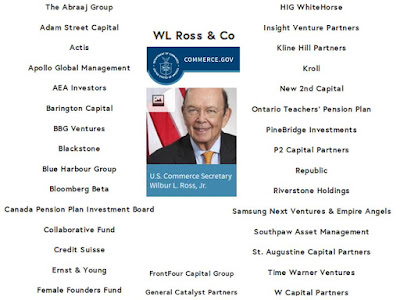

Growing More PEUs

New York University's Stern School of Business hosted its twelfth conference dedicated to venture capital and private equity. It came three days after former PEU Wilbur Ross was sworn in as Secretary of Commerce.

And that's why the PEU boys are falling over themselves in greedy anticipation.

Wednesday, March 1, 2017

Rubenstein Bullish on PEU

Bloomberg reported:

The private equity industry is as excited about its prospects as it’s been in decades, Carlyle Group LP’s David Rubenstein said.Here are a few Rubenstein quotes from the interview:

Most attendees at this week’s SuperReturn International conference in Berlin think U.S. President Donald Trump is good for business, according to a show of hands by hundreds of dealmakers at a presentation by Rubenstein on Wednesday.

The market is very, very high. Private equity ;probably has benefited from that.Actually the administration will be focused on things that benefit private equity, infrastructure (once called pork barrel) and lower taxes. President Trump's cabinet is chock full of private equity underwriters (PEU) and they will advantage their brethren with Uncle Sam's trillion dollar budget.

The United States is dominant in what the private equity world does.

There will be less regulation of private equity in some ways.

The administration will be focused on other things, not beating up on private equity, not that the previous administration did.

Rubenstein pulled a P.T. Barnum encouraging investors to "step right up."

Private equity adds more value than we used to.Carlyle looks to raise $100 billion by 2019. This way to the great egress. Carlyle exited Butterfield Bank with up to 2.5x its investment. Remember the market is very, very high.

Investors say "We want to be in the first closes of your funds. We don't want to get shut out."

Down Under a different Carlyle Group spokesman offered:

Between the two they have the bases covered.“I think returns will come down dramatically, “ he said. Mr Arpey said while Carlyle strove to secure returns of up to 20 per cent, investors were being warned there were risks involved.

D.C. Big Wigs Celebrate Rubenstein's Ability to Talk

Bloomberg hosted a party for Carlyle Group co-founder David Rubenstein's billionaire interview show. The Washington elite turned out to support one of their own. Politicians Red and Blue love PEU.