Thursday, June 29, 2017

PEU Deals Back On

Nearly one out of ten corporate buyout in 2017 involved private equity underwriters (PEU). These are the people who flip whole companies in search of gigantic returns for a handful of executives and their PEU sponsor. The greed and leverage boys enjoy close relations with leaders of both the Red and Blue political parties. Red team's Jason Chaffetz is leaving Congress, hoping to land positions on corporate boards. How many might be PEU owned? I see Chaffetz getting a PEU appointment straight up. He just might not do it right away, a strategy employed by Blue Team's Evan Bayh.

Chaffetz could be replaced by Tanner Ainge, co-founder of PEU Prelude Partners and formerly with Jon Huntsman's HGGC.

There are companies to buy and influence to arrange. There are Congressional seats to buy, directly or indirectly. It's the PEU way!

Sunday, June 25, 2017

Ackman Salts Biden's Wound in Vegas

NYPO has an odd story about a dust up between Vice President Joe Biden and hedge fund manager Bill Ackman at the SALT Conference in Las Vegas last month. The story refers to "wise ass" Bill Ackman, who'd given a half hour talk at the conference that afternoon, Biden closed the day with his interview.

Conference Chair Anthony Scaramucci, founder of SkyBridge Capital, hosted the dinner for the day's A list speakers. The media focus on Biden-Ackman interpersonal scuffle could simply highlight a sincere reaction by a grieving father to an insensitive lout.

The title of Biden's talk seems odd, "Keeping the Momentum: A Conversation on Politics, Prosperity + the American Dream." Both political parties sold their souls to big donors, who've done remarkably well as the common person lost ground the last two decades.

Biden sat in a position of power for the last eight years, a time when prosperity went to those who already had it. It's hard to see where Joe Biden's Blue political team has any momentum at all.

Politics now involves a series of campaign positions intended to get voters to press a candidate's button. Once votes are counted the winner is free to jettison their promises and turn the federal budget toward their political friends and supporters.

Valerie Jarrett spoke on "Democratic Divergence" and Jeb Bush on "Republican Reformation" in a discussion for the future of American politics. Jarrett's SALT bio omitted her recent position asmember for Ariel Investments' board.

The greed and leverage boys turn out for the SALT Conference:, which fosters one-on-one meeting throughout the event. It's a place deals can get done. Founder Scarmucci has his deal in hand, courtesy of China's HNA Group..

SkyBridge Capital’s flagship fund saw net outflows of $1.6 billion for its fiscal year ending March 31, leaving the fund with $5.4 billion in assets, according to a filing with the Securities and Exchange Commission earlier this month.It remains to be seen if Scaramucci makes the expected $100 million in profits from selling a declining asset to the Chinese.

Scaramucci, an ardent Trump supporter and fundraiser, sold Skybridge to a team of foreign buyers earlier this year in anticipation of landing a gig with the Trump administration.

The deal is expected to close this summer although Scaramucci’s White House ambitions have been delayed.

Scaramucci may join the Trump White House, currently stocked with billionaire private equity underwriters wanting to help their brethren. Carlyle co-founder David Rubenstein offered insight as to how to profit in the Trump Age.

Big money boys and politicians share out-sized egos and a twisted symbiotic relationship. Ackman's long been in the Blue camp. That's what makes reporting the Biden-Ackman dinner skirmish so odd.

While the media portrays Joe Biden as the unfairly treated party a few elements don't seem quite right. It doesn't make sense to me that a grieving father would consider running for office, especially the U.S. Presidency. There is a time when grief is the work. It makes less sense that a grieving father would brag that they were the better candidate for the election they skipped. How can one be better if they were brokenhearted?

I'll leave this as another conundrum in our strange world, where the rich and powerful serve the rich and powerful. Might the disintegration our money obsessed leaders foisted on those below be spreading among the ruling class?

Saturday, June 24, 2017

Healthcare Stinks Now with PPACA

Even with PPACA out of pocket healthcare expenses have eaten up more of citizen's income. Employers and Uncle Sam conspired to shift responsibility for healthcare to the individual while generating market opportunities for companies to profit handsomely off the suffering of people.

So how do the people feel about healthcare? Lawyers were more esteemed than the healthcare industry in an August 2016 survey. Only the federal government fared worse than healthcare and pharmaceuticals.

Citizens have paid more out of pocket and gotten less. My employer sponsored insurance covers less every year and my out of pocket expenses, solely for physician visits, soared in 2016. Healthcare earned its sorry reputation by overcharging while cutting service and coverage levels. The data shows both.

I can imagine healthcare getting worse as healthcare corporations optimize profits for their PEU owners. Yes, PPACA kicked off huge private equity investments in health care companies. Those firms have funneled massive amounts to sponsors. Some affiliates will need to be flipped or returned to debt holders, like The Carlyle Group's HCR ManorCare.

KKR's HCA and Carlyle's ManorCare are but two windows into the PEU healthcare world. Neither reduced costs during the Obama years.

People sense something is terribly wrong in healthcare. It's hyper-profitization, the want for the greed and leverage boys to grow their billions in holdings. Smile pretty, because they want to profit from your misery and suffering.

Update 9-25-19: PPACA Report Card: Employers shifted costs to employees via higher deductibles and increased co-pays. PPACA has not helped make healthcare more affordable. It has made a lot of money for the PEU boys.

Update 4-16-20: A coronavirus pandemic revealed

America's broken healthcare system and PPACA's many shortcomings. How

many 22 million newly unemployed can afford the premiums? How many of

these will get COVID-19 and die at home without proper care?

Update 1-20-22: In 2020, the average health insurance premium contribution was 6.9% of median income, while the average deductible was 4.7%, combining for a mighty 11.6% of median income. Curve not bent in the least.

Thursday, June 22, 2017

India PM Modi to Meet with Carlyle's Rubenstein

American CEOs expected to meet India PM Narendra Modi on Sunday include Apple's Tim Cook, Walmart's Doug McMillon, Caterpillar's Jim Umpleby, Google's Sundar Pichai and Microsoft's Satya Nadella.PM Modi's visit will take place June 25-26. The Prime Minister will meet with firms helping India go cashless. Global leaders serve the corporations, not the people. Modi is but one. He's coming to meet with the many.

Among others are Mariott International chief Arne Sorenson, Johnson & Johnson's Alex Gorsky, Mastercard's Ajay Banga, Warburg Pincus's Charles Kaye and Carlyle Group's David Rubenstein.

Update 12-15-17: Carlyle acquired a stake in SBI card, second-largest and fast-growing credit card franchise in India.

Monday, June 19, 2017

Milk'em PEU Conference

The father of leveraged buyouts, Michael Milken, hosted his annual conference for 2017. With the Clinton Global Institute a fond memory billionaires gathered in Beverly Hills to pontificate the best way to get even richer.

The Trump team's former PEUs mingled with their billionaire brethren according to Bloomberg.

This year’s event is a homecoming of sorts for Mnuchin, a former Goldman Sachs Group Inc. partner who later relocated to Los Angeles to invest in banks and films. (PEU - Dune Capital) Commerce Secretary Ross, who made his fortune snatching up and rebuilding distressed businesses, (PEU - Invesco/WL Ross) also slips in easily with the Wall Street who’s-who milling about the Beverly Hills Hilton. Those include PEU Blackstone Group LP billionaires Steve Schwarzman and Tony James, JPMorgan Chase’s Jamie Dimon, Wells Fargo CEO Tim Sloan, hedge-fund billionaire Ken Griffin and billionaire private equity underwriter David Rubenstein of Carlyle Group LP.I believe the conference theme was "Milk'em in the name of progress and equality."

Sunday, June 18, 2017

PEU Bonderman's Joke About Women

This week's outrage went toward David Bonderman, TPG founder and Uber board member for his comments in an Uber board meeting. Yahoo Finance reported:

“There’s a lot of data that shows when there’s one woman on the board, it’s much more likely that there will be a second woman on the board,” Arianna Huffington said around six minutes into the recording.“Actually what it shows is it’s much likely to be more talking,” Uber board member David Bonderman said.“Oh. Come on, David,” Huffington responded.

David Bonderman did not say the last sentence in the image above. That's my theory, projection, supposition, and/or active imagination.

But if the shoe fits......... keep it. If not, please return using the enclosed label. That may be the greatest lesson history has taught Bonderman regarding capital structure in the retail industry.

Saturday, June 17, 2017

CCC's Failure Tied to Cobalt Energy's Sweetheart Angola Deal for Government Officials?

In testimony that provided flashes of Carlyle Group’s rarefied perch in the investment world, Mr. Conway said the Angolan government, CCC’s biggest investor, considered putting $500 million in the fund. The West African country ended up taking a $150 million stake.After CCC imploded Carlyle asked Michael Huffington for the chance to make his $20 million back and more. Huffington declined and sued Carlyle for his losses. Carlyle plead a puffery defense in another equity investor lawsuit (SemGroup).

Several CCC investors, including former Republican U.S. congressman Michael Huffington and Kuwait’s National Industries Group, later brought lawsuits against Carlyle Group, but only the liquidators’ case made it to trial. The other suits were all thrown out or dropped and are no longer active.

The liquidators were appointed by the Guernsey court in 2008 as part of the island’s insolvency procedures.

After raising $600 million privately in late 2006 and early 2007, CCC prepared to offer shares on Euronext Amsterdam in the summer of 2007. But alarm bells began to sound on U.S. subprime mortgages, and other mortgage-related assets were hit. It was touch and go whether CCC’s initial public offering would go ahead, according to emails shown in court.

CCC’s Fannie Mae and Freddie Mac bonds had fallen in value, and banks wanted more cash and collateral to keep providing loans. CCC borrowed around 30 times its equity to increase returns and had little wiggle room.

“Pulling the deal will be a public black eye,” Mr. Rubenstein wrote in an email to Mr. Conway at the end of June 2007, according to court filings. “On the other hand I’m at a loss to say how the whole market can be wrong about the product at this time and we are right,” he wrote.

The information about The Carlyle Group's close ties with Angola's flies in the face of Carlyle's defense regarding Cobalt Energy, which effectively partnered with government officials via subsidiary corporations, Alper Oil and Nazaki Oil and Gas. An SEC investigation produced nothing.

In light of Carlyle's plea to Huffington to make good his CCC investment, did something similar happen in Angola? After losing $150 million in Carlyle Capital Corporation any government would be hard pressed to partner with an affiliate of that same firm. What inducements did Carlyle indirectly offer, if any, to keep Angolan government leaders in their PEU camp?

In 2015 Carlyle affiliate Cobalt Energy sold the Angola offshore fields back to its local partner, minus the shady add on companies. That chapter is closed but CCC testimony on Carlyle's close ties with the Angolan government makes one wonder what happened between the $150 million debacle and Cobalt's exit of Angolan offshore oil and gas fields.

This story is important as Carlyle co-founder David Rubenstein is the new Chairman of the Board for the Council on Foreign Relations, the Western oriented group of global tamperers and profiteers.

Friday, June 16, 2017

Chairman Rubenstein: Carlyle Chief Tops Board for CFR

Carlyle Group co-founder David Rubenstein has been named Board Chair for the Council on Foreign Relations, a collection of Western oriented global tamperers. Rubenstein's role places Carlyle in a prime position to profit from global changes directed by CFR's high powered political stable.

Mr. Rubenstein replaces two CFR co-chairs, former Treasury Chief and Centerview Counselor Robert Rubin and Carla Hills, member of J.P. Morgan's International Advisory Board and CEO of Hills and Company.

CFR's board elected two Vice Chairs, Jami Miscik and Blair Effron. Jami Miscik produced faulty WMD intelligence on Saddam Hussein's Iraq and was rewarded with a global risk management position with Lehman Brothers. That role ended in September 2008 when Lehman Brothers imploded.

After her second monumental failure with Lehman Miscik landed a job with Kissinger Associates, a consulting firm for Western companies interested in global tampering. She sits on the board of Morgan Stanley and made a fortune when Dell bought EMC in a mega LBO deal worth $60 billion. Miscik served on EMC's board from August 2012 until deal close.

Centerview Partners kept a top board slot at CFR by shifting from Bob Rubin to Blair Effron. The move will allow Centerview to keep their key player role advising global corporations

CFR retains its Western PEU orientation with its new Board officers. Rest assured private equity underwriters (PEU) are the wrong prescription for our globe. That's all consummate salesman Rubenstein knows how to push. Watch out globe the PEU push isn't close to over.

Update 6-21-17: NYT produced the latest puff piece on Mr. Rubenstein. A former big league news reporter felt differently nearly six years ago.

Wednesday, June 14, 2017

Carlyle's PEU Financial Abuse Puts ManorCare Under

One might expect Healthcare Finance to understand the financial games The Carlyle Group used to put down ManorCare. These include deal fees, management fees, monetizing real estate and skewing all the rewards to executives and sponsor Carlyle. It took nearly a decade but ManorCare ceased paying its debt and the company will go to debtholders. Carlyle's 2007 purchase of ManorCare came with the endorsement of President George W. Bush and Gail Wilensky, former Medicare Chief and ManorCare board member. Wilensky promised a quality committee would keep Carlyle on the up and up. That didn't happen.

Two years ago the Department of Justice said it was investigating HCR ManorCare for allegedly exerting pressure on skilled nursing facility administrators and rehabilitation therapists to perform unnecessary services on patients in order to collect additional Medicare and Tricare payment, the DOJ said in 2015.Greed, intimidation are PEU methods. Healthcare, thanks to Presidents Bush and Obama, is peppered with PEU owned companies. Who will provide these firms life support after years of toxic sponsor ownership? Apollo Global Management will own part of ManorCare's carcass, so the company will not be leaving the PEU fold. That's sad for patients and their families.

Patients were kept in facilities even though they were medically ready to be discharged, the DOJ said.

Skilled nursing facility managers and therapists were threatened with discharge if they did not administer the additional treatments necessary to qualify for the highest Medicare payments, according to the complaint.

Update 6-18-17: The media continues to soft pedal Carlyle's mismanagement of ManorCare. The Toledo Blade traditionally has gone deeper into ManorCare as they share a hometown. The Blade reported "HCR ManorCare has said the leases it signed came at the top of the market." The leases were intended to enrich ManorCare's sponsor, The Carlyle Group. Carlyle's sponsorship of ManorCare did the company in.

Update 11-25-18: WaPo's piece nails Carlyle's role in sinking ManorCare.

Sunday, June 11, 2017

Carlyle to Buy Italian Sweet Supplier

A Carlyle Group press release stated:

Global alternative asset manager The Carlyle Group (NASDAQ: CG) has today announced it has entered into an agreement to acquire the majority shareholding of the Italian company IRCA, a large European manufacturer of ingredients and food products for pastry-making, baking and ice-cream retailing. Carlyle will acquire an 80% shareholding from Ardian and the company’s founding Nobili family, who will continue to manage the company.It will be interesting to see how the founding family mixes with Carlyle. The Brintons' family had nothing nice to say about Carlyle and its PEU ways.

Established in 1919, Irca has a prominent position in the artisanal pastry and ice-cream markets, expanding its European presence across France, Germany, Spain and Eastern Europe, renowned for the quality of its product offering, which currently totals nearly 1800 lines. Irca currently distributes its products in approximately 70 countries, through a strong network of long-standing distributors.

Mr Roberto Nobili, member of the fourth generation of entrepreneurs, will continue to retain his role as Irca’s CEO.

Carlyle expects high end desserts to grow. As the rich get richer does their appetite for sweets grow? Finally, Carlyle will have an affiliate with the mission "Let them eat cake, with a dollop of ice cream." Fitting for our PEU world.

Wednesday, June 7, 2017

Carlyle Bags Another CRO

The Carlyle Group and fellow PEU GTCR struck a $922 million deal to buy AMRI, Albany Molecular Research. Carlyle's latest deal in the pharmacy research space comes after The Carlyle Group sold PPD to Carlyle for $9.05 billion. Carlyle paid $3.6 billion to buy PPD six years ago. How many clinical research organizations can a PEU own and how many times?

I'll peruse the SEC filing on the deal for specifics and post any findings.

Update 6-11-17: Carlyle inked a deal to buy iNova Pharma, another pharmaceutical company that can send business to PPD and AMRI.

Monday, June 5, 2017

Carlyle in Double Fight Over Sinking ManorCare

Congress held hearings on the buyout. A number of former Medicare/Medicare Chiefs supported the deal, including ManorCare board member Gail Wilensky. No one asked about Carlyle's LifeCare Hospitals failure after Hurricane Katrina which resulted in 25 patient deaths. Oddly ManorCare is being investigated for poor quality care, including patient deaths, and inappropriate billing.

Beneath the Carlyle-Apollo PEU match lies an internal foe, ManorCare's CEO Paul Ormond. NY Post reported:

The landlord of America’s second-biggest nursing home chain is haggling with the company’s top executive over a lavish compensation package, even as the chain teeters on the edge of bankruptcy, sources told The Post.Could Carlyle be that bad to work for, that a CEO would need that kind of pay to stomach working for PEU ilk? Not likely. Ormond invited Carlyle in and partnered to make himself stinking rich. Carlyle expected to make billions more. After putting ManorCare in a precarious position, Carlyle's founders know better to throw good money after bad.

Paul Ormond, CEO of HCR ManorCare, is demanding $100 million in deferred compensation that private equity giant Carlyle Group promised to pay him as part of a $6.3 billion buyout of the company in 2007.

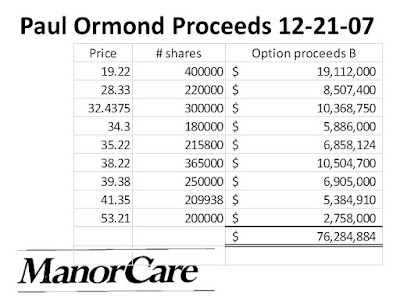

ManorCare CEO Paul Ormond grossed $198 million from Carlyle's purchase of the company. Here's the breakdown:

.

Now Paul wants another $100 million. The Carlyle Group is free to pay Ormond what he's due. They won't pay from the sponsor level. Affiliates pay Carlyle for the privilege of being owned.

Ormond's excessive deferred compensation is a window into private equity practices where the top get outsized rewards while legions of employees struggle as costs from deteriorating benefits eat up more than any pitiful raises PEU boys hand out

Carlyle is ready to walk away from ManorCare's failing financial health. The cause is PEU ownership.

They have two fights as they ready to hand over the keys. One has Leon Black ready to back door Carlyle on ManorCare, a move quite familiar to Carlyle chiefs (Brinton's, Mrs. Fields).

The other fight is with the CEO who brought Carlyle in. Does that make The Carlyle Group a Trojan Horse?

Update 6-13-17: Carlyle is out of ManorCare according to NYPo. Ten years of PEU ownership drove it under.

Sunday, June 4, 2017

Carlyle Group Among Hacked OneLogin Customers

"We detected unauthorized access to OneLogin data in our US data region," OneLogin disclosed in a blog posting this week.

This initial notice was frustratingly lacking in detail, and customers were left to assume the worst with regards to the severity of the attack. However, OneLogin has since updated its blog posting with more details, including the unfortunate news that hackers were able to gain access to the company's AWS keys.

The hackers were then able to use those keys to "access the AWS API from an intermediate host with another, smaller service provider in the US." The company reports that the intrusion began at 2AM on May 31st, but it wasn't until seven hours later that OneLogin staff detected any anomalies and was able to cut off access. That is a rather lengthy period of time for the "threat actors" to have access to the company's database tables.TechCrunch had a portion of the e-mail sent to customers:

OneLogin also provided this rather dour warning:

While we encrypt certain sensitive data at rest, at this time we cannot rule out the possibility that the threat actor also obtained the ability to decrypt data. We are thus erring on the side of caution and recommending actions our customers should take, which we have already communicated to our customers.

Those actions of course include resetting passwords, generating new API keys and creating new security certificates.

It is reported that OneLogin provides services to over 2,000 companies (including Yelp, Midas, Pinterest, Pacific Life, The Carlyle Group, Conde Nast, and Pandora) and has millions of individual users. OneLogin allows users to integrate with services like Amazon Web Services, Office 365 and Google ecosystem.

All customers served by our US data center are affected; customer data was compromised, including the ability to decrypt encrypted data.Carlyle most recent podcast tackled cybersecurity. Their advice could be timely. Any egg would come from vendor selection not from direct investment.

OneLogin received funding in three rounds, the first $4.7 million from Charles River Ventures, the second $15 million from Social Capital and Scale Venture Partners funded the last round at $25 million.

I ran across an interesting story that likely is not related. IndiaWest reported on May 13, 2017:

• Skyhigh Networks named Dheeraj Khanna as VP of technical operations. Khanna joins Skyhigh from OneLogin, where he built a team from the ground up as the VP of technical operations.Mr. Khanna's new employer Skyhigh Networks may be in a position to make hay from OneLogin's security failure.

Carlyle is a OneLogin customer and its IT team is working to keep its data safe. The question is who used OneLogin at Carlyle? Possibilities include employees, founders and/or limited partners. Limited partners do not like surprises, especially those placing their data at risk.

Saturday, June 3, 2017

Bain's Gymboree Misses Interest Payment

News stories highlighted Gymboree's failure to make a required interest payment. All shared the expectation of bankruptcy. MarketWatch reported:

Gymboree is another retailer that is saddled with debt taken on in a leveraged buyout. The company was acquired by Mitt Romney’s former firm Bain Capital in 2010 for $1.8 billion. Today, the company has $1.043 billion of debt, split between a $769 million term loan, the $171 million of 9125% senior secured notes due December of 2018, an $80 million ABL revolving credit facility and a $49 million first-lien ABL term loan.The report did not say how much Bain siphoned from Gymboree via deal fees, annual management fees and special dividends/distributions. It did not share whether Bain added Gymboree debt since 2010 to fund a sponsor PEU dividend.

The company’s bonds were last trading at 8.729 cents on the dollar, according to MarketAxess, deep into distressed territory. Its term loan was quoted at 44 cents to 46 cents on the dollar, according to Debtwire.

Also, there is no word on credit default swaps Bain may have purchased for risk management purposes. We'll see if any of this information exists or comes to light.

As of now everything is marked down, including Gymboree's debt.

Friday, June 2, 2017

Carlyle's Rubenstein Returns to Bilderberg

Carlyle Group co-founder David Rubenstein returns to The Bilderberg Group meeting in Chantilly, Virginia. Carlyle has $100 billion in fundraising to do and a junk bond IPO fund to push, TCG BDC.

Other private equity firms at Bilderberg include KKR, Thiel Capital, Johnson Capital Partners, Ariel Investments, Citadel, Carlyle Group partner Koc Holdings, Evercore, Greylock and Goldman Sachs.

Bob Rubin, Vernon Jordan, Andy Stern and James A. Johnson will be at Bilderberg to relish the millions they've made by integrating the Blue Team with Wall Street and the greed/leverage boys.

Palantir will be at Bilderberg to protect the secret enclave from public scrutiny or accountability. Trump Commerce Chief Wilbur Ross will attend the meeting. He and Rubenstein could tell deadly stories of how they failed workers and customers.

Billionaire's don't talk about the little people very often. Their pocketbooks are more important and they've consistently acted as democratic kingmakers.