Tuesday, December 24, 2019

Home Dialysis Goes PEU

The U.S. for-profit healthcare system arose from bipartisanship and is a major investment target for private equity underwriters (PEU). Ensuring profits is behind the talk of empowering patients. Take the burgeoning area of home dialysis, encouraged by last summer's Presidential Executive Order.

PEU Town Hall Ventures is behind Somatus, while Frist-Cressey Ventures backs Monogram Health. Town Hall Ventures founder Andy Slavitt is a former Obama Medicare Chief. Dr. Bill Frist is former Republican U.S. Senator and founder of Frist-Cressey Ventures.

Humana recently partnered with Somatus and Monogram Health. Humana aggressively entered homecare with its 40% purchase of Kindred at Home, a giant home health and hospice provider. PEU Welsh, Carson, Anderson and Stowe owns 30% of Kindred at Home, as does TPG Capital. WCAS employs Tom Scully, former Medicare Chief under President George W. Bush.

Turn over a PEU rock and you'll find a former Medicare Chief. They will do for healthcare what The Carlyle Group did for giant nursing home ManorCare and LifeCare Hospitals. Their grand returns will not be deterred by a "lonely, agitated" public sick of overpaying for healthcare.

Friday, December 20, 2019

Swift vs. Carlyle: Round Two

The Carlyle Group plans to make big money off its investment in Ithaca Holdings, the company that owns most of Taylor Swift's music. Carlyle nearly doubled its money in Beats Electronics in eight short months and would love for Taylor Swift to give them that level of return.

Business news sources gave considerable deference to Carlyle co-founder David Rubenstein and current high level executives. Reports highlighted how much Rubenstein likes Swift's music and how Carlyle will have a successful investment, i.e. profitable exit in resolving the controversy over Swift's music.

How much extra will Swift have to pay the next set of middlemen to get the rights to her creations? Taylor eloquently shared her concerns at the Billboard Women in Music Event where she received "Woman of the Decade" honors.

Swift told the audience that as the “resident loud person,” she wanted to talk about the “new shift that has affected me personally” and “is a potentially harmful force in our industry.” She said it’s the “the unregulated world of private equity coming in and buying up our music as if it's real estate. As if it’s an app or a shoe line.”

She continued, “This just happened to me without my approval, consultation or consent. After I was denied the chance to purchase my music outright, my entire catalog was sold to Scooter Braun’s Ithaca Holdings in a deal that I’m told was funded by the Soros family, 23 Capital and the Carlyle Group. Yet, to this day, none of these investors have ever bothered to contact me or my team directly— to perform their due diligence on their investment. On their investment in me. To ask how I might feel about the new owner of my art, the music I wrote, the videos I created, photos of me, my handwriting, my album designs.” (Big Machine Label Group has said Swift was given an opportunity to buy her music back, however, she has said it wasn’t a straight-forward deal.)

Swift went on to say Braun — a music manager who reps megastars including Ariana Grande, Justin Bieber and Demi Lovato — “never contacted me or my team to discuss it prior to the sale or even when it was announced. I’m fairly certain he knew exactly how I would feel about it though — and let me just say that the definition of toxic male privilege in our industry is people saying, ‘But he’s always been nice to me,’ when I’m raising valid concerns about artists and their right to own their music. And of course he’s nice to you — if you’re in this room, you have something he needs.”Swift said that “private equity is what enabled this man, according to his own social media post, that he could ‘buy me,’” before adding, “[I’m] obviously not going willingly.”

There are more rounds to come. Swift's truth telling could wake up people to the harm done by private equity underwriters. The PEU boys don't play nice, so neither should she. One music video could counter decades of PEU public relations, which never resonated with citizens (many of whom actually work for private equity owned companies and have experienced the damage done by the greed and leverage boys).

Update 12-24-19: FT reported "Scooter Braun and The Carlyle Group are currently learning how it feels to be one of Swift’s exes as she seeks to frame a battle over her masters as a fight for artists’ rights. Don’t bet against her."

Update 12-26-19: Swift is in a position to hurt Carlyle and company by re-recording her music. She can also make products sold by Carlyle affiliates less cool.

Update 4-12-21: Swift re-released her Fearless album. Loyal fans are burying the old versions on Spotify.

Following Friday's midnight release of Fearless (Taylor's Version) — for which Swift re-recorded her music after failing to acquire the rights to her early albums two years ago — Swifties launched a campaign to bury the Big Machine version on Spotify.Hopefully the unnamed investment firm can claw-back money from Ithaca and The Carlyle Group. Taylor Swift, like the City of Missoula with Mountain Water, tried many times to buy back the rights to her music.

Thursday, December 19, 2019

PEU Blackstone's Mascot Recalls Carlyle's Beats Rap

The Blackstone Group released a "fun" video of the private equity underwriter's mascot development project. The mascot role was shunned or poorly performed until an unknown person showed their dance moves and dunked for the PEU faithful. It was Blackstone co-founder Stephen Schwarzman exceeding the low hurdle for the slam.

The public hasn't had this much fun since Carlyle Group co-founder David Rubenstein rapped a holiday greeting wearing Beats headphones, where it made $430 million in 243 days (on its original $500 million investment).

Trump corporate tax cuts reduced their tax burden to an average 11.3% last year, yet half of workers got no raise this year.

This phenomenon occurred under Red and Blue political teams. That's our PEU world where politicians Red and Blue love PEU.

P. Buttigieg needs only a few letter change to become PEUttigieg, the second coming of President Obama for the greed and leverage boys.

Tuesday, December 10, 2019

Carlyle Refinery Exploded due to 45 Year Old Pipe Elbow

State Impact Pennsylvania reported:

An outdated piece of pipe that had corroded so much its sides were the width of half a credit card led to the catastrophic explosion and fire at the Philadelphia Energy Solutions refinery in June, according to a new report out Wednesday by the Chemical Safety and Hazard Investigation Board.Carlyle Group co-founder David Rubenstein spoke with Delta Airlines CEO Ed Bastain, another Philadelphia area refinery owner, but the topic of explosions did not come up. Rubenstein interviewed Bastain a month before the CSB finding was released.

“The PES refinery is 150 years old,” she said. “The piping component that failed was installed in the 1970s, and although parts of the piping circuit had been inspected as recently as 2018, the specific component that failed has not been inspected for corrosion in the past 45 years.”

“The CSB continually points out that the most obvious causes of a major incident, such as a corroded pipe, are not what actually caused the incident,” Wilson said. “Major industrial failures like this are nearly always the consequence of management decision-making and the way safety is prioritized or not.”Mr. Rubenstein has not been deposed but former Carlyle joint venture executive, Lord John Browne was forced to give deposition in the Texas City refinery explosion that killed fifteen people and injured another 500.

After refusing to testify for almost 3 years, Lord John Browne, former CEO of British Petroleum at the time of the Texas City explosion, was recently forced to give a deposition to attorney Brent Coon of Brent Coon and Associates, by the Texas Supreme Court. Mr. Coon, who argued before the Supreme Court in October of 2007, was finally allowed to depose Browne for one hour on April 4th 2008. “He fought, wrangled and appealed the courts requests every step of the way,” said Mr. Coon. “We wondered what he was hiding…and now we know.”Carlyle hired Browne with full knowledge of safety lapses under his watch. Lord Browne's deposition was the opposite of the hand's on leader who challenged the Texas City refinery to cut maintenance 25%.

Insisting that he had only ever visited Texas City twice, Browne said it looked the same as any other refinery and that he did not perceive it to be dilapidated: "I didn't see that it was unusually - I didn't come away with an impression that is lasting with me that it was unusually different."Browne did acknowledge Carlyle being his sponsor in the deposition.

When asked about an internal document suggesting that he was personally monitoring accident statistics at Texas City because he knew of its poor safety performance, Browne gave a qualified denial: "Well, certainly to the best of my recollection, this is an inaccurate statement. I don't recall doing this."

Browne did, however, accept that a survey of employees' worries at the site was "disturbing" and he accepted responsibility for company-wide cutbacks which were blamed by certain victims for falling safety standards. "It was necessary to reduce costs to get [BP] competitive with others and to bring a degree of discipline into the management of the firm," he told Brent Coon, a lawyer for bereaved families and injured workers.

Browne said he had never read a report into the tragedy's causes by the Chemical Safety Board.We will see if history buff David Rubenstein's reads the CSB report on the PES refinery explosion. I expect it to be de-riveting.

Update 12-15-19: Philadelphia Inquirer reported bankrupt Philadelphia Energy Solutions is seeking a new round of bonuses that would pay seven top executives millions of dollars, depending upon the success of a plan to reorganize or sell the company. Board member Mark Cox could get millions, employees zip. This is on top of $4.5 million in retention bonuses paid two weeks after the massive explosion.

Monday, December 9, 2019

Carlyle's Rubenstein Learned Delta Can't Offer Free Wi-Fi

TravelPulse reported:

Delta Airlines CEO Ed Bastian told podcast host David Rubenstein that charging for internet access prevents too many people from using it.Bastian didn/t mention Carlyle owned ARINC which makes airline communication equipment.

“One of the reasons why I say it’s ‘not a good reason’ why we charge for internet’ — you don’t pay for internet practically anywhere else — is that the planes do not have the technical capacity, and capability yet that if we made it free the system would crash,” Bastian said. “So, once it gets above about a 10% take-rate onboard performance starts to erode…if you turned it on free.”

FT reported:

Rubenstein has, he admits, always been a workaholic but he denies that the happiest day of his life was the one he found out he could send emails while airborne.Carlyle bought ARINC in 2007 and sold it in 2013 to Rockwell Collins for $1.4 billion. Not many people know of David Rubenstein's history with airline WiFi systems. Rubenstein received the Digital Patriot Award from CES on the Hill in April 2012. He received his award for protection of technology.

Rubenstein cited Delta Airlines in a Spring 2018 Philanthropy interview:

I was surprised to learn that Delta was broadcasting the interviews on airplanes. Friends would e-mail me, saying they were flying and watching an interview. People around the world watch them because Bloomberg is a global television network.Rubenstein returned the favor when he interviewed Delta's CEO in Fall 2019. Bastain's "if you turned it on for free" comment runs against the decade long tide of airline's charging for anything and everything, known as ancillary revenue.

Face the Nation recently interviewed David Rubenstein on his appreciation for history. Rubenstein, like Thomas Jefferson, started working as an idealistic youth. Jefferson crafted the "All men are created equal" Declaration of Independence. Rubenstein worked in President Carter's White House.

Both used leverage in innovative ways and ended up obsessed with profits. Jefferson was the first man to use slaves as collateral for a loan when he had access to riches by simply setting his slaves free, something Jefferson refused to do. Rubenstein pioneered private equity's connection to the seat of power, Washington, D.C. and helped grow covenant light debt.

Mr. Rubenstein wants people to study and recall history. Carlyle's history has a number of dark spots, 26 patient deaths at LifeCare Hospitals post Hurricane Katrina, torture rendition flying by Landmark Aviation, World Bank procurement violations by ARINC and several pay to play (bribery) settlements where Carlyle paid tens of millions but admitted no wrongdoing.

History is written by the winners, like Mr. Rubenstein. Face the Nation did not interview the Brinton's family, who had their company back-doored by Carlyle's purchasing discounted debt and forcing it into bankruptcy. John Dickerson did not interview Former Texas Governor Rick Perry who gave Carlyle $35 million for 3,000 new jobs at Vought Aircraft Industries' Dallas operations. Vought cut 35 jobs during the six year performance period for $1 million per job reduced. Vought sent Boeing 787 Dreamliner production to South Carolina where they gunked up Dreamliner production.

Character is revealed across a person's interactions with others. Mr. Rubenstein's philanthropy is admirable but it does not counter the tremendous damage the private equity model has done to industries and workers. Prioritizing profits over people had Thomas Jefferson use slaves as loan collateral. Private equity is its modern day expression.

Tuesday, December 3, 2019

Cisneros, Albright, Cohen and Rubin: From Clinton Cabinet to PEU

PEU lobbying group American Investment Council reported over seven years ago:

May 31, 2012: Former President Bill Clinton appeared on CNN’s Piers Morgan Tonight, guest hosted by Harvey Weinstein, to provide his take on the presidential election. When Clinton was asked about the recent attacks on private equity, he responded:Good work for many former members of the Clinton cabinet. Many joined the greed and leverage boys after serving President Clinton.

“If you go in and try and save a failing company…you can go into a company, have cutbacks and make it more productive with the goal of saving it, and when you try, like anything else you try, you don’t always succeed…so I don’t think that we ought to get into the position where we say this is bad work. This is good work.”

Madeline Albright founded Albright Capital.

APR Energy, an Albright Capital portfolio company, secured a contract to supply the South Australian government with a new fast-start power plant made up of nine turbines to help avert potential shortages over summer. The company also filled the breach for Tasmania last year when an under-sea power cable to the mainland failed.Henry Cisneros is Co-Chief Investment Officer and Chairman of American Triple I Partners. His PEU landed a deal this week to redevelop New York's JFK Airport.

In the article, APR Energy's executive chairman John Campion discusses the transaction and the invaluable involvement of Ms Madeleine Albright and Albright Capital Management.

A minority-owned private equity firm led by Clinton administration veteran Henry Cisneros has been selected as an investment partner for a project at New York’s John F. Kennedy International Airport. American Triple I Partners will contribute 30% of the equity for the redevelopment of terminals 6 and 7 at JFK.

The addition of American Triple I, a 100% minority-owned business, helps the consortium meet Governor Andrew Cuomo’s goal for the JFK redevelopment plan to include 30% participation from minority and women-owned business enterprises, known as MWBEs.

The Carlyle Group is behind the new Terminal 1 at JFK. Carlyle co-founder David Rubenstein worked in President Jimmy Carter's White House but benefited from Clinton's privatizing the government's background check arm. Carlyle flipped USIS several times for huge returns.

William Cohen founded TCG Financial Partners in 2004. His co-founding partner sold a Palm Beach house for $2,312 a square foot in June 2019.

Robert Rubin joined Insight Capital Partners before moving on to Centerview Partners. Rahm Emanuel worked in the Clinton and Obama White Houses and recently joined Rubin at Centerview Partners.

New Democratic Presidential Candidate Deval Patrick headed up the Civil Rights Division under Bill Clinton. He recently resigned his PEU position with Bain Capital.

A flashback to Bill Clinton defending the PEU boys to Harvey Weinstein is symbolic on a number of levels. The greed and leverage boys are predatory.

Update 12-19-19: Presidential Candidate Pete "PEU" Buttigieg worked for The Cohen Group and the Truman Center, where Madeleine Albright sat on the board. Peuttigieg!

Update 3-23-22: Madeline Albright died today. Cancer took her life at the age of 84.

Sunday, November 24, 2019

PEU Default Risk More than Twice Public Firms

WSJ reported:

The default risk of companies owned by private-equity firms is 2.5 times that of their public counterparts, according to data collected from banks, insurers and asset managers by analytics firm Credit Benchmark.Carlyle Group co-founder David Rubenstein said the following on CNBC earlier this year:

Private-equity firms use leveraged loans, rated below investment grade, for the financing of buyouts of target companies. Financial institutions raised their estimates of the average probability of default—or nonpayment—for such loans to about 6% in September from 5.44% a year earlier, according to the data.

A jump in leveraged-loan defaults could have more impact on global finance than in years past because there are far more of the loans in existence and they are broadly held by mutual funds, institutional investors and collateralized loan obligations, or CLOs.

Let me just say that private equity has done a pretty good job of improving the efficiency of the companies in the United States for 30 or 40 years. And around the world, people like private equity, that come into their country to show them how to improve and modernize companies. And I think it has created value for the economies in which it operated. There’s no doubt there’s a fair amount of money in private equity now. That’s because the returns have been very good. The people aren’t putting money in private equity because the returns are bad. The returns are good.How does efficiency result in a much higher debt default risk, which can turn into systemic risk in a major downturn? That's outside Mr. Rubenstein's approved question list for the business media.

Forbes also wrote about private equity's rising default rate:

a significant amount of high yield debt and leveraged loans are not necessarily being used for sustainable growth strategies for the firms and no evidence points to those funds being used to increase workers’ wages or to hire more. Recently, I wrote about how private equity has been causing unemployment in thousands of the firms that they buy out.The greed and leverage boys have one interest in mind and it's not the common citizen's.

Update 11-25-19: PEU's latest debt shtick, the unitranche which combines "senior and junior debt into a single tier and eliminates the syndication process, unitranches can be arranged in a fraction of the time it takes to complete a traditional leveraged loan." The articles states they remain untested in distressed scenarios.

Sunday, November 17, 2019

Taylor Swift's Plea for Help Tests Carlyle Cool

Music superstar Taylor Swift has been blocked from using older songs and video in her upcoming American Music Awards appearance. The Independent wrote:

“I’ve been planning to perform a medley of my hits throughout the American Music Awards,” she wrote, adding that Braun and Borchetta “said that I’m not allowed to perform my old songs on television because they claim that would be re-recording my music before I’m allowed to next year.”This continues the ongoing bullying of Swift by Big Machine, which purchased Swift's music with funds from The Carlyle Group.

Swift is being honoured with the Artist of the Decade trophy at the AMAs, which take place on 24 November.An investor might view this award as adding to the value of their music holdings in Taylor Swift.

The artist is explicitly seeking help from Carlyle. CNBC reported.

“I’m especially asking for help from The Carlyle Group, who put up money for the sale of my music to these two men.”The Carlyle Group declined comment on the CNBC story. Bloomberg reported:

"Taylor Swift’s feud with her record label reveals a little-known fact about the entertainment business: the outsized role private equity plays in funding its biggest stars.Swift asked Carlyle Group in a tweet on Thursday to help her as she battles to secure ownership of albums she recorded with her previous label. The pop star didn’t criticize Carlyle, only appealing for its help. But her conspicuous mention of the company put a spotlight on an industry her legions of young fans normally wouldn’t have reason to pay attention to. Google searches for Carlyle Group surged after her tweet."Which cool Carlyle side will they show? So far it's been the cool, arrogant, disconnected, aloof, greedy side. That could change.

The public face of Carlyle is co-founder David Rubenstein. Swift could appeal directly to her fellow rap star.

Rubenstein met with other music legends in the past. Take Dr. Dre.

Carlyle Cool could be at risk. Think Beats, Golden Goose and Supreme. Carlyle owned Beats for less than a year, making huge money flipping the company to Apple.

Carlyle wants to flip Golden Goose Deluxe Brands, maker of luxury sneakers.

I'd venture these sneakers are popular in entertainment circles. Does Taylor have a pair of Golden Goose Superstars (retail price $1,770)? If so, she has options.

Carlyle invested in Supreme, the epitome of urban skater cool. Esquire is concerned that Carlyle's past profits from death could rub off on Supreme.

Styles can change in a heartbeat, especially under the direction of a

pop-star with millions of fans. How many appearances does David Rubenstein have in the next week? Will any enterprising reporters ask for Carlyle to respond to Taylor Swift's request? Carlyle cool is at risk in a way they've never experienced.

Millions of teens could hate The Carlyle Group overnight. Their parents will surely hear of Carlyle's cruelty to their favorite musician. These are the very people Carlyle wants to sell retirement investment products in the coming years. Carlyle spent decades building its good name. It might swiftly evaporate.

Update 11-28-19: NYT reported Carlyle intervened to get the parties to a longer term agreement, one that jumps Carlyle's ROE hurdle.

Update 12-9-19: Rubenstein told Fox News Maria Bartiromo "In that particular case, I do think there'll be a resolution of that in

the near future. Hopefully, [Swift] can continue to

do very good music, but it's something that is more complicated than my

being able to resolve it right here." Rubenstein wants to make Beats like money off of Taylor Swift.

Update 12-15-19: Swift called out Carlyle in her Billboard Women in Music acceptance speech for Woman of the Decade Award. Swift said that “private equity is what enabled this man, according to

his own social media post, that he could ‘buy me,’” before adding,

“[I’m] obviously not going willingly.”

Update 6-6-20: Streetwear retailer Supreme is under fire

for its connections to The Carlyle Group, given Carlyle's history in

war making and oppressing peaceful protesters. The article stated "including ownership of Combined Tactical Systems, a company that (as MC

suggests) “specializes in the manufacture of military and police

equipment such as tear gas canisters, flash grenades, breaching

munitions (rubber bullets), and handcuffs.”

Update 4-12-21: Swift re-released her Fearless album. Loyal fans are burying the old versions on Spotify.

Following Friday's midnight release of Fearless (Taylor's Version) — for which Swift re-recorded her music after failing to acquire the rights to her early albums two years ago — Swifties launched a campaign to bury the Big Machine version on Spotify.Hopefully the unnamed investment firm can claw-back money from Ithaca and The Carlyle Group. Taylor Swift, like the City of Missoula with Mountain Water, tried many times to buy back the rights to her music.

Thursday, November 14, 2019

Carlyle Group's New Healthcare JV Raised ER Bills $25 Million

BusinessWire ran the following press release on The Carlyle Group's latest healthcare venture:

Cannae Holdings, Inc. (NYSE:CNNE) (“Cannae” or the “Company”) today announced that it has entered into an agreement to participate in a health care joint venture with an investment vehicle advised by an affiliate of The Carlyle Group and another investor with deep health care services experience. The joint venture will focus on acquiring, integrating and operating synergistic health care services companies in the provider and payer space.T-Systems helped increase ER bills by $24.8 million for residents of Savannah, Georgia. The case study showed how Carlyle's new JV will not bring healthcare costs down:

Cannae will contribute its T-System business to the joint venture and Cannae’s joint venture partners will contribute equity capital to enable it to acquire other complementary health care services companies. As part of this effort, T-System has also entered into a definitive agreement to acquire a leading provider of coding and clinical documentation services to domestic health care providers which will be funded by the joint venture.

At closing, it is anticipated that Cannae will be a minority shareholder of the joint venture and have all of its T-System intercompany debt repaid, which totaled approximately $60 million as of September 30, 2019. The investment vehicle affiliated with The Carlyle Group will be the majority controlling shareholder of the joint venture.

A few months after transitioning to T-System’s RevCycle+® service, Memorial University Medical Center’s revenue quickly increased to the numbers T-System had estimated. And, just a few months later, revenue continued to improve even further to $1,269 per patient visit, from the original baseline of $1,040 per patient visit.

Results

• $24.8 million gross annual revenue increase:

• $259 increase per patient for facility E/M charges\

• $31 increase per patient for facility procedure charges

• $502 increase per patient for observation services charges

A higher level of service was assigned for about 65 percent of the ED patients, and a lower level of service was assigned to three percent. Also, a higher level of service was assigned for about 70 percent of observation cases.Healthcare is no longer about serving people. At a recent reunion I asked healthcare professionals: "How has healthcare changed over the last few decades?" Nurses, physicians and nurse practitioners said universally. "It's all about money and numbers."

That's because the greed and leverage boys have infected healthcare. The system may be septic.

Update 6-22-20: The PEU JV added Trust HCS in January. TrustHCS, based in Springfield, Mo., is a provider of staffing and advisory services for coding, clinical documentation improvement, denial management and coding education solutions.

Sunday, November 10, 2019

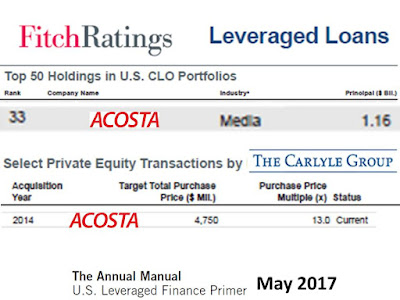

Carlyle's Acosta to Enter Bankruptcy

Acosta's "pre-packaged" Chapter 11 Plan of Reorganization (the "Plan")Acosta, Inc. ("Acosta" or the "Company"), a full-service sales and marketing agency, today announced that it has reached an agreement with more than 70% of its lenders and more than 80% of its noteholders, each by principal amount, on the terms of a comprehensive reorganization and recapitalization. The deal will eliminate all of the Company's approximately $3 billion of long-term debt. Further, investors have committed $250 million in new equity capital backstopped by institutions committed to the long-term success of Acosta.

New York City Retirement Systems invested $330 million in Carlyle's fund that owned Acosta. A 2017 Q3 report showed the negative impact of Carlyle's ownership of Acosta:

Carlyle Partners VI, L.P. - Side Car, a 2014 Co-Investment partnership, generated a net value loss of $0.03 million during the third quarter of 2017. Acosta, Inc. drove performance as the holding was written down 11% to $226.4 million as of September 30, 2017.

Update 12-1-19: Bloomberg reported Acosta filed for bankruptcy in the Delaware U.S. District Court.

Update 3-3-20: Forbes ran a story on Carlyle's failure with Acosta. While the piece did not highlight how much cash Carlyle pulled from the company it said, "Acosta is still running a respectable 10% net internal rate of return."

Tuesday, November 5, 2019

Ex-Medicare Chiefs Love PEU

Presidents George W. Bush and Barack H. Obama enacted significant healthcare reform in their terms in office. Bush added the Medicare Prescription Drug benefit known as Medicare Part D. Bush's Medicare Chief Tom Scully stepped down after Congress passed Part D.

Obama enacted the Patient Protection and Affordable Care Act (PPACA). His White House Health Reformer Nancy-Ann Deparle was a former Medicare Chief under President Bill Clinton. For a time Marilyn Tavenner and Andy Slavitt served as Obama's Medicare head.

What do these four individuals have in common? Private equity underwriters (PEU).

Tom Scully - General Partner Welsh, Carson, Anderson and Stowe (WCAS)The Atlantic reported PPACA passed due to:

Nancy-Ann Deparle - Partner and co-founder Consonance Capital

Andy Slavitt - Founding Partner Town Hall Ventures

Marilyn Tavenner - Board of LifePoint Hospitals, an Apollo Global affiliate, and Board of Select Medical, a WCAS affiliate

"compromises that led to the ACA, executed by Obama and his then–chief of staff, Rahm Emanuel, are what staved off a full-scale medical-industry uprising against the bill."PPACA was designed by for-profiteers for PEUs. The greed and leverage boys have had a field day on citizen's wallets. Surprise medical billing, thank Blackstone and KKR.

President Donald J. Trump's Medicare Chief Seema Verma:

"blasted "Medicare for All" even as some Democratic presidential candidates continue to propose the idea for healthcare reform.Patients in control? The only control I have is paying more and more out of pocket for the same limited care I access every year.

"I’m always very concerned that we’re hearing conversations about more government, more Medicare for All. I think those kinds of things are very scary to me,” she said. "We need to put patients in control of care, not the government."

For that right I become an instrument in an algorithm. Humana's Chief Strategy Officer said the company wants to be a healthcare company with elements of insurance:

"Part of predictive analytics is getting close to the member. We're partnering with organizations outside of healthcare where, with the member's consent, we can identify information they are sharing with us. Proximity is the key to predictive ability,"Having my health insurer emulate the NSA? That is very scary to me, as is the parade of PEU paid former Medicare Chiefs.

Healthcare is an absolute Gordian knot and it grows larger every year due to greed.

Around 45% of Americans said a major health-related expense could potentially lead to bankruptcy, according to a Gallup poll. Health care expenses can break the bank at any age, but they're especially detrimental to older Americans –- retirees in particular.America's for-profit healthcare landscape is a trail of tears for many seniors who go bankrupt, even with health insurance coverage.

Two-thirds of people who file for bankruptcy cite medical issues as a key contributor to their financial downfall.Scully, Deparle, Slavitt and Tavenner don't have bankruptcy worries. They count piles of cash from the very PEU healthcare profits breaking seniors bank accounts.

A new study from academic researchers found that 66.5 percent of all bankruptcies were tied to medical issues —either because of high costs for care or time out of work. An estimated 530,000 families turn to bankruptcy each year because of medical issues and bills, the research found.

Former Medicare Chief Gail Wilensky sold ManorCare to The Carlyle Group as a board member. Eleven years later Carlyle bankrupted the nursing home giant and Mrs. Wilensky had over a decade to grow her nearly $3.4 million in proceeds from ManorCare's PEU buyout.

Carlyle just added a huge insurance broker to its PEU family. The Hilb Group offers health insurance. Hilb's website states:

Like magic, you can increase benefits while reducing total costs.

I work for a PEU affiliate and it has only reduced benefits, healthcare and otherwise. Like evil magic I've seen coworkers disappear and service quality harmed. This year I've had the highest out of pocket expenses in my lifetime for healthcare. My employer states it emphasizes preventive care but I am unable to get a basic vaccination without having to drive several hours.

PEU greed and the for-profiteers who've commandeered the healthcare system are not looking out for my best interest. They are looking out for theirs.

Update 12-12-19: Andy Slavitt landed a board slot at Exact Sciences alongside Kathleen Sebelius, Obama's HHS Chief. His background prior to serving as Acting Chief of Medicare/Medicaid included stints at McKinsey and Goldman Sachs. Currently Slavitt serves on the Board of Directors of United States of Care, a

national non-profit health think-tank and advocacy organization, is

co-chair of the Future of Healthcare Initiative at the Bipartisan Policy

Center.

Update 8-2-21: One division of PEU Apollo will sell LifePoint to another. The "arm's length" transaction provided a $1.6 billion gain. Now the credit division can look forward to buying back LifePoint debt for pennies on the dollar.

Update 2-19-21: Nancy Ann Deparle had a banner payday after Consonance Capital sold Enclara Healthcare to Humana in 2020. Enclara is "one of the nation's largest hospice and benefit management providers." Yet, Humana intends to spin off Kindred Hospice as it prefers a partnership model for end of life care.

Update 4-3-22: The average health insurance premium more than tripled for a family plan since PPACA passed in 2010. Cost curve bent but in the wrong direction. Concave went convex.

Saturday, November 2, 2019

Carlyle Co-Founder Rubenstein History Maker

The Guardian ran a piece on Carlyle Group co-founder David Rubenstein and his historic life as a modern day robber baron. The story began with Rubenstein's revealing interview at The Economic Club of Washington, D.C.

Rubenstein interviewed Secretary of State Mike Pompeo in late July. Pompeo noted President Donald Trump's use of financial leverage to achieve diplomatic goals. Somehow burnishing Trump's image and re-election chances became a U.S. diplomatic goal.

MR. RUBENSTEIN: OK. So, when you have decisions with the president, meetings with him, is he best with oral communications, written communications? What’s the process by which decisions are made? Is it through the NSC10 or informal?The piece ignored Rubenstein's profiting from the American military-corporate-economic juggernaut. That is part of The Carlyle Group's history.

SEC. POMPEO: Yeah. So, there’s a very robust NSC process. When I brief him myself, I always prefer to have a document. It’s the way I prefer to receive information. So, I almost always bring something – a one-page summary at the very least, that says here’s the outline of what it is that I think are the priorities now. We should think about how we should frame this particular problem. And then the president does like to engage in oral exchanges. And I’ve found them to be elucidating for myself. I often learn things as well. He’s very focused on where the money is, and how we use economic leverage to achieve our diplomatic ends.

David Rubenstein has a book to sell, in addition to his ever present cheer leading for private equity underwriters (PEU), also known as the greed and leverage boys. His book highlights great men among our Founding Fathers.

Thomas Jefferson was the first businessman to use his slaves a collateral for debt. The Smithsonian wrote:

It had long been accepted that slaves could be seized for debt, but Jefferson turned this around when he used slaves as collateral for a very large loan taken out in 1796 from a Dutch banking house in order to rebuild Monticello. He pioneered the monetizing of slaves, just as he pioneered the industrialization and diversification of slavery.The Carlyle Group used very large loans for Carlyle Capital Corporation. CCC's 2007 year end results stated:

As of February 27, 2008, the Company’s $21.7 billion investment portfolio is comprised exclusively of AAA-rated floating rate capped residential mortgage backed securities issued by Fannie Mae and Freddie Mac, which are considered to have the implied guarantee of the U.S. government and are expected to pay at par at maturity.One week later Carlyle Capital Corporation was in deep trouble:

Carlyle Capital Corporation touched off a wave of selling on Thursday, especially in mortgage real estate investment trusts, after the company failed to meet some of its margin calls and received a default notice.Two weeks later Carlyle revealed CCC would declare bankruptcy. BBC reported:

Carlyle Capital is a European listed, publicly traded company that is an affiliate of the much larger Carlyle Group, a private equity firm.

Carlyle Capital apparently received margin calls from seven different parties on Wednesday, totaling $37 million dollars. The company said that these parties demanded additional collateral and that Carlyle Capital was unable to satisfy four of their demands.

Carlyle Capital fell 58% on Thursday, touching off a wave of selling across the world that saw some REITS fall as much of 20%. The company is listed in Amsterdam.

According to a report in Bloomberg, most of Carlyle's counterparties are Wall Street firms.

On Wednesday, CCC said that it had not been able to refinance its business. It said it had so far defaulted on about $16.6bn (£8.1bn) of its debt and the only assets it had left were US government AAA-rated residential mortgage-backed securities.On March 16, 2008 Reuter's reported:

CCC said it also expected to default on this after the portfolio's value was marked down again on Wednesday.

Carlyle Capital, an affiliate of U.S.-based buyout firm Carlyle Group CYL.UL, said it has received default notices from its last two remaining lenders and believes that its lenders have now taken possession of substantially all of its U.S. government agency AAA-rated residential mortgage-backed securities (RMBS).Carlyle Capital had $600 million in equity and $21 billion in debt. A lawsuit revealed how Carlyle set up CCC's financing:

The RMBS assets were purchased using one-month repurchase (repo) borrowing. The assets were subject to daily margin calls if prices changed.Financing long term assets with short term money, what could go wrong? That question was not asked of Mr. Rubenstein. It has bearing today as the Federal Reserve Bank entered the repo lending market in a big way.

Carlyle danced away from CCC's carcass as it neared an IPO for China Pacific Insurance.

Previously, Carlyle Group announced that it was just an investment consultant for Carlyle Capital, under the agreement between them, and it did not buy any securities of Carlyle Capital, although some persons in Carlyle Group totally hold an about 15% stake in Carlyle Capital.One might expect better from a storied private equity firm. BBC noted at the time:

"Almost within the blink of an eye, a business that had borrowed $21bn from the world's biggest banks to invest in high-quality mortgage-backed securities will be gone, liquidated, kaput," said BBC business editor Robert Peston.Six months after CCC's implosion the Financial Crisis hit. Did that whirlwind grow into a Category 5 hurricane in part due to The Carlyle Group's actions? Not asked, thus not answered.

"Such is the whirlwind blowing through global financial markets."

Another item not recorded for history is why the Carlyle Group withdrew completely from the Corpus Christi oil shipping terminal at Harbor Island. Carlyle lauded their role as "exclusive developer" one short year ago.

Trump's ongoing greatness and Rubenstein's ever present greed are unique in history. Neither make for an honest exploration of events.

Update 11-4-19: PEU Blackstone's chief strategist warned the "mother of all bubbles" could blow up. One sign of instability cited is the failure of the repo market. JessesCafeAmericain shared a quote worthy of PEU founders and their exalted status:

"His money came from human misery and death and despair, as always it does. Yet, there is none to reproach him, neither God nor man, and all fawn upon him and he will be a senator and crowds will laud him and he will have the ear of the President and all will honor his riches and consider him worthier than other men because of it.Update 11-5-19: CNBC interviewed Carlyle co-founder David Rubenstein. The PEU greed and leverage boys hate paying taxes.

Mankind adores its betrayers, and murders its saviors."

Taylor Caldwell, Captains and Kings

Thursday, October 31, 2019

Retirees Aren't Clamoring for PEU Investments

St. Louis Business Journal reported:

Thus private equity investments will need to be dressed in a way that cons the retiree into thinking they have a liquid, predictable income producing asset. Rest assured it will come with layers of fees.Edward Jones CEO and Managing Partner Penny Pennington said her firm's clients are not clamoring for access to investments in private companies but said that could change over time.Private equity investments, which are less liquid and more risky, historically have been the purview of very wealthy investors and outside the reach of most retail investors. "We're not seeing that demand yet in our marketplace," Pennington said. "Though what we know is what's attractive to ultra-high-net-worth individuals becomes more attractive, and manufacturers look at getting it more into retail investments. So I am hearing a little bit about that, but I think it will take a bit."Pennington's comments came during an interview with Bloomberg about the economy and the current investing climate.As for the risk of private equity investments, Pennington said: "Private equity is illiquid. When you are talking about the need for liquidity, when you are talking about folks getting into a comfortable retirement and needing to produce income, private equity is not set up right now to do that.

Harken back to Carlyle Capital Corporation. Forbes reported Carlyle's sales pitch to Michael Huffington, who sued The Carlyle Group for losing his $20 million investment:

the fund was "conservative,' 'low risk' and that the 'downside [was] very limited"Huffington was concerned about the safety of private equity underwriters (PEU).

Huffington expressed reservations about the risky nature of private equity, but Rubenstein responded that he would "look for something appropriate for you."Carlyle Capital Corporation was listed in Amstedam, giving it the appearance of a stable investment. The mortgage backed security firm was levered 32 times. Four days ago Carlyle Group co-founder David Rubenstein said on Sunday Morning:

"What we've learned over thousands of years is that history repeats itself," Carlyle Group co-founder David Rubenstein said. "And if you can find the solutions that people came up with or the mistakes they made in trying to deal with these problems, you're probably going to avoid some of the mistakes that people made in the past."Beware whatever the PEU boys package for retirees needing safe, predictable income. Someone may be telling you a story.

Someone has to be the final mark for the greed and leverage boys holding trillions in dry powder. Beware the spark that makes it go "Boom."

Monday, October 28, 2019

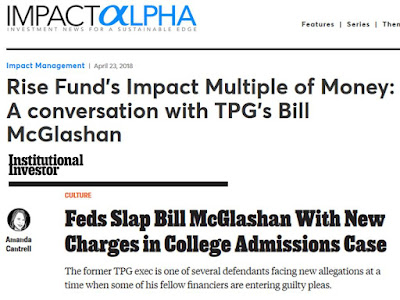

Rise Fund's Bill McGlashan PEU Fall

TPG Capital, a Forth Worth, Texas based private equity underwriter (PEU), targeted social and environmental impact in addition to massive profits in their Rise Fund. TPG calls that "complete returns."

The Rise Fund, which launched in December 2016, was co-founded by Bill McGlashan, Founder and Managing Partner of TPG Growth and Co-Founder and CEO of The Rise Fund; U2 lead singer Bono, a well-known activist and a special partner with TPG Growth; and Jeff Skoll, a global entrepreneur, film producer, and impact investor.Rise refers to the fund as a "leading global education investor." Institutional Investor reported:

“Education is a crucial part of The Rise Fund’s mission. Expanding access to quality education creates a foundation for long-term growth, progress, and prosperity,” said Bill McGlashan. “There is a vast need for improved and expanded educational resources around the world. At the same time, there are exciting opportunities to build innovative and impactful educational businesses and technologies.

Bill McGlashan, founder and managing partner at TPG Growth and co-founder of The Rise Fund, a social and environmental impact fund, was accused of allegedly paying bribes to facilitate his children's admission to colleges, federal prosecutors said.

Institutional Investor later added:

TPG was a few months into fundraising for Rise Fund II when co-founder McGlashan was accused of bribing a University of Southern California official to facilitate his son’s admission to the school as a recruited athlete.CNBC reported Rise co-founder McGlashin was either fired for cause or quit:

“After reviewing the allegations of personal misconduct in the criminal complaint, we believe the behavior described to be inexcusable and antithetical to the values of our entire organization."TPG co-founder David Bonderman made a sexist remark at an Uber board meeting which caused his resignation from the Uber board. I am not aware of any funds pulled from TPG as a result of Bonderman's comment to fellow board member Arianna Huffington.

McGlashan is disputing the terms of his departure, saying he resigned.

The impact of McGlashin's actions has not hurt Rise Fund fundraising. Rise Fund II is at $1.7 billion with a target of $2.5 billion. Contrast this with Ken Fisher of Fisher Investments. Pensions and Investments reported:

The toll exacted by asset owners for Kenneth L. Fisher's sexist comments made at a conference earlier this month is $3 billion and counting.The same groups put money into Rise and Fisher investments. How does one firm get a free pass while the other gets pummeled? The big money boys will have to answer.

It's like the Dubai Ports World brouhaha where the prospect of American ports falling into Middle Eastern hands caused a giant uproar. Shortly after that The Carlyle Group sold fifty U.S. airport operations to Dubai Aerospace and there was not one peep in the media.

It's a rising PEU world, even as one of their stars fell.