Over half of U.S. companies are owned by private equity underwriters (PEU) according to FT. Milken Institute researchers published "Companies Rush to Go Private" in August 2018. Michael Milken is considered the founder of leveraged buyouts which morphed into private equity.

Private equity owned/backed companies are much smaller than their public counterparts.

The PEU model initially loads affiliates with debt, deal fees and annual management fees. It often adds another layer of debt to pay its sponsor (the PEU) a special dividend/distribution as well as more deal fees.

Workers have seen their wages stagnate as PEU ownership spread like a toxic chemical spill. The billionaire class which is widely represented in the PEU community received the economic benefits while workers did not.

The period from the black line to today corresponds with the time frame from the first graph showing how private equity underwriter owned firms became ubiquitous.

Adding debt initially and over time is a signature PEU move. Micheal Milken was known as the Junk Bond King before he was convicted and sent to jail. Junk bonds are less than investment grade and carry a concern that they will be paid off. The concern can rise to whether their next interest payment will be made.

Forbes reported on record issuance of B3 rated bonds and the concern they may default in an economic downturn.

The Financial Stability Oversight Council met May 30th to discuss this very possibility. The Street,com headline read:

The Financial Stability Oversight Council, a panel of top U.S. regulators charged with preventing future financial crises, met Thursday to discuss the past decade's surge in corporate borrowing, much of it by companies with junk-grade credit rating. An economic downturn likely would bring a wave of credit-rating downgrades and debt defaults that could ripple across markets.The Board heard public testimony/feedback on the issue. The PEU boys submitted a report defending their industry as safe and solid.

It read like Carlyle Group co-founder David Rubenstein's 2006 sales pitch for Carlyle Capital Corporation. CCC was the canary in the coal mine, imploding in March 2008, six months before Lehman Brothers fell..

Federal Reserve Chair Jay Powell sees potential corporate debt defaults as a recession amplifier but noted times are good in a House of Representatives report on leveraged lending. Powell worked for The Carlyle Group for eight years.

Rest assured the PEU boys have something to sell and they want the little investor to buy. The Milken report offered:

There is always a final mark.Regulations that segregate investment opportunities, and exclude large groups of investors from profitable investment opportunities have severe consequences that include worsening the distribution of wealth. Such exclusionary practices raise thorny social justice issues regarding whether all investors should have equal access to investment opportunities.However, as more companies are owned by PE funds in which households cannot invest, social policy questions about the fairness of maintaining an unequal distribution of investment opportunities need to be addressed. Moreover, legislation that mandates listed companies to meet more social and wealth distribution objectives that are not directly related to the operations of the company, likely will incentivize even more delistings from stock exchanges and exits into private ownership. This, in turn, likely will exacerbate the unequal distribution of investment opportunities and worsen the already skewed distribution of wealth.

Update 6-11-19: Nearly half of Americans (43%) cannot afford the basics of life. Regulators are concerned about junk loans and their possible default. "When the credit cycle finally does turn, UBS estimates investors in junk bonds and leveraged loans could lose almost a half-trillion dollars." (Bloomberg)

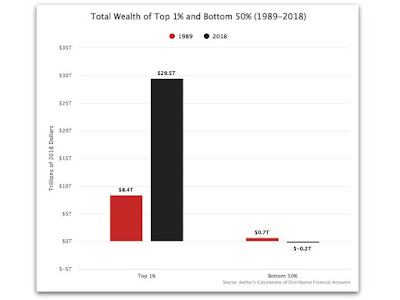

Update 6-16-19: The top one percent of Americans gained $21 trillion in wealth since 1989 while the bottom 50 percent lost $900 billion.