Uncle Sam saved Boston Private during the 2008 financial crisis such that The Carlyle Group could more than double its investment in the wealth management firm/bank.

Boston Private received the 82nd-largest amount from TARP out of 822 recipients

Silicon Valley Bank bought Boston Private in July 2021. A major BP investor opposed the deal citing conflicted management and a non-existent sales process.

Boston Private is giving itself another week to win enough shareholder

votes to secure approval for its sale to Silicon Valley Bank. An

activist shareholder slammed the delay as a "shameless maneuver ... to

manipulate the voting process."

Over this past weekend the government

saved SVB's Boston Private yet again.

Axios reported:

By 2022, SVB had become the 16th-largest bank in the nation, and the 10th-largest in Massachusetts by deposits.

...what would happen to the Boston area's emerging startups if the SVB

holding company doesn't get bought, or if a buyer shifts focus away from

the innovation economy?

Many powerful people pushed for SVB's rescue. Boston Private may be sold with SVB or separately.

“Boston Private will be a high priority because their clients are

likely in panic mode and demanding answers. No doubt there will be

plenty of interested parties knocking on the door, so I wouldn’t expect

it to go for bargain-basement pricing like the Lehman assets.”

History sometimes repeats, as in the case of Uncle Sam

saving Boston Private.

....private equity firms are looking to bid on all the components of SVB.

Will it repeat in another round of Carlyle Group ownership? Can the current FDIC Chair offer a sweeter deal to Carlyle and company than BankUnited? That was most generous.

Another history repeat is Randall Quarles. Carlyle Group Managing Director Quarles commented on the investment stake in Boston Private summer 2008:

Randal Quarles, a managing director on Carlyle's financial services team,

adds: 'In these challenging economic times, we have looked at many

investment opportunities in the financial services sector and have seen

few that we have found as attractive. We are attracted to Boston

Private's strong history of growth and their diversified business

structure that derives revenues not only from the private banking

business but from strong fee-based businesses.'

Quarles later joined the Fed as Chair of Supervision. BIG by Matt Stoller reported:

...Fed Governor Randy Quarles, pushed to get rid of these stress tests. As Quarles said in 2019,

“I think we’ve moved not too quickly, but quite quickly, in adjusting —

again, with an eye toward efficiency — some aspects of post-crisis

regulation.”

Quarles rejoined The Cynosure Group after leaving the Fed. Cynosure has a number of former Carlyle Group executives.

A European bank regulator offered on the SVB rescue:

“At the end of the day, this is a bailout paid for by the ordinary

people and it’s a bailout of the rich venture capitalists which is

really wrong.”

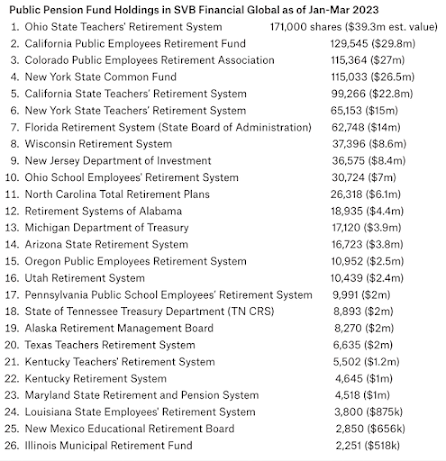

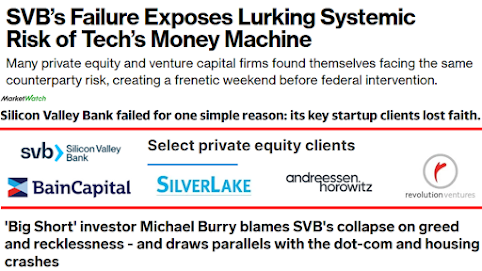

Don't forget the greed and leverage boys. SVB had a whole department dedicated to private equity underwriters (PEU).

Uncle Sam backstops the super wealthy so they can have yet another profit-gasm while keeping their preferred taxation. It's that way because politicians Red and Blue love PEU and increasingly, more are one.

Update: A Guardian opinion piece stated:

SVB’s meteoric rise and fall serves as a reminder that many of the

guardrails erected after the last crisis have since been dismantled – at

the behest of banks like SVB, and with the help of lawmakers from both

parties beholden to entrenched finance and tech lobbies.

Update 3-23-23: Bids for SV Private Bank have been postponed until Friday. Will Carlyle rebuy its former affiliate?

Update 4-29-23: The Fed now says Congress caused them to go lighter on supervision.