It's 2030 and financial crime is a thing of the past. Financial crime ceased to exist once the enforcers were eliminated, wealthy fraudsters pardoned and everybody got the freedom to have our money in whatever form the marketers decided, the Tik Tok influencers pushed and the enterprising conmen executed via AI.

Bitcoin - the Swiss Army knife of crypto as it does it all; digital gold, political hedge, currency of the end times (where we still have lots of electricity and computers to hold those wallets) - hit it's maximum 21 million float. People ask how can 21 million of anything change the world, a question my wise friend asked in November 2024? Change is here and it's not for the better, not for most of us.

The world has more Gazas, where violence has permeated to the point that humanity is nearly gone. More inhumane things happen on an hourly, minute and second basis than humane. All for something, someone, land, buildings, treasure, resources, power, ego or simply because they can and have that desire.

Words mean nothing anymore, definitions twisted far beyond those silly, past conventions. Racists implement racist policies under the guise of anti-racism. Religious freedom is the freedom to believe what the people in power are pushing, nothing more.

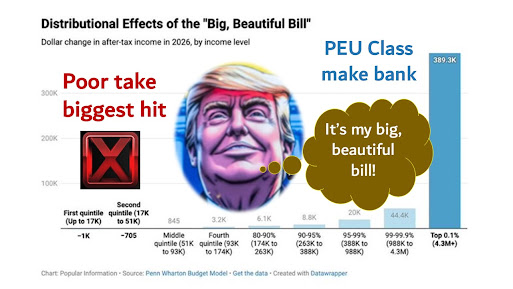

Five years ago elected officials chose to throw millions of poor people off government health insurance, requiring those who remained to work. Bad timing, as AI killed off millions of jobs. People in power huddled the starving masses into specific areas. These became the "more Gazas."

We drove past our little Gaza yesterday. It's out past the Stargate Data Center and it's new natural gas fired power plant, all subsidized with local, state and federal money. I told my grand daughter, "that's the place that stole all the jobs, took the health insurance money from the poor and enriches the wealthiest people on the planet."

She said, "What do you call that?"

"Dicktopia," I replied.

Update 5-31-25: TechGod Joe Lonsdale is a major funder of the new Dicktopia. His CNBC interview revealed his outrage over Chinese intellectual property threat, something AI does regularly and Joe has a new AI venture, Thorin. TechGods love to name things after J.R. Tolkien characters.

Londsdale shared Thorin's focus.

.

.. hard problems like: - Mapping and automating complex, recurring workflows across entire companies

- Real-time orchestration between people and AI systems at massive scale

- Delivering lightning-fast, cost-efficient inference in production

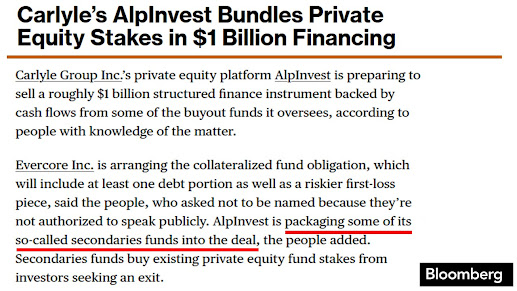

Per usual, TechGods are going after the money not solving hard, long standing social problems, poverty, hunger, joblessness. Joe does want to dismantle state medical boards, certificate of need laws and health information privacy. TechGods have to destroy what is and that includes usurping medicine, already damaged by private equity underwriter (PEU) corporate ownership.

Our community is excited about future data centers. The local CBS affiliate ran a special video segment on why San Angelo is attractive to the AI crowd, cheap and plentiful land, available power, city services....

Update 12-6-25: Lonsdale said he

wants to invest in Iran. Joe must be studying under the mullahs given

his desire for public executions done by masculine leadership.

It's imperative to use all that information obtained from spying on U.S. citizens. Otherwise Uncle Sam may quit paying the TechGods billions.