NomDePlumber wrote on X:

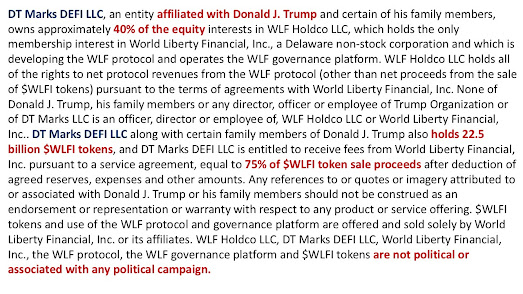

"Nothing wrong with a Private Equity fund manager which owns an insurer, which sells annuities, which are backed with Private Credit loans, which finance the Private Equity fund manager portfolio companies, and which require capital protection against default losses, which consists of loss-absorption guarantees by offshore reinsurers, which the Private Equity fund manager also owns.

That sums up the current state of my lingering concern about private equity underwriters (PEU) being on all sides of a deal, charging fees for their multiple roles and setting up recurring payments via management fees, as well as special dividends/distributions.

NomDePlumber's observation highlights the credit/equity side of PEU family churn, but it also occurs in operations as affiliates buy goods and services from one another. I imagine AI is turbocharging PEU internal cross selling.

AI is another opportunity for sponsor fee generation. There's the fee for "parent AI services" and AI could be used to identify yet to be thought of new PEU fees for yet to be conceived products.

And the U.S. Treasury is supposed to backstop all of this when profit accelerating leverage reverses and becomes a capital destruction buzz saw? Yes, Virginia that is the way Congress works. Politicians Red and Blue love PEU (and their new TechGod brethren).