Texas Attorney General Ken Paxton faces impeachment in the Texas House of Representatives. The case involves Paxton's relationship with a major donor and an affair with a paid staff member.

Fort Worth Star Telegram reported:

At the heart of Texas Attorney General Ken Paxton’s recent troubles is that he used his office to help a political donor — Austin real estate investor Nate Paul — in exchange for allegedly helping the attorney general remodel his home and giving Paxton’s mistress a job in his company.

Seven senior members of Paxton’s staff accused their boss of accepting bribes and abusing his office. Those seven resigned while others were fired.

Four of his former employees filed suit, arguing that Paxton and his agency improperly retaliated against them. A $3.3 million settlement was reached earlier this year.

Members of the same political team found Paxton's behavior untoward and worthy of scrutiny. The buying and selling of influence is a major feature of private equity underwriters (PEU). So it should be no surprise that Paxton donor Nate Paul has a private equity fund, World Class Capital Income Fund I LP.

Paul launched the fund in 2009 with a goal of raising $10 million for private equity investments Riverstone Wealth Management of Austin is shown as the sales agent with an expected 5% sales fee.

A number of Nate Paul's real estate holdings under the World Class banner declared bankruptcy. With PEU like sleight of hand Paul's Rising Tide Investments LLC bought up those failed properties.

The Real Deal reported:

Rising Tide Investments LLC — a shell company affiliated with the Austin

developer’s World Class Holdings — has bought up the assets of at least

five World Class entities, according to the Austin Business Journal.

I'd say Nate Paul has shown his PEU bona fides, political connections that manifest in demonstrable financial benefit, use of shell companies to limit asset and liability risk and being able to buy back his failed ventures after running them into the ground. Sweet.

Finally some members of the Red Team are disgusted enough over the insider money funnel to take action. I didn't expect it to happen in Texas, but here we are.

Politicians Red and Blue love PEU and increasingly, more are one.

Update: Lubbock Avalanche Journal has a timeline of events regarding the Paxton case. Former President Donald Trump came to Paxton's defense suggesting the November 2022 vote was an adjudication of the charges. Blue Team Rep. Harold Dutton Jr. agreed that he did not wish to go against the voter's wishes.

Elections have nothing to do with investigations of potential crimes and any charges. Many members of the House argued the process of creating the Articles of Impeachment have been unfair to the AG Paxton.

“I would like to point out that several members of this House while on

the floor of this House, doing the state business, received telephone

calls from general Paxton personally, threatening them with political

consequences in their next election,” state Rep. Charlie Geren said.

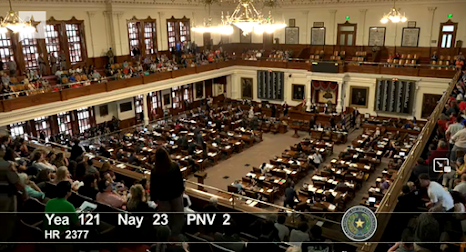

The House voted for Articles of Impeachment against Paxton. It

passed by a wide margin.

The Texas Senate will conduct the trial. I didn't see our state stepping up in this

regard but it may finally show one can't act with complete impunity.

Update 5-29-23: Rep. Drew Darby voted for the articles of impeachment for Paxton. Let's hope these are more than just words of oversight.

Update 5-30-23: HuffPo ran a story on "The Golden Age of White Collar Crime".

An entrenched, unfettered class of superpredators is wreaking havoc on

American society. And in the process, they've broken the only systems

capable of stopping them.

Update 6-9-23: The FBI arrested Nate Paul.

Update 8-31-23: Paxton's staff detailed the many ways he milked Texas taxpayers to fuel his lifestyle and ego.

Paxton was in Qatar for the 2022 World Cup

— a trip that does not appear in his filings or security records.

Another Republican state attorney general, Sean Reyes of Utah, also

attended and disclosed through a spokesman that Qatar's government paid

his expenses without saying how much they were.

Paxton once bought a $600 sports coat from a hotel store while at a conference and billed it to the event's organizer.

Which brings us to:

"The corruption that has become widely tolerated throughout the various

upper strata of our society is shocking in its boldness. And even more

shocking is its general acceptability, and too often downright

fashionability, among our elite in business and government, and their

courtiers and partisans in the various professions. And it provides a

corrosive example and temptation to the public.

The breaking of

oaths is a serious transgression, and there will be an accounting for

it, if not in this world then the next. And sadly it is the

partisanship, and the willing gullibility of simple souls given over to

the wiles of a skillful persuasion to anger, and willfulness, and

hatred, that permits the unscrupulous to prosper."

Jesse, Repentance and Forgiveness the Wellspring of Joy, 22 December 2017

This very thing is unfolding locally. How long will the unscrupulous prosper?

Update 9-7-23: Ken Paxton's impeachment trial hit day three. Witnesses claim the AG was fixated on Nate Paul.

Update 9-16-23: Texas Reds vote for PEU sponsorship! They acquitted Paxton on all charges. Line 'em up boys. We'll have the best billionaire sponsored government anywhere! Yeeehaawwww!!!

Update 1-15-25: Nate Paul pled guilty to making false statements to a financial institution in a federal plea deal. He faces up to six years in prison.