Stories regarding billionaire families hit the news recently. The first involves Carlyle Group co-founder David Rubenstein and his daughter Ellie who

serves as Vice Chair of the Alaska Permanent Fund Corporation board. Ellie Rubenstein, like her infamous father, is a private equity underwriter (PEU). The Alaska Permanent Fund Corporation has $800 million invested in Carlyle's private equity funds.

Upon her July 2022 appointment to the APFC board the organization announced:

As CEO and Co-Founder of an investment firm, Trustee Rubenstein brings extensive private equity, investment management and corporate experience to the Board. Trustee Rubenstein also supports numerous organizations and initiatives through her family office and dedicates countless hours volunteering with the Red Cross of Alaska.

“The Alaska Permanent Fund is a globally recognized sophisticated investor. I am humbled and honored to serve on the Board. I look forward to getting to know the Trustees and Staff and working with them in service to the people of Alaska.” ~ Trustee Rubenstein

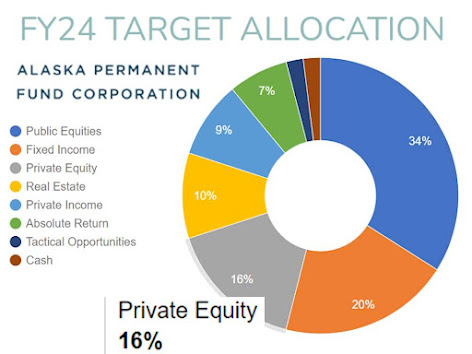

Ellie Rubenstein wants the fund to reach $100 billion by expanding investments in private equity, which sits at 16% of fund assets.

Background set. Emails reveal a strange set of interactions from a board Vice Chair.

“As we all know she has made dozens upon dozens of investment manager referrals in her 18 months on the APFC board. Many of these have been in the private credit space and my team has declined to pursue all of them.”

Those referrals included TCW (Carlyle), Churchill Asset Management (formerly owned by Carlyle) and Goldman Sachs private credit. Several of those firms have stakes in Ellie's Manna Tree.

The board Vice Chair did more than cross the conflict of interest line. She targeted APFC staff, saying her infamous father was "not impressed" with a staff member. I thought David Rubenstein was affable and took a personal interest in people he met. Churchill's CEO said this in a 2022 interview:

Who leaves their mentor after three short years?

Back to the unimpressive junior staffer. Apparently father Rubenstein was miffed that the Permanent Fund didn't send more "senior people" to hear his sales pitch. How lucky he had his board appointed daughter to deliver that message.

The Vice Chair targeted another staffer in private credit for being "like 25." That person had ten years tenure with the "globally recognized sophisticated investor."

This PEU apple fell directly under the tree. Flashback to 2011:

I watched a video interview of (David) Rubenstein and his arrogance is really beyond tolerance. He was going on about the debt ceiling problem and how there would need to be cuts in services and higher taxes. When the reporter asked him about tax on carried interest he turned really disdainful and said that this "only" amounted to $22 billion over some number of years and this was not serious money. Boy, nothing like everybody doing their small part to save the country from oblivion!

That not serious money ended up being $1 trillion in accumulated carried interest.

Ellie also implied that she would soon be top dog on the APFC board as the current chair "would not be reappointed."

"Arrogance beyond tolerance" birthed "arrogance beyond comprehension." Welcome to our PEU world which brings us to our second billionaire family story. Four members of Britain's wealthiest family were convicted in Switzerland for exploiting staff.

How would you

like $8 pay for an 18 hour shift?

Switzerland had the guts to do what most countries won't, charge the super rich, politically connected for crimes committed.

The "jury is in" in Geneva but remains out regarding the Alaska Permanent Fund Corporation. Will investigating

attorneys go after the leaker(s) and ignore powerful

bad actors (as so frequently happens in the U.S.)? Stay tuned.

There is one final commonality between the Rubenstein's and the richest family in Britain. David Rubenstein coined "patriotic philanthropy" and the Hinduja Group's

core value is "work to give." Odd that these givers do so much taking.

Politicians Red and Blue love PEU and increasingly, more are one. Those who make laws are often loathe to enforce them, at least within their circle.

Update 6-25-24: Members of the public were able to view the Executive Session where the board

discussed the leak controversy.

Rubenstein, who remained quiet during the public portion of the meeting, became animated during executive session,...

...at one point APFC CEO Deven Mitchell and Scott Balovich, the head of IT for the APFC, were asked to leave the executive session at the request of Rubenstein.

...the meeting was intensely focused on identifying the source of the leak.

Rubenstein expressed concern about staff making “unchecked allegations.”

She went on state that there had been no head of private equity for nine months, and that the CIO had worked to undo relationships.

Translation: Bad

news for the little people.

News stories show the Alaska Permanent Fund

employing leverage to juice returns, a signature PEU strategy. Also, Ellie Rubenstein

spoke at this year's FII Conference in Saudi Arabia and

shared the APF's future strategies (not all of which were endorsed by the APFC board). The moderator introduced her as an LP with the Alaska Permanent Fund. Odd.

During the FII session Ellie shared her personal health concerns that led her to

invest in firm working to improve infant gut health.

Update 6-26-24: Citadel's Ken Griffin

reached a settlement with the IRS after a leaker revealed his preferred tax status. The leaker got five years in prison. Will David Rubenstein be as successful in defending his daughter?

News of the Griffin settlement came from "a person familiar with the situation who asked not to be identified discussing confidential information." In other words, a leaker. It all depends on who you serve.

The billionaire boys know how to play the system because they are ever redesigning it to their advantage.

Update 7-21-24: Board chair Ethan Shutt was

reappointed by Alaska's governor, thus ending any immediate rise by the younger Rubenstein.

Update 8-11-24: Ellie Rubenstein resigned from the Alaska Permanent Fund board. She referenced the time consuming nature of APF board service in order to make the organization more professional. Chris Ullman, former Communications Director at The Carlyle Group, served as Ellie's spokesman. Ullman also

hangs a Declaration Partners shingle, according to a recent press release. The insider money funnel is good to Chris as he has his own communications firma and is a

senior advisor to Narrative Strategies.

Chris whistled the National Anthem at a Baltimore Orioles

home game in early June. Ellie's father recently purchased the Orioles. Lead owner David Rubenstein co-founded The Carlyle Group before establishing his Declaration Partners family office. Declaration now competes with Carlyle by soliciting investor funds and doing deals. Ellie resigned from the APF board so she could spend more time on her PEU, Manna Tree. Her father is an investor in Manna Tree. It sounds like a conflict of interest soup.

Ullman said, “Ellie has concluded that the scope and pace of change necessary to fully institutionalize the Permanent Fund are not compatible with the demands of leading her private equity firm.”

Fully institutionalize? Nice dig on the way out.

Of course she had the gratitude of new board officers for her fine work as a board member, even as Vice Chair Ellie Rubenstein was slated to assume the Board President role. There are no conflicts of interest in PEU land, just personal connections that provide insiders multiple full time job incomes for doing part time work.

Update 10-17-24: Fortune ran

a story on Churchill Asset Management and its divorce from Carlyle. Churchill celebrated ten years of freedom from Carlyle chains.