Carlyle co-founder and Interim CEO William Conway made no mention of former CEO Kewsong Lee in Carlyle's Q3 earnings call. Lee steered the politically connected private equity underwriter (PEU) for most of Carlyle's third quarter. Conway noted the CEO search, saying it is underway.

Conway did not say anything about asset valuation markdowns. During The Carlyle Group's Q3 earnings call analysts heard:

What we've seen is that public market valuations have decreased much faster than private markets valuation.--Ruulke Bagijn

This has been a tough challenging market in a lot of fronts. But even in all of that, our funds have appreciated 10% year-to-date, which is really good. -- Interim CEO Bill Conway

Revenue growth overall has been in the low-double-digits across that portfolio. And many companies are passing on price increases, but also demand has remained really strong in most areas the economy so-far. On margins, there's clearly there is some cost pressure, so on margins, margins are growing in the mid-single-digit. --Peter Clare

The greed and leverage boys at Carlyle earned higher profits on the backs of financially stressed consumers.

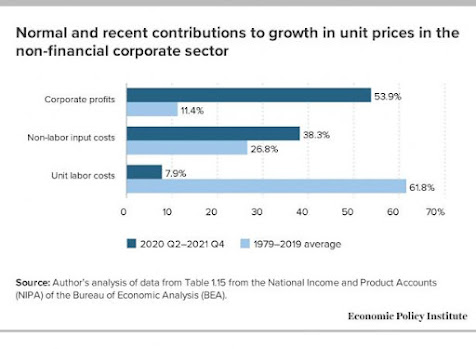

Higher corporate profits contributed to over half of price increases/inflation.

Politicians Red and Blue love PEU and increasingly, more are one. So no matter which team wins the Midterms the greed and leverage boys will be served.

Update 11-9-22: Carlyle reached a separation settlement with Kewsong Lee:

Carlyle said it will pay Lee $1.405 million as base salary and bonus as well as $1.95 million as stock dividends as a part of the separation agreement that terminates at the end of this year. The Washington, D.C.-based firm also agreed that most of Lee's restricted stock options would be allowed to vest between November and February next year.