The Guardian reported:

One of the world’s biggest cryptocurrency exchanges, FTX, has filed for bankruptcy protection in the US amid warnings the embattled industry faces a 2008-style crisis.

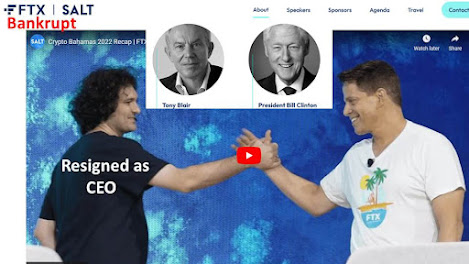

FTX’s founder, Sam Bankman-Fried, also resigned as chief executive after a precipitous fall from grace that began last week with reports about the financial structure of his crypto empire.

In a statement, FTX said a range of related businesses including its US-based exchange and Alameda Research, a trading firm also owned by Bankman-Fried, had filed for chapter 11 proceedings in the US state of Delaware “in order to begin an orderly process to review and monetise assets for the benefit of all global stakeholders”.

Also included in the bankruptcy filing were “approximately 130” further businesses that made up the sprawling FTX group, a network of associated companies tied together through subsidiaries, contractual agreements, and the shared figurehead of Bankman-Fried himself.

Bankman-Fried may be out as CEO but he remains a major equity owner and board member. FTX's press release indicated a number of corporate entities were not part of the bankruptcy filing.

Anthony Scaramucci coached business partner SBF to come clean on untoward activities with regulators. Mooch said he would be buying back the 30% stake SBF and FTX took in Skybridge Capital in September.

Scarmucci spoke of SBF's violation of trust to investors, account holders and the crypto industry. He said a small group in Sam's inner circle knew every single working while others were unaware. Legal and compliance staff quit the following day.

Bitcoin Magazine reported:

Only 10% of FTX's $8.8 billion in customer funds is backed by liquid assets.

Back to the small group in SBF's inner circle. CoinDesk reported:

...30-year-old Bankman-Fried is roommates with the inner circle who ran his now-struggling crypto exchange FTX and trading giant Alameda Research.

Many are former co-workers from quantitative trading firm Jane Street, others he met at the Massachusetts Institute of Technology, his alma mater. All 10 are, or used to be, paired up in romantic relationships with each other.

Scaramucci didn't want to use the term "fraud", but conflicts of interest are clear if ten romantically involved people ran 130 different corporate entities.

Did SBF or any of his lieutenants transfer assets to any of the FTX entities not declaring bankruptcy? If so, that would be salt in investor wounds.

Is Crypto Bahamas 2023 still on? Will Bill Clinton and Tony Blair return to headline the event?

Update 11-12-22: It's amazing how the smartest guys in the room turn stupid when caught doing something bad.

....Bankman-Fried’s stunning claim that he was unaware of FTX’s leverage risk, including an apparent lack of basic financial controls.

Update 11-13-22: Son of a law and psychology professor SBF calls it a "poor judgment call":

"FTX extended loans to Alameda using money that customers had deposited on the exchange for trading purposes, a decision that Mr. Bankman-Fried described as a poor judgment call... All in all, FTX had $16 billion in customer assets, the people said, so FTX lent more than half of its customer funds to its sister company Alameda."

More like financial crime.... Mark Cuban said:

....with FTX now—that’s somebody running a company that’s just dumb as f*** greedy. So, what does Sam Bankman do? He just, give me more, give me more, give me more, so I’m gonna borrow money, loan it to my affiliated company, and hope and pretend to myself that the FTT tokens that are in there on my balance sheet are gonna sustain their value.”

FTX account holders are trying a workaround to get their money out of the exchange. They are getting FTX users in the Bahamas to buy NFTs with their crypto. Shenanigans got FTX to where it is. They continue.

SBF should be under the control of a legal authority.

Update 12-4-22: FTX founder Sam Bankman-Fried should be in custody by now said Coinbase CEO Brian Armstrong. I thought that three weeks ago.

Update 12-13-22: SBF is finally under the control of a legal authority.

Update 12-18-22: Once again the smartest guys in the room plead ignorance.

"I think he believes he can play the media and the world the way he plays the markets. Get the view out there that was just incompetent. Just speculation, but I think this is the game he is playing."

Update 1-4-23: The last count in the indictment is an allegation that SBF conspired with others to violate campaign finance laws. SBF made "enormous illegal contributions disguised to look as if they were coming from SBF’s “wealthy co-conspirators.”

Update 1-5-23: SBF's General Counsel at FTX "told prosecutors what he knew of Bankman-Fried's use of customer funds to finance his business empire." He had over a year to learn how SBF did business.

8-3-2021: Cryptocurrency exchange FTX.US named a former Sullivan & Cromwell LLP and U.S. Commodity Futures Trading Commission attorney as general counsel.

Meanwhile Sullivan and Cromwell remains the law firm for FTX, before, during and after the revelations of gross mismanagement and fraud.

Update 1-15-23: Scaramucci is now using the fraud word regarding SBF.

Update 9-19-23: FTX's insider money funnel included SBF's parents.