How does s founder and CEO approve a $1 billion personal loan from the company and its affiliated entities? Sam Bankman-Fried of Alameda Research and FTX did just that.

What are the mechanisms to ensure there are no conflicts of interest and the loan furthers the company's legitimate business strategy? FTX lacked a board of directors with independent members. The board consisted of SBF, a FTX employee and a lawyer. FTX refused a request from one investor to create a real board.

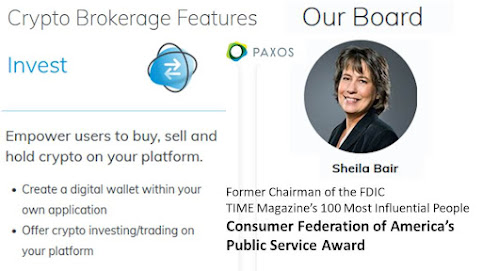

Effective altruism was operationalized as financial fraud with blatant conflicts of interest. Former FDIC Chair Sheila Bair compared FTX to Bernie Madoff. Bair was named to the board of Paxos, a crypto infrastructure firm, in 2016.

Ms. Bair serves on the board of a non-public fintech, Paxos Trust Company, LLC and its parent Kabompo Holdings, Ltd

FTX invested in Paxos in its Series D round. Bair failed to mention FTX's equity stake in the firm she oversees.

“There is no systemic impact to the real economy,” Bair said, adding that this is all just “funny money in the ether with speculation.”

So Mrs. Bair, real people did not lose real money? You sit on a board that provides infrastructure to the speculative economy?

Paxos' addressable market is evaporating with the failure of every crypto exchange:

As for Paxos itself, the company is not as buzzy as many others in the crypto industry, since it is not consumer-facing; it focuses primarily on back-end infrastructure. Paxos CEO Charles Cascarilla has frequently said he wants to use blockchain to remake the financial plumbing of Wall Street—a process he says will reduce delays and free up capital, and also prevent the sort of meltdowns that befell Robinhood and others when clearinghouses couldn't keep up with record trading volumes.

Has Paxos made any capital calls as a result of the ongoing crypto implosion? That would be more real money going to support "funny money in the ether with speculation."

Bair speaks out of both sides of her mouth, a unique insider ability. She knows when and how to deliver her lines.

The man who wound down Enron said FTX is the worst he's seen in his career.

On September 1, 2022 Bloomberg's "The David Rubenstein Show" interviewed FTX founder Sam Bankman-Fried. Rubenstein's family office Declaration Partners invested in Paxos and holds a seat on the Paxos board, alongside Bair.

FTX invested in Paxos in July 2022. The fact that both FTX and Declaration Partners had investments in Paxos was not mentioned in the Bloomberg interview.

Carlyle Group co-founder David Rubenstein made a fortune on BankUnited, courtesy of Sheila Bair. That gift came in the aftermath of the 2008 financial crisis.

Rubenstein's crush on crypto has been apparent since he took his Paxos stake in late 2020. Not long ago he called crypto titillating. He is skilled in hawking his investments.

Paxos provides firms the ability to have their own crypto brokerage. The brokerage plans to "generate yield by lending assets to institutional counterparties."

Mrs. Bair notes her recognition from the Consumer Federation of America. It states the following about crypto regarding retirement plans:

...several aspects of cryptocurrencies raise serious questions about the prudence of exposing plan participants to these assets, including:

● They can exhibit extreme price volatility, which can be particularly devastating for participants who are approaching retirement;

● It can be extraordinarily difficult, even for expert investors, to evaluate these assets and separate the facts from the hype;

● Because cryptocurrencies are not held like traditional plan assets in trust or custodial accounts, they are at heightened risk of fraud, theft and loss;

● There are no consistent, reliable, and widely accepted standards for valuing cryptocurrencies; and

● Rules and regulations governing the cryptocurrency markets are evolving, and some market participants may be operating outside of existing regulatory frameworks or not complying with them at all.

Given these concerns, and the many uncertainties that currently pervade digital asset markets, we think it would be particularly challenging for plan fiduciaries to satisfy their prudence obligations when exposing plan participants to this category of assets.

My worry is how Mr. Rubenstein and Mrs. Bair will use the push to regulate crypto to fluff up the value of Paxos. They have influence and will use it to their advantage.

With crisis comes opportunity. That generally does not come with accepting responsibility, accountability or recognition of one's role in a debacle. Sweep it under the rug, prop up its remains and position for future profits.

Politicians Red and Blue love PEU and increasingly, more are one.

Update: SBF isn't alone in making unilateral decisions as founder. Tesla's Elon Musk did likewise:

Musk said he made a unilateral call on ending Tesla's acceptance of Bitcoin cryptocurrency and acknowledged that the board was not informed before he told analysts in October that Tesla's board was considering buying back up to $10 billion of stock.

FTX's bankruptcy filing actually states:

The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.

In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas.

...the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested).Basic business skills were absent in a firm run by polymaths. Laws don't apply either.

The bankruptcy filing shows some investment holdings but does not list Paxos. There are two places where the word "others" is used.

Update: The law firm that helped FTX make acquisitions is the same law firm assisting with the bankruptcy process. It's Simon and Cromwell. In odd timing the Fed announced a pilot digital token with Citigroup. Simon and Cromwell is providing legal services for the digital token pilot. The firm also has a vibrant private equity practice.

Update 11-18-22: Vox reported

Last year Bankman-Fried had described his ethical framework to reporter, Kelsey Piper, telling her that unethical conduct was not acceptable, even in service of “the greater good.”

In their conversation early Wednesday, Piper asked him if he stood by that. “Man, all the dumb shit I said,” he replied. “It’s not true, not really.”

Ethics, he elaborated, aren’t as important to a person’s public standing as whether they achieve success.

"Effective altruism" was a scam. operationalized as greed, massive fraud and widespread conflicts of interest.

Update 11-25-22: SBF's effective altruism endorsed greed, fraud and blatant conflicts of interest under the guise of helping alleviate some suffering not borne by the monied class.

Update 11-29-22: More funny money implodes:

Crypto lender BlockFi has about $355 million in cryptocurrencies currently frozen on crypto exchange FTX, attorney Joshua Sussberg told a U.S. bankruptcy court on Tuesday.

The $355 million is on top of another $671 million in loan to FTX sister company Alameda Research.

Update 12-18-22: Once again the smartest guys in the room plead ignorance.

"I think he believes he can play the media and the world the way he plays the markets. Get the view out there that was just incompetent. Just speculation, but I think this is the game he is playing."

Update 1-4-23: The last count in the indictment is an allegation that SBF conspired with others to violate campaign finance laws. SBF made "enormous illegal contributions disguised to look as if they were

coming from SBF’s “wealthy co-conspirators.”