Carlyle Group co-founder David Rubenstein sits on the Investment Advisory Board on Financial Markets at the Federal Reserve Bank of New York.

Their January meeting had cryptocurrencies on the agenda. Rubenstein had this to say on crypto in May 2021:

If you go into cryptocurrencies, you should expect big ups and downs and big fluctuations. If you’re not prepared for that, don’t go into cryptocurrency.

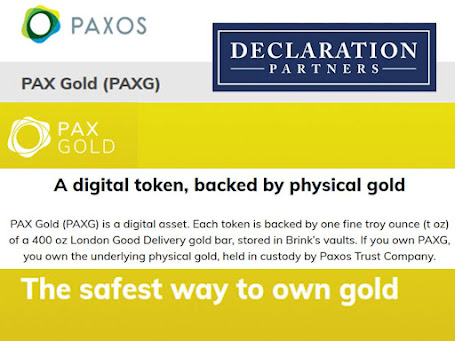

That doesn't sound like a good fit for a group charged with maintaining financial stability. Rubenstein has a personal stake in Paxos, a multi-product cryptocurrency company. The investment came through Rubenstein's family office, Declaration Partners.

One of those products is a cryptocurrency based on gold. The Federal Reserve divorced the dollar from the gold standard in 1971.

The agenda for the January 12th conference call covered:

• What are your expectations for U.S. economic growth and inflation? How are you thinking about the global macroeconomic outlook? How has the trajectory of the COVID pandemic and the emergence of new variants impacted your economic outlook, if at all?

The Carlyle Group has a deep COVID portfolio as it is important to profit from human misery.

• What is your outlook for Federal Reserve monetary policy? What impact will the gradual removal of policy accommodation across major advanced economy central banks have on financial asset prices? What are your expectations for balance sheet policy going forward in the U.S. and abroad?

Carlyle monetized numerous affiliates during the everything bubble and needs distressed assets to purchase with its massive amount of dry powder.

• What is your view of the evolution of cryptocurrencies to-date and your outlook for their use going forward? To what extent do cryptocurrencies pose risks, if at all, to economic and/or financial market stability? How do stablecoins and central bank digital currencies (CBDCs) fit into your outlook?

I am sure Rubenstein got to share all the ways Paxos can meet investors' cypto needs. Paxos Crypto Exchange takes Venmo, Paypal and Mercado Pago. It works with Interactive Brokers and offers a U.S. dollar stablecoin, as well as the gold based one. Did Rubenstein make a presentation on crypto, like Ray Dalio did in February 2021?

The public should not be surprised if Rubenstein's billions continue to grow while they struggle.

Update 2-3-22: Carlyle's earnings call revealed a "record level of asset sales from its private equity portfolio." Fed Chair Jay Powell can help Carlyle reinvest those winnings and mobilize all that dry powder by distressing financial assets.

Update 5-27-22 Paxos received a federal trust charter from the Office of the Comptroller of the Currency. Paxos National Trust entity is a federally regulated entity offering custody services, stablecoin management, payment, exchange and other services. It is different from New York Department of Financial Services-chartered Paxos Trust Co. The next step would be for Paxos National Trust to apply to Federal Reserve to become a real bank with FDIC coverage.

Update 8-2-22: A number of FDIC insured banks ran with the crypto devils and may go under as a result. How this is remotely OK is a question one should ask David Rubenstein and his former employee Jerome Powell.

Update 5-7-23: ZeroHedge reported "a Texas House committee passed a bill to create 100% reserve gold and silver-backed transactional currencies. Enactment of this legislation would create an option for people to conduct business in sound money, set the stage to undermine the Federal Reserve’s monopoly on money, and possibly create a viable alternative to a central bank digital currency (CBDC)." David Rubenstein must be excited.